Unveiling Newmark Group (NMRK)'s True Worth: Is It Really Priced Right?

Despite a daily loss of 2.51% and 3-month gain of 5.96%, Newmark Group Inc (NASDAQ:NMRK) has an Earnings Per Share (EPS) of 0.18. The question at hand is whether the stock is modestly undervalued. This article aims to provide a comprehensive analysis of Newmark Group's valuation, inviting readers to delve into the details of its financial performance and prospects.

Company Overview

Newmark Group Inc is a leading commercial real estate advisory firm. Its services range from leasing and corporate advisory services to investment sales, commercial mortgage brokerage, and property management. The company caters to a diverse clientele, including Fortune 500 and Forbes Global 2000 companies, government agencies, healthcare organizations, and higher education institutions. With a current stock price of $6.22 and a fair value (GF Value) of $8.43, the market cap stands at $1.10 billion. The following income breakdown illustrates Newmark Group's financial performance:

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value. It considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price significantly deviates from the GF Value Line, it indicates overvaluation or undervaluation, influencing future returns.

Newmark Group (NASDAQ:NMRK) is currently considered modestly undervalued, with a fair value higher than its current stock price. Consequently, the long-term return of its stock is likely to be higher than its business growth.

Assessing Financial Strength

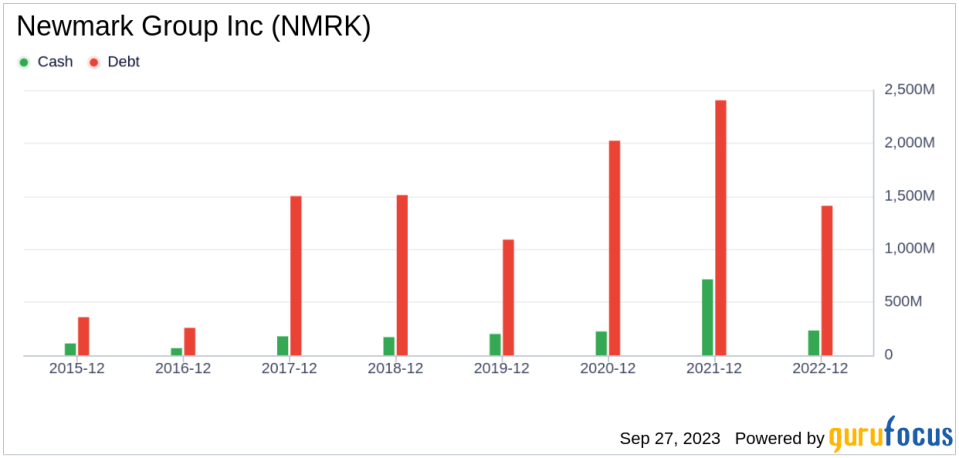

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, investors must examine a company's financial strength before purchasing shares. Newmark Group's cash-to-debt ratio of 0.11 ranks worse than 69.66% of 1783 companies in the Real Estate industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies carries less risk. Newmark Group has been profitable for 7 out of the past 10 years, with revenues of $2.40 billion and Earnings Per Share (EPS) of $0.18 in the past 12 months. However, its operating margin of 4% is worse than 68.46% of 1782 companies in the Real Estate industry.

Growth is a critical factor in a company's valuation. Newmark Group's 3-year average revenue growth rate is worse than 61.93% of 1676 companies in the Real Estate industry. Its 3-year average EBITDA growth rate is -11.1%, which ranks worse than 70.53% of 1381 companies in the Real Estate industry.

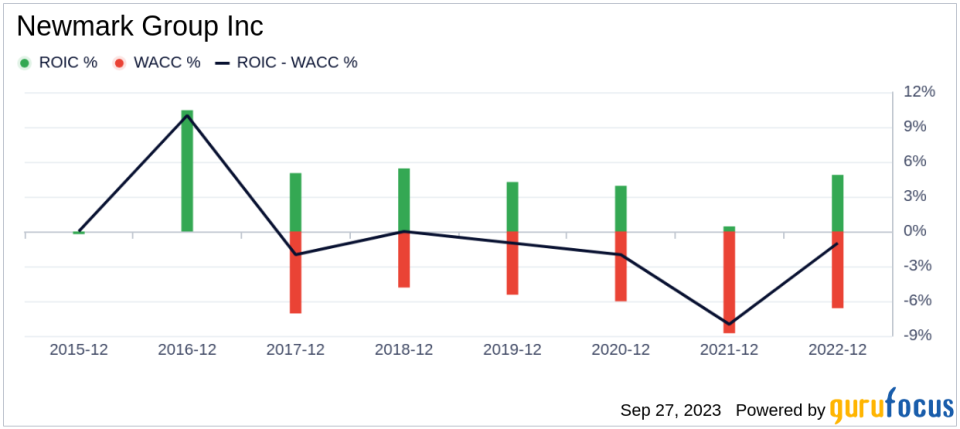

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can indicate its profitability. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Newmark Group's ROIC is 1.44, and its WACC is 6.4.

Conclusion

In conclusion, Newmark Group (NASDAQ:NMRK) stock appears to be modestly undervalued. The company's financial condition is poor, its profitability is fair, and its growth ranks worse than 70.53% of companies in the Real Estate industry. For more information about Newmark Group stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.