Unveiling NiSource (NI)'s Value: Is It Really Priced Right? A Comprehensive Guide

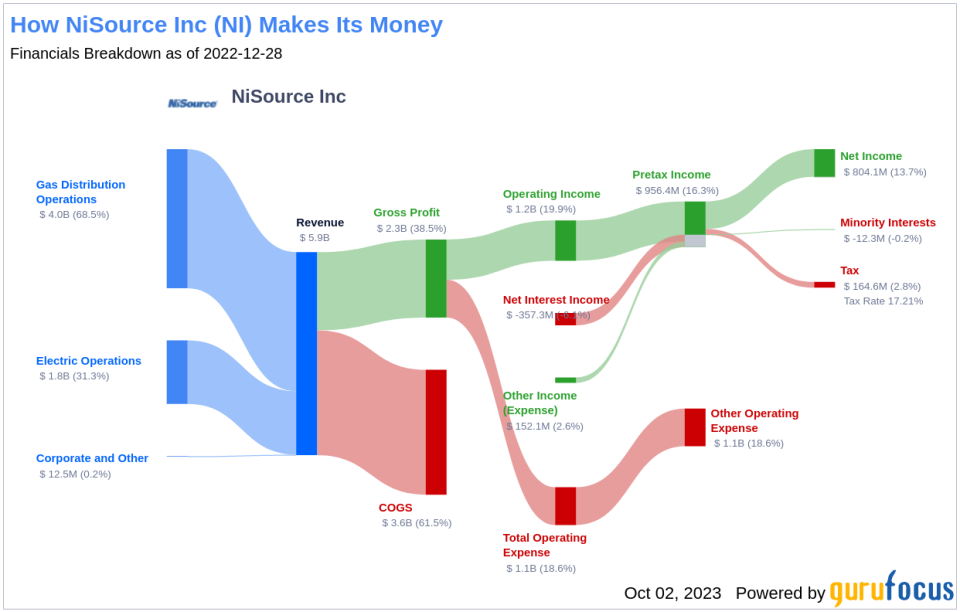

NiSource Inc (NYSE:NI), one of the nation's largest natural gas distribution companies, saw a daily loss of -5.33%, contributing to a 3-month loss of -13.27%. Despite this downward trend, the company reported Earnings Per Share (EPS) of 1.44. The question now arises: Is NiSource stock modestly undervalued? This article aims to answer this question through a comprehensive valuation analysis. We encourage you to read on for an in-depth exploration of NiSource's value.

Company Introduction

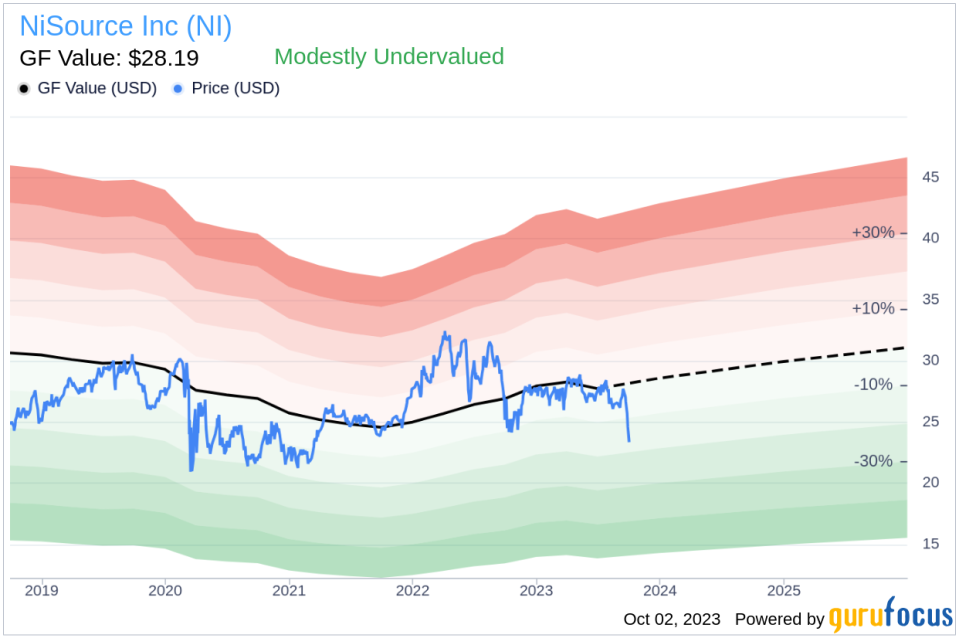

NiSource is a significant player in the natural gas distribution sector, serving approximately 3.2 million customers across several states. The company also operates in the electric utility space, transmitting and distributing electricity to about 500,000 customers in northern Indiana. Despite its current stock price of $23.37, the GF Value, a proprietary measure of intrinsic value, estimates NiSource's fair value at $28.19. This discrepancy prompts a more profound exploration of the company's value.

Summarizing GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it may be overvalued and could yield poor future returns. Conversely, if the stock price is significantly below the GF Value Line, the stock may be undervalued and could yield higher future returns.

Currently, NiSource's stock appears to be modestly undervalued. With a share price of $23.37, the GF Value suggests that the stock's long-term return is likely to be higher than its business growth due to its relative undervaluation.

Link: These companies may deliver higher future returns at reduced risk.

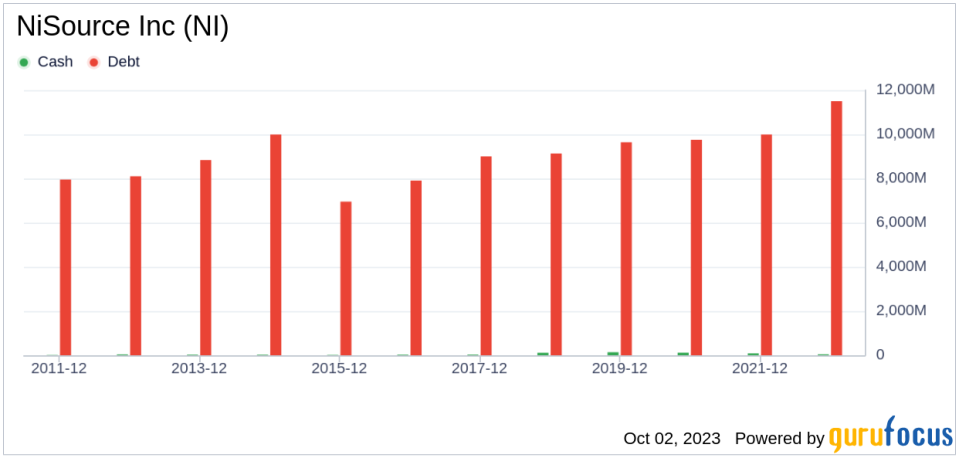

NiSource's Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. It's crucial to carefully review a company's financial strength before deciding to invest. NiSource's cash-to-debt ratio of 0.01 is worse than 95.42% of companies in the Utilities - Regulated industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. NiSource has been profitable for 8 of the past 10 years, indicating fair profitability. However, its 3-year average annual revenue growth of -1.6% ranks worse than 86.49% of companies in the Utilities - Regulated industry, indicating poor growth.

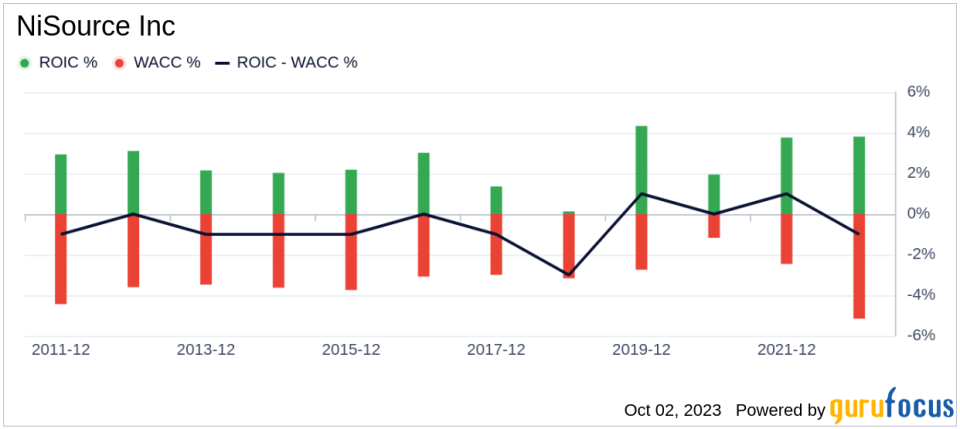

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can determine its profitability. NiSource's ROIC of 3.79 is lower than its WACC of 5.59, suggesting that the company is not creating value for shareholders.

Conclusion

In conclusion, NiSource's stock appears to be modestly undervalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 50.11% of companies in the Utilities - Regulated industry. For more information on NiSource stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.