Unveiling A.O. Smith (AOS)'s Value: Is It Really Priced Right? A Comprehensive Guide

A.O. Smith Corp (NYSE:AOS) has seen a daily gain of 1.1% and a 3-month loss of -7.56%. With an Earnings Per Share (EPS) (EPS) of 1.8, the stock appears to be modestly undervalued. But is this really the case? This article provides an in-depth analysis of A.O. Smith's intrinsic value, allowing investors to make well-informed decisions. Read on to understand the company's valuation and potential for future returns.

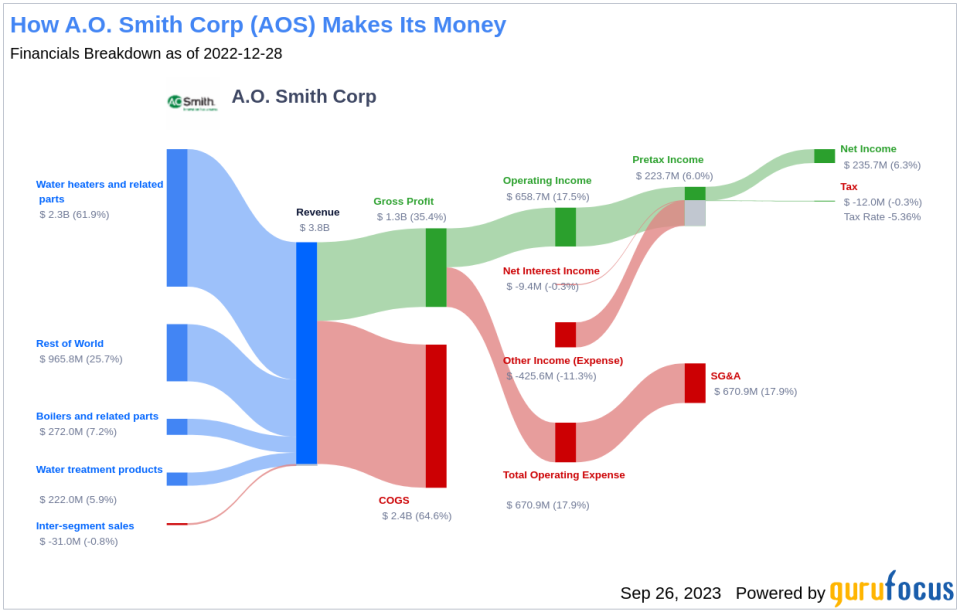

Company Overview

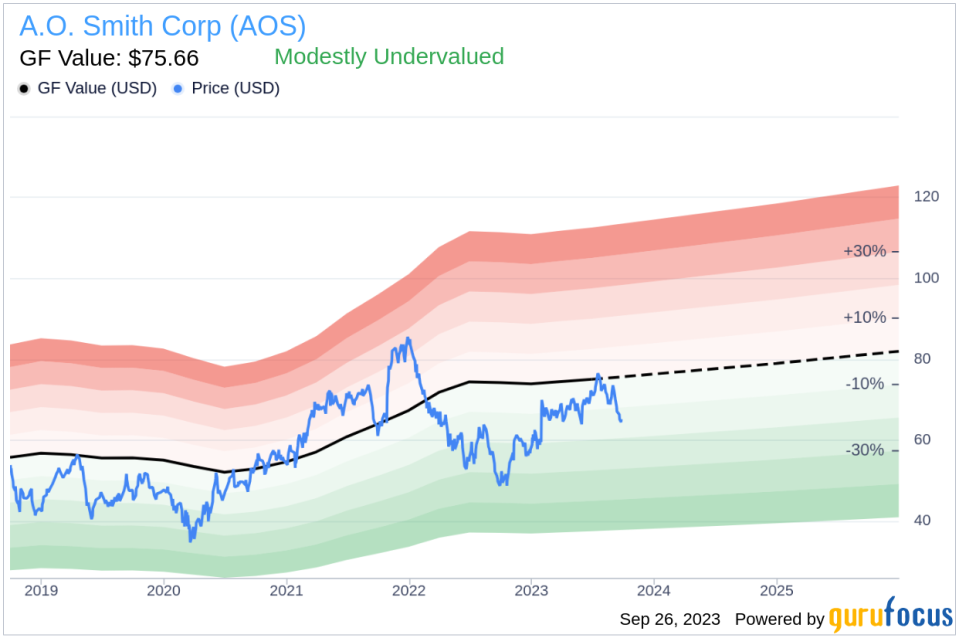

A.O. Smith Corporation, symbolized as AOS, is a leading manufacturer and marketer of residential and commercial gas, gas tankless, and electric water heaters. The company also offers supplementary products such as water heating equipment, condensing and non-condensing boilers, and water system tanks. With its two operating segments, North America and the Rest of the World, A.O. Smith has a significant market presence. The company's stock price stands at $65.18, while its intrinsic value, denoted by the GF Value, is estimated at $75.66.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line offers an overview of the fair trading value of the stock. If the stock price is significantly above the GF Value Line, it's overvalued, and its future return is likely to be poor. Conversely, if it's significantly below the GF Value Line, it's undervalued, and its future return will likely be higher.

A.O. Smith (NYSE:AOS) is considered modestly undervalued based on GuruFocus' valuation method. Given this undervaluation, the long-term return of A.O. Smith's stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

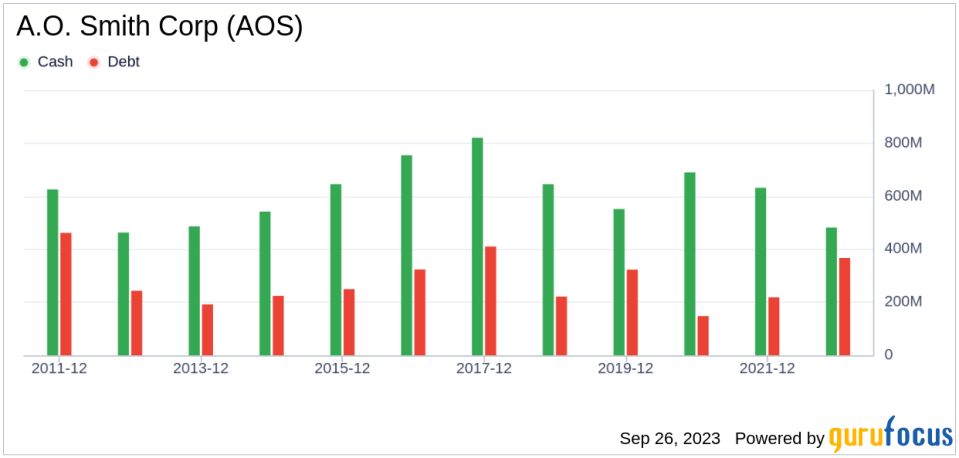

Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, investors must review a company's financial strength before purchasing shares. A.O. Smith has a cash-to-debt ratio of 1.77, ranking better than 56.54% of companies in the Industrial Products industry. Overall, A.O. Smith's financial strength is strong, with a 9 out of 10 rating.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. A.O. Smith has been profitable for 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $3.70 billion and an EPS of $1.8. Its operating margin is 19.28%, ranking better than 90.48% of companies in the Industrial Products industry. Overall, A.O. Smith's profitability is strong, with an 8 out of 10 rating.

However, growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of A.O. Smith is 10.3%, ranking better than 62.32% of companies in the Industrial Products industry. Unfortunately, the 3-year average EBITDA growth rate is -16.1%, ranking worse than 85.58% of companies in the industry.

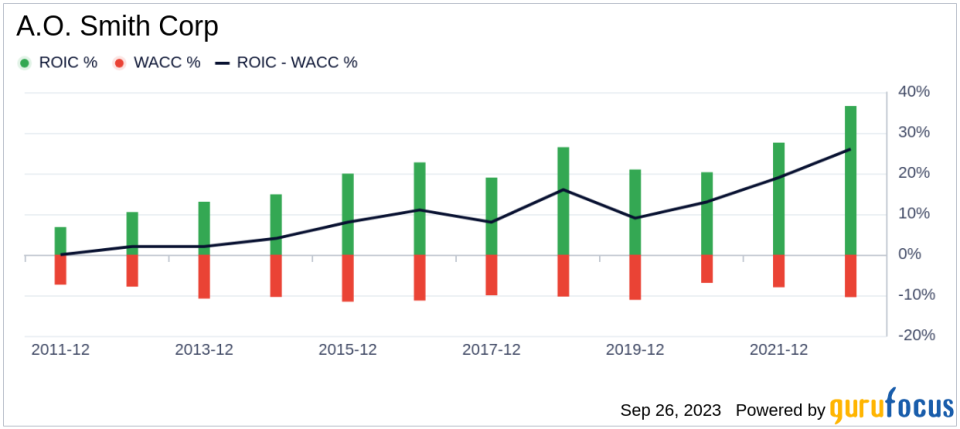

ROIC vs. WACC

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) to its weighted cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, A.O. Smith's ROIC was 34.79, while its WACC came in at 12.86.

Conclusion

In conclusion, A.O. Smith (NYSE:AOS)'s stock is estimated to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. However, its growth ranks worse than 85.58% of companies in the Industrial Products industry. For more information about A.O. Smith's stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.