Unveiling Owens & Minor (OMI)'s Value: Is It Really Priced Right? A Comprehensive Guide

Owens & Minor Inc (NYSE:OMI) witnessed a daily gain of 3.28%, albeit a 3-month loss of -12.45%. The company reported a Loss Per Share of 1.3. Despite these figures, the question arises: is the stock significantly undervalued? This article aims to provide a comprehensive valuation analysis of Owens & Minor, offering insights into its financial performance and intrinsic worth. So, let's delve into the details.

Company Introduction

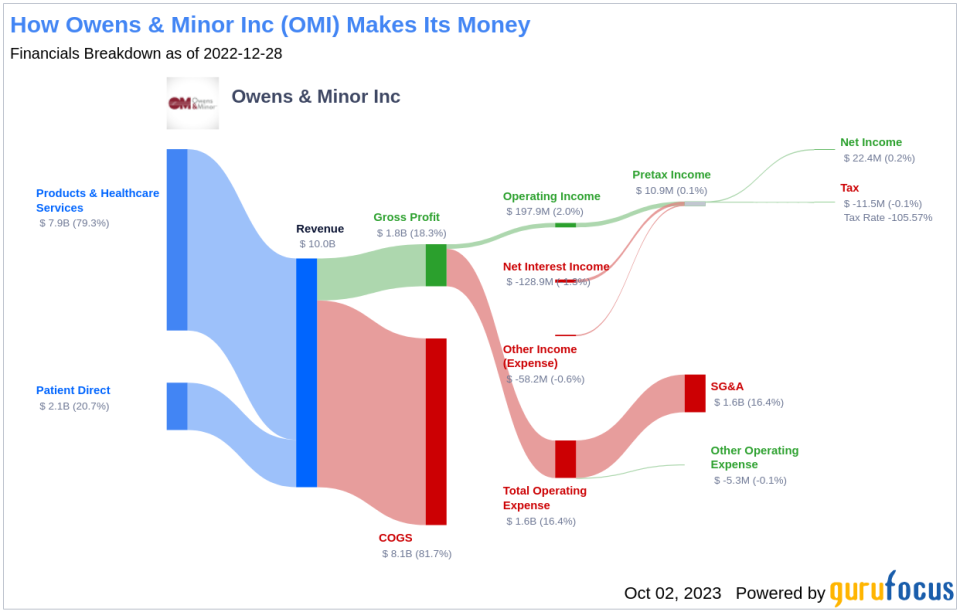

Owens & Minor Inc is a prominent distributor of consumable medical supplies to various providers. The company operates under two segments: Products & Healthcare Services and Patient Direct. The former includes the United States distribution business (Medical Distribution), outsourced logistics and value-added services business, and Global Products business. The latter encompasses home healthcare businesses (Byram and Apria).

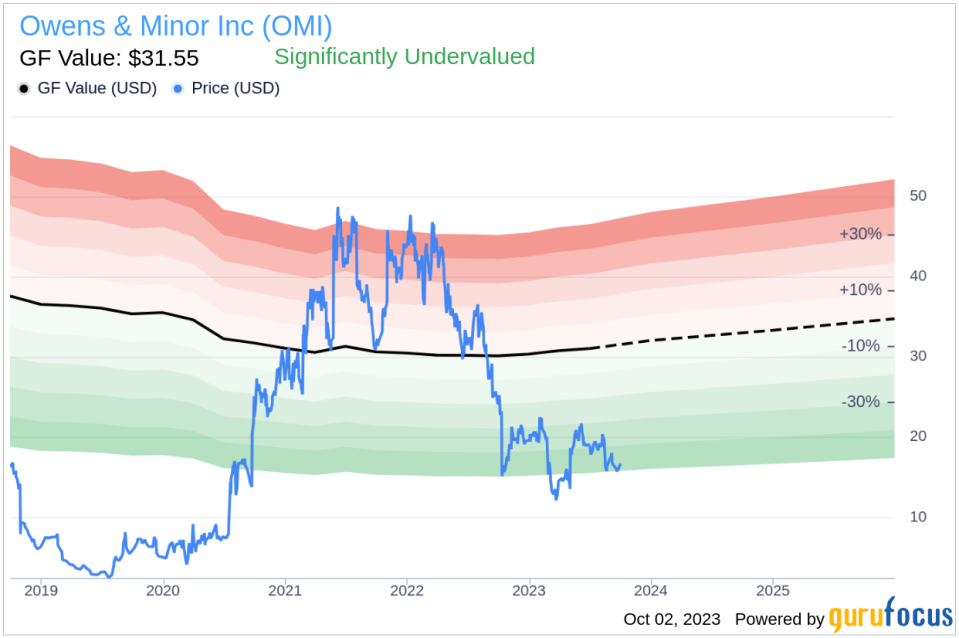

Comparing Owens & Minor's current stock price of $16.69 with its GF Value (fair value) of $31.55, the stock appears significantly undervalued. Here's a breakdown of the company's income:

Understanding the GF Value

The GF Value provides an estimation of a stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor considering the company's past returns and growth, and future business performance estimates. If the stock price significantly deviates from the GF Value Line, it could indicate overvaluation or undervaluation.

According to the GF Value, Owens & Minor's stock is significantly undervalued. This is based on historical multiples, an internal adjustment factor, and analyst estimates of future business performance. Given the current price of $16.69 per share, Owens & Minor stock is projected to offer higher future returns due to its significant undervaluation.

Because Owens & Minor is significantly undervalued, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

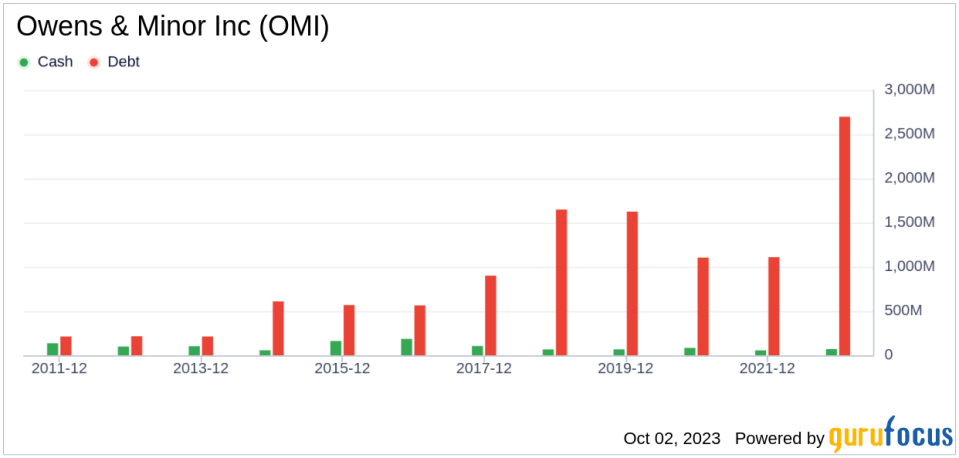

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Hence, it's crucial to carefully assess a company's financial strength before investing. A good starting point is to look at the cash-to-debt ratio and interest coverage. Owens & Minor's cash-to-debt ratio stands at 0.11, which is lower than 82.76% of the companies in the Medical Distribution industry. This indicates fair financial strength. Here's a glance at Owens & Minor's debt and cash over the past years:

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Owens & Minor has been profitable for 8 out of the past 10 years. Over the past twelve months, the company reported a revenue of $10.10 billion and a Loss Per Share of $1.3. Its operating margin is 1.29%, ranking it lower than 72.22% of the companies in the Medical Distribution industry. This indicates fair profitability.

Growth is a critical factor in a company's valuation. Owens & Minor's 3-year average revenue growth rate is lower than 83.33% of the companies in the Medical Distribution industry. However, its 3-year average EBITDA growth rate is 16.3%, ranking it higher than 65.71% of the companies in the industry. This indicates better growth prospects.

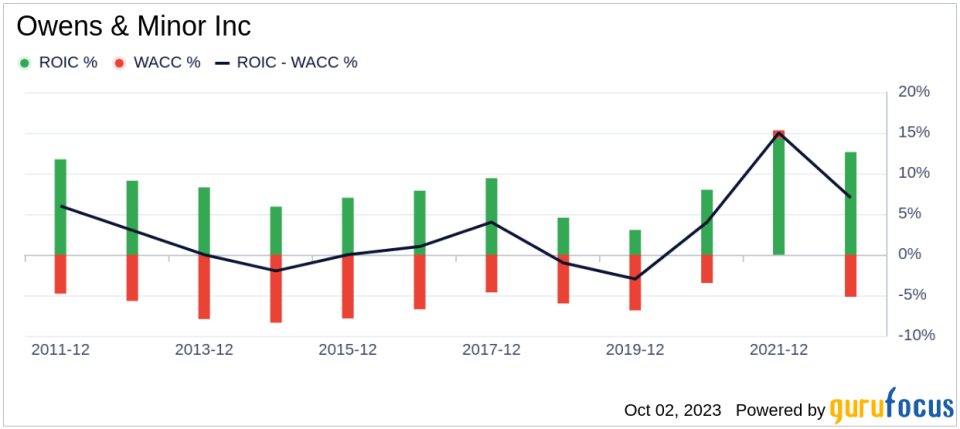

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to finance its assets. When ROIC is higher than WACC, it implies the company is creating value for shareholders. For the past 12 months, Owens & Minor's ROIC is 2.25, and its WACC is 7.47. Here's a historical comparison of Owens & Minor's ROIC and WACC:

Conclusion

In conclusion, Owens & Minor's stock appears to be significantly undervalued. The company's financial condition and profitability are fair, and its growth ranks better than 65.71% of the companies in the Medical Distribution industry. To learn more about Owens & Minor stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.