Unveiling the Ownership Dynamics of BWX Technologies Inc

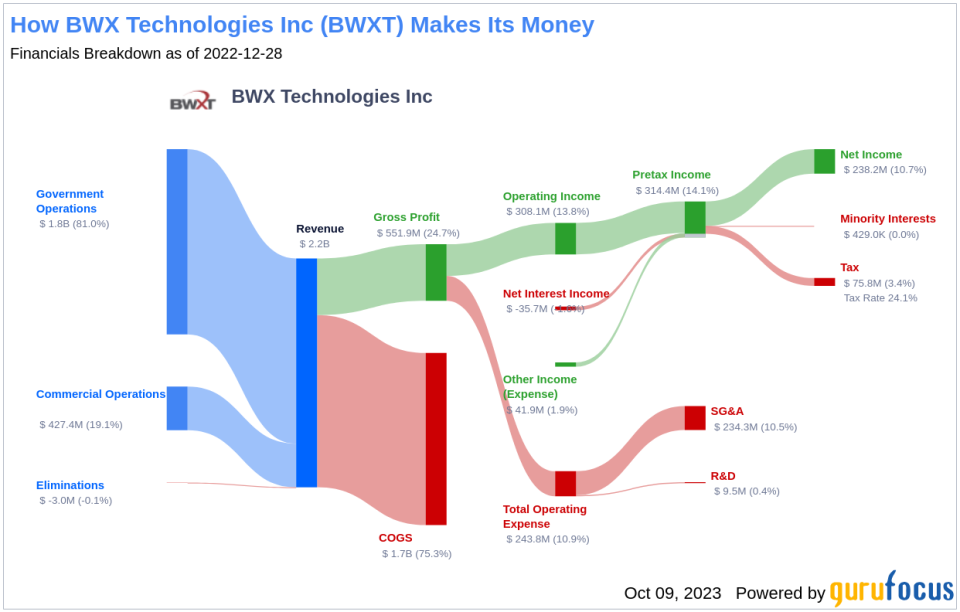

BWX Technologies Inc (NYSE:BWXT) is a renowned specialty manufacturer and service provider of nuclear components. The company operates in two segments: Government Operations and Commercial Operations. It has a significant presence in the United States, Canada, and the United Kingdom, with the majority of its operations based in the United States.

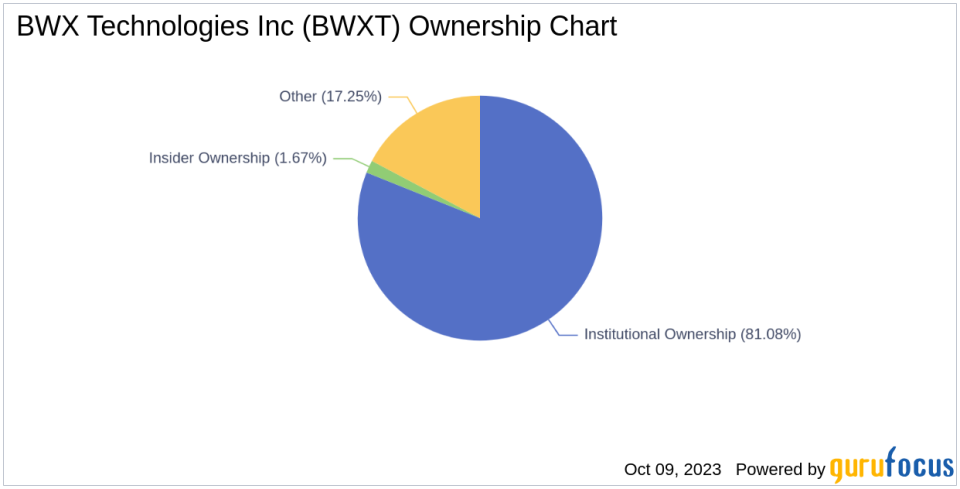

As of the most recent data, BWX Technologies Inc has an outstanding share count of 91.47 million. Institutional ownership stands at 74.16 million shares, representing 81.08% of the total shares. Meanwhile, insiders hold 1.53 million shares, accounting for 1.67% of the total share count.

Stock Performance and Market Capitalization

BWX Technologies Inc experienced a decline of about 5.51% in its stock value over the past week. However, as of Oct 09, 2023, the stock rose by 3.25%, aligning with its three-month return of 8.5%. The company's market cap rose to $6.55 billion in the most recent quarter from $5.76 billion in the preceding one, indicating a volatile yet upward trend.

Income Breakdown

Institutional Ownership and Key Players

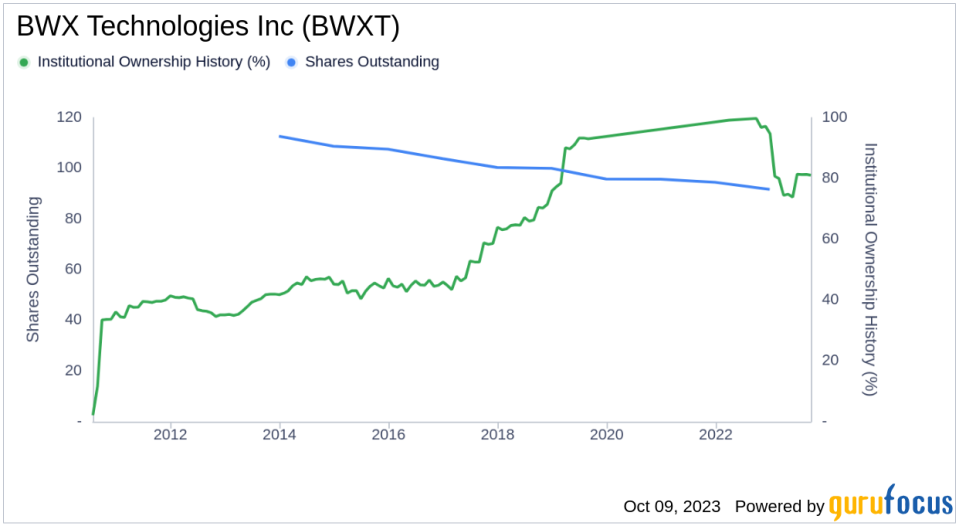

BWX Technologies Inc's institutional ownership history reveals that major stakeholders have a high level of trust in the company's future. As of 2023-09-30, the institutional ownership level is 81.08%, slightly down from the previous quarter but still significantly high.

Among the most significant stakeholders, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), Jefferies Group (Trades, Portfolio), and Keeley-Teton Advisors, LLC (Trades, Portfolio) hold 1.9%, 0.05%, and 0.04% of shares outstanding respectively.

Earnings: Past and Future

BWX Technologies Inc's Ebitda growth averaged 2.6% per year over the past three years, outperforming 53.04% of companies in the Aerospace & Defense industry. Looking forward, the estimated earnings growth for BWX Technologies Inc is 0% per year, indicating a potential slowdown.

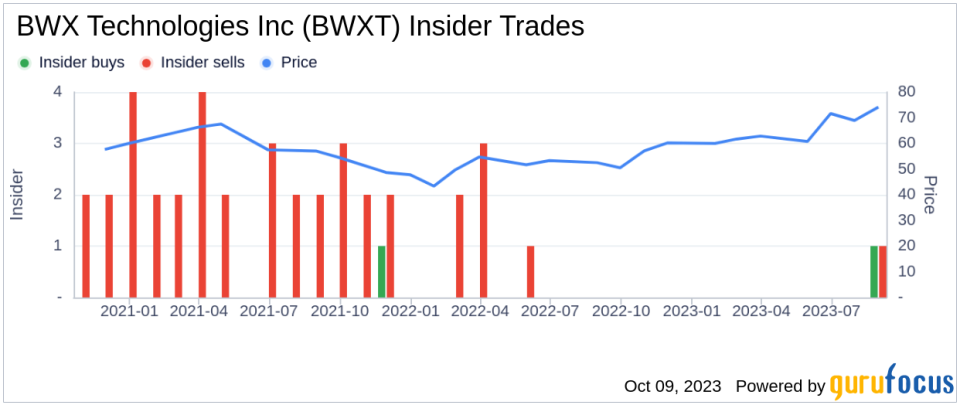

Insider Ownership and Activities

Insider ownership offers insights into the convictions of the company's board directors and C-level employees. BWX Technologies Inc's insider ownership is approximately 1.67% as of 2023-08-31, a slight increase from the previous year, reflecting the increased faith of those intimately familiar with the company's operations.

Conclusion

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. BWX Technologies Inc's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.