Unveiling the Ownership Landscape of Axalta Coating Systems Ltd (AXTA)

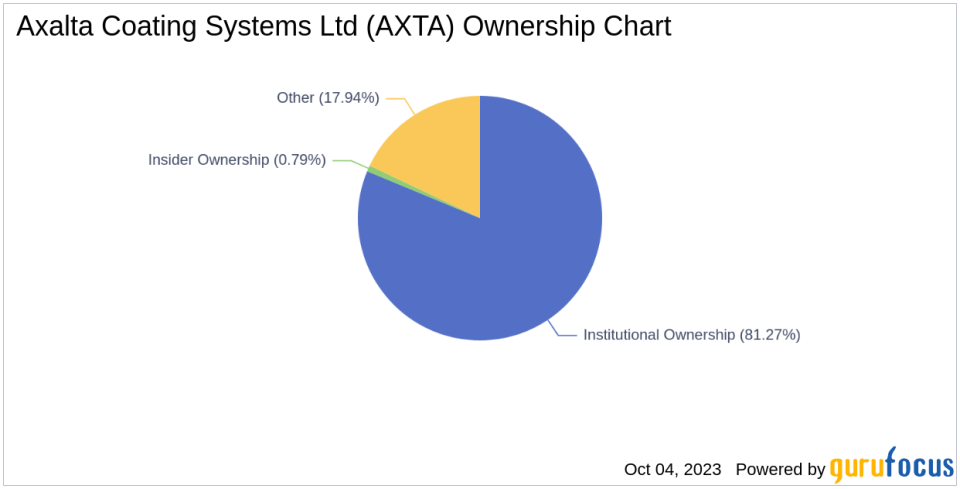

Axalta Coating Systems Ltd (NYSE:AXTA), a leading manufacturer, marketer, and distributor of high-performance coating systems, has been a focal point of market attention due to its recent stock performance and ownership trends. As of the latest data, Axalta Coating Systems Ltd has an outstanding share count of 221.70 million, with institutional ownership accounting for 81.27% and insider ownership comprising 0.79% of the total shares.

Stock Performance and Market Cap Fluctuation

In the past week, Axalta Coating Systems Ltd experienced a decline of about 1.83% in its stock value. As of Oct 04, 2023, the stock fell by 0.17%, contrasting with its three-month return of -17.88%. The company's market cap rose to $7.27 billion in the most recent quarter from $6.71 billion in the preceding one, sparking keen interest in the company's ownership trends.

Institutional Ownership and Key Players

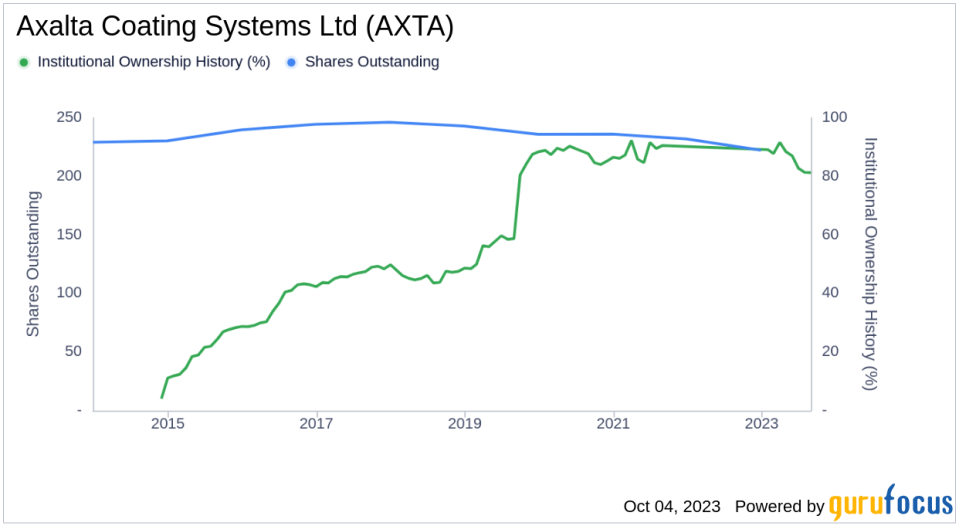

Axalta Coating Systems Ltd's institutional ownership history reveals the levels of trust and confidence that major players have in the company's future. As of 2023-08-31, Axalta Coating Systems Ltd's institutional ownership level is 81.27%, down from 87% as of 2023-05-31 and 84.64% from a year ago.

The top fund managers owning chunks of Axalta Coating Systems Ltd's stock are Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), John Rogers (Trades, Portfolio), and Richard Pzena (Trades, Portfolio), with 7.06%, 2.54%, and 1.69% of shares outstanding respectively. Recent institutional trading activity provides a vivid picture of the market sentiment.

Earnings: Past and Future

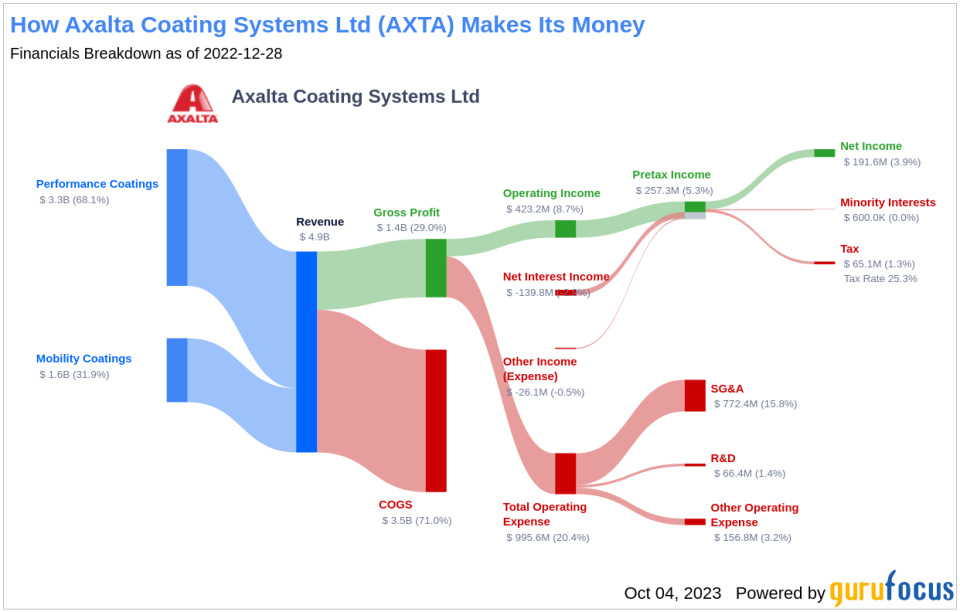

Over the past three years, Axalta Coating Systems Ltd's Ebitda growth averaged -4.2% per year. Looking forward, the estimated earnings growth for Axalta Coating Systems Ltd is 0% per year, higher than the earnings growth of -6.7% during the past three years.

Insider Ownership and Activities

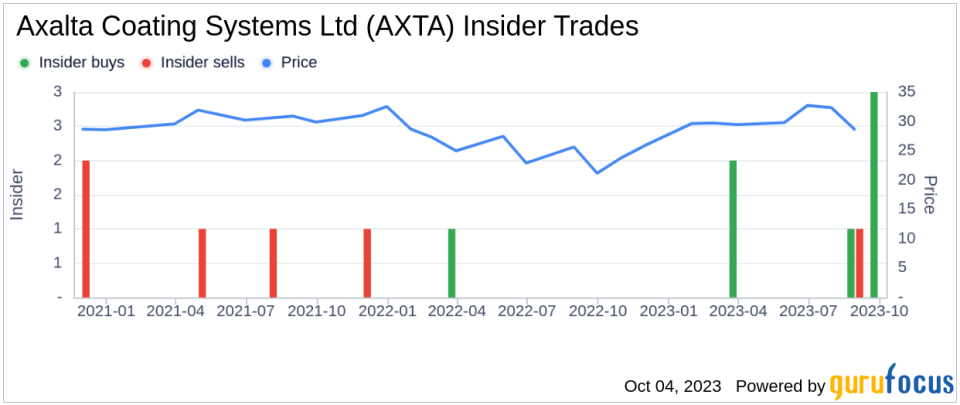

Insider ownership of Axalta Coating Systems Ltd is approximately 0.79% as of 2023-08-31, compared to 0.64% from a year ago. Recent insider trades provide a nuanced view of this sentiment. During the past three months, Axalta Coating Systems Ltd had 1 insider sell transactions and 4 insider buy transactions.

Conclusion

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. Axalta Coating Systems Ltd's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article first appeared on GuruFocus.