Unveiling the Ownership and Performance Analysis of DigitalOcean Holdings Inc (DOCN)

DigitalOcean Holdings Inc (NYSE:DOCN) is a leading cloud computing platform that offers on-demand infrastructure and platform tools primarily for developers, start-ups, and small to medium-sized businesses. The platform is used for a wide array of applications including web and mobile applications, website hosting, e-commerce, media and gaming, personal web projects, and managed services, among others. The company has a global presence with operations in North America, Europe, Asia, and other regions.

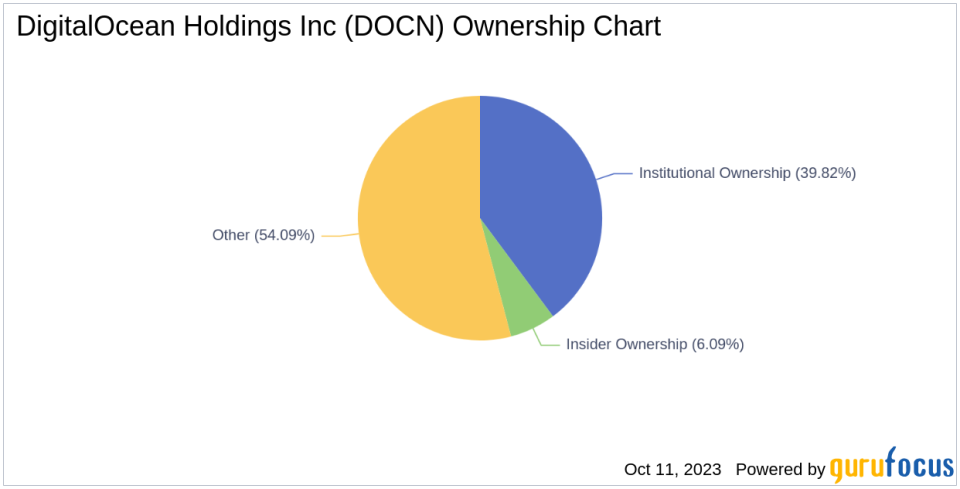

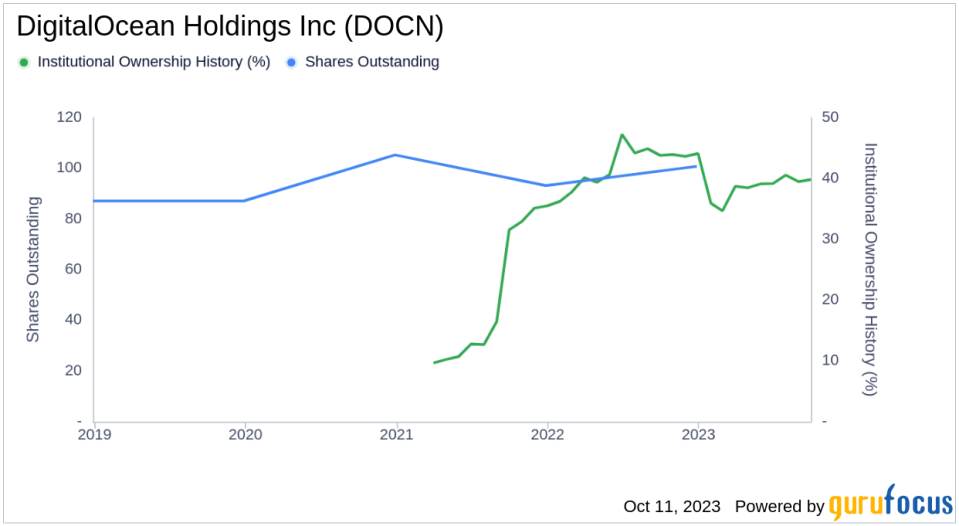

As of the latest data, DigitalOcean Holdings Inc has an outstanding share count of 88.85 million. Institutional ownership stands at 35.38 million shares, constituting 39.82% of the total shares, while insiders hold 5.42 million shares, representing 6.09% of the total share count. The company's stock performance and ownership trends have been a focal point for investors due to recent fluctuations in its market value.

Recent Stock Performance

DigitalOcean Holdings Inc has experienced a decline of about 10.36% in its stock value over the past week. As of October 11, 2023, the stock rose by 0.78%, contrasting with its three-month return of -47.39%. The company's market cap increased to $3.56 billion in the recent quarter from $3.52 billion in the preceding one, highlighting the volatility in its stock value.

Institutional Ownership and Key Players

The history of institutional ownership in DigitalOcean Holdings Inc reveals the confidence levels that major players have in the company's future. As of September 30, 2023, the institutional ownership level is 39.82%, which is an increase from the institutional ownership of 39.17% as of June 30, 2023, but a decrease from the institutional ownership of 43.94% a year ago.

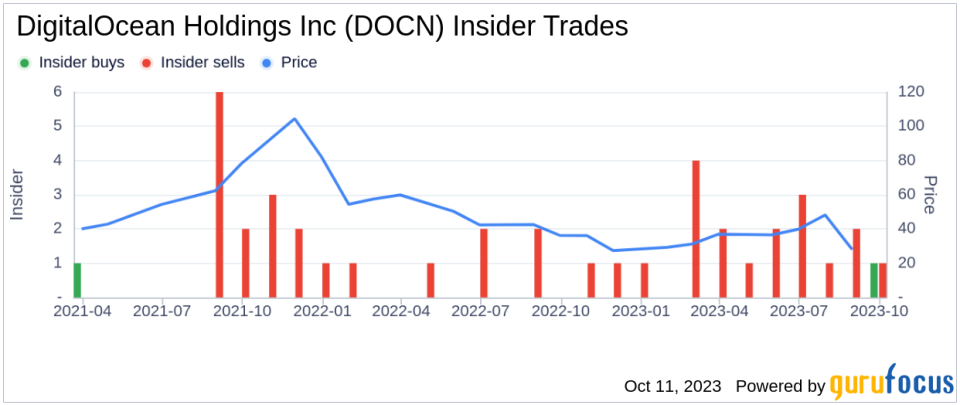

Among the most significant stakeholders, Ken Fisher (Trades, Portfolio), Arnold Van Den Berg (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio) are the top fund managers owning 0.16%, 0.06%, and 0.03% of shares outstanding respectively. Their trading activities provide a clear picture of the market sentiment towards DigitalOcean Holdings Inc.

Financial Performance and Earnings

Over the past three years, DigitalOcean Holdings Inc's Ebitda growth averaged 31.6% per year, outperforming 78.95% of 1986 companies in the Software industry. However, the estimated earnings growth for the company is 0% per year, which is lower than the earnings growth of 15.5% during the past three years.

Insider Ownership and Activities

The insider ownership of DigitalOcean Holdings Inc is approximately 6.09% as of August 31, 2023, an increase from the insider ownership of 4.65% a year ago. This reflects the increased confidence of the company's board directors and C-level employees. However, recent insider trades show a mixed picture, with three insider sell transactions and one insider buy transaction in the past three months.

Conclusion

Understanding the intricacies of ownership and earnings is crucial in the ever-evolving realm of stocks. DigitalOcean Holdings Inc's recent dip provides a case study in how major players react to market shifts. Their movements offer valuable insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to making sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.