Unveiling Pure Storage (PSTG)'s Value: Is It Really Priced Right? A Comprehensive Guide

Pure Storage Inc (NYSE:PSTG) experienced a daily loss of -4.87%, with a three-month loss of -3.54%. The company reported a Loss Per Share of 0.02. With these figures, we question: is the stock modestly overvalued? This article aims to provide a comprehensive valuation analysis of Pure Storage. Read on to delve into the financial intricacies of this tech giant.

Company Introduction

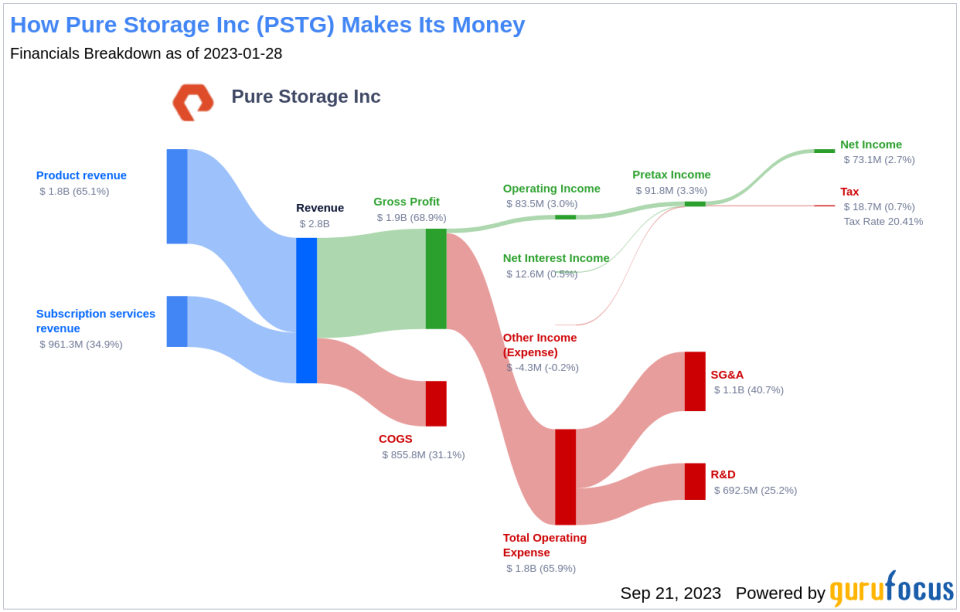

Pure Storage Inc is a US-based company that provides an enterprise data storage platform. It transforms businesses through a dramatic increase in performance and reduction in complexity and costs. Its revenue sources include product revenue, which includes the sale of integrated storage hardware and embedded operating system software, and subscription services revenue. The latter includes Evergreen Storage subscriptions, Pure as-a-Service, Cloud Block Store, and Portworx. Subscription services revenue also includes professional services offerings such as installation and implementation consulting services.

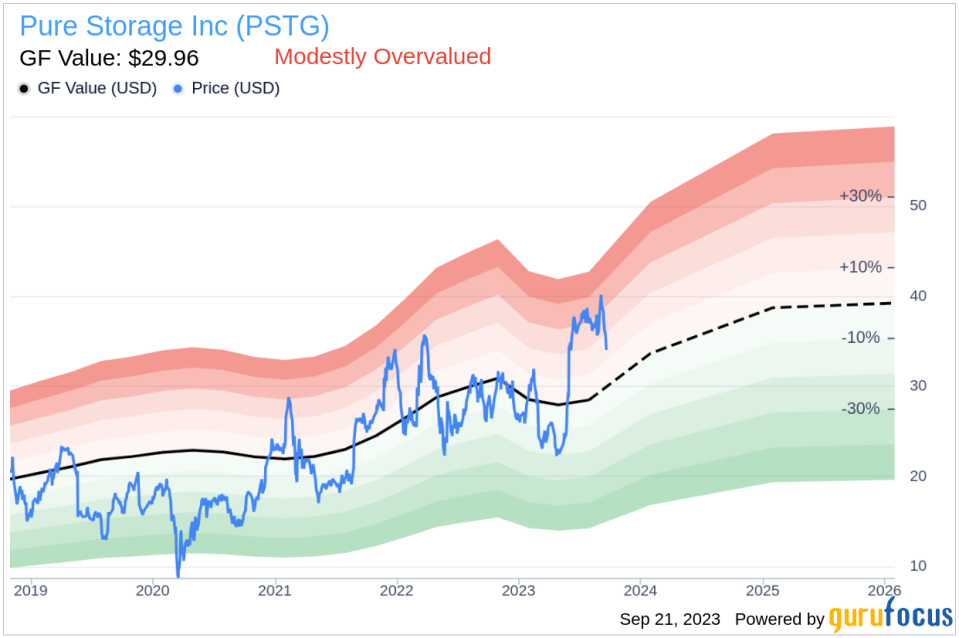

At a price of $33.97 per share, Pure Storage's stock is trading above its GF Value of $29.96, suggesting that it may be modestly overvalued. The following analysis will delve deeper into the company's value.

GF Value Summary

The GF Value is a measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. It provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, the stock is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus' valuation method, Pure Storage (NYSE:PSTG) is estimated to be modestly overvalued. The stock's fair value is calculated based on historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. At its current price of $ 33.97 per share, Pure Storage stock is estimated to be modestly overvalued. As a result, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

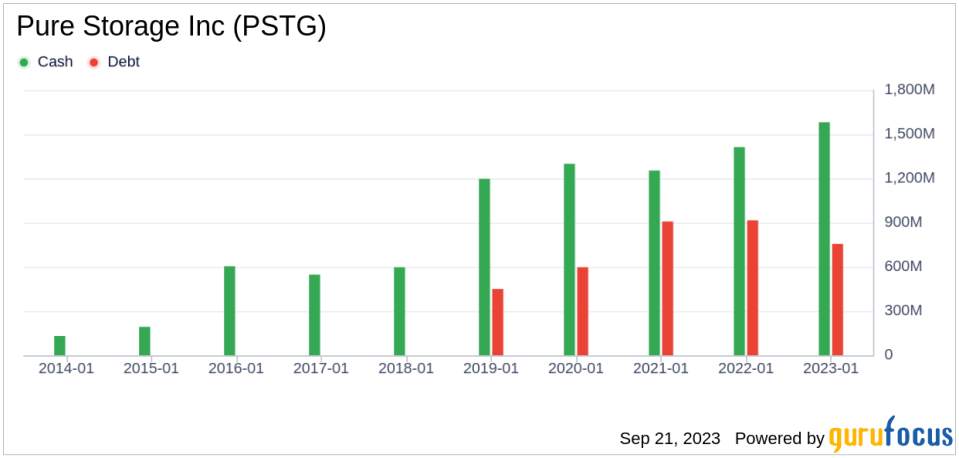

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. Looking at the cash-to-debt ratio and interest coverage can provide a good initial perspective on the company's financial strength. Pure Storage has a cash-to-debt ratio of 4.37, ranking better than 69.25% of 2374 companies in the Hardware industry. Based on this, GuruFocus ranks Pure Storage's financial strength as 7 out of 10, suggesting a fair balance sheet.

This article first appeared on GuruFocus.