Unveiling R1 RCM (RCM)'s Value: Is It Really Priced Right? A Comprehensive Guide

R1 RCM Inc (NASDAQ:RCM), a provider of technology-driven solutions that transform the patient experience and financial performance of healthcare providers, is currently experiencing a daily loss of 4.58% and a 3-month loss of 30.97%. Despite this, the company reports a Loss Per Share of $0.16. In light of these figures, the pertinent question arises: Is the stock modestly undervalued?

This article aims to provide a comprehensive valuation analysis of R1 RCM, delving into its financial health, profitability, growth, and intrinsic value. We invite you to read on for an informed perspective on this stock.

Company Overview

R1 RCM Inc is a key player in the healthcare sector, offering technology-driven solutions that significantly enhance the patient experience and financial performance of healthcare providers. The company's services have proven instrumental in generating sustainable improvements in operating margins and cash flows for healthcare providers, while also boosting patient, physician, and staff satisfaction. The majority of the company's revenue comes from operating fees received.

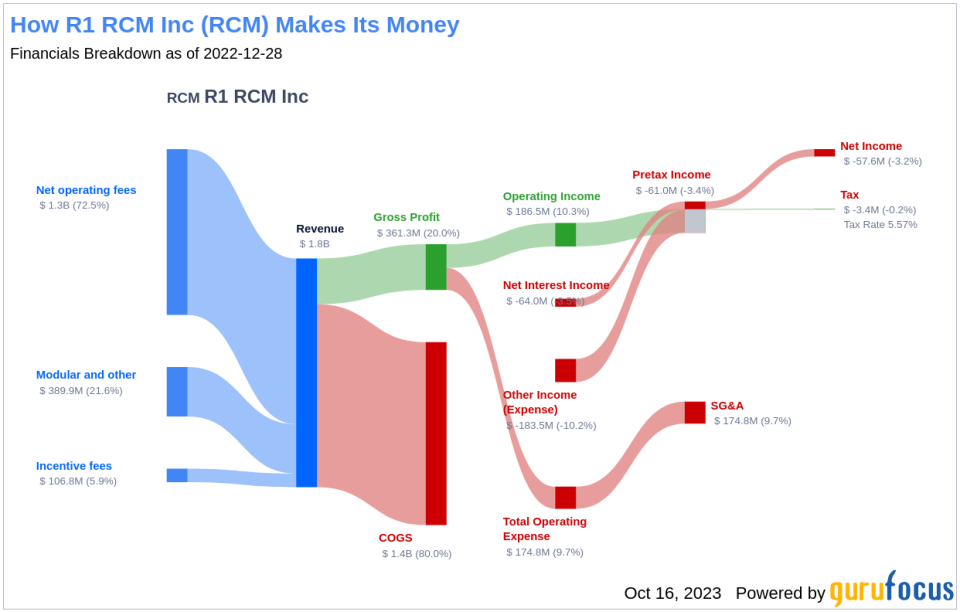

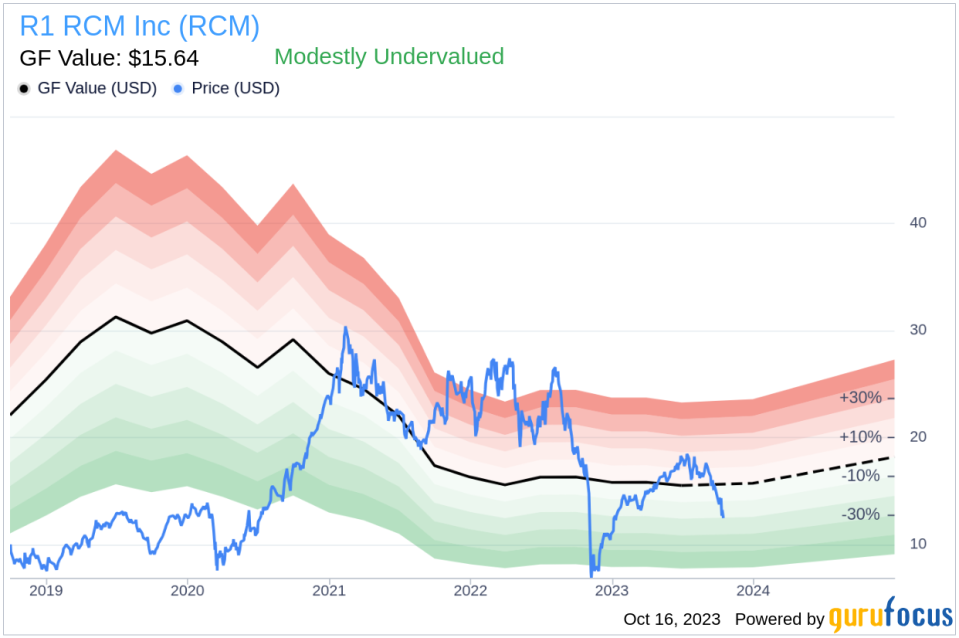

The company's current stock price stands at $12.6, while the GF Value, an estimation of fair value, is $15.64. This comparison suggests that the stock might be modestly undervalued. Let's delve deeper into the company's value with a look at its income breakdown:

Understanding GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) at which the stock has traded.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Our analysis suggests that R1 RCM (NASDAQ:RCM) is modestly undervalued. Given this, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

[The rest of the article will continue to discuss the financial strength, profitability and growth, and ROIC vs WACC of R1 RCM (NASDAQ:RCM), finally concluding with a summary of the stock's valuation.]

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.