Unveiling Rambus (RMBS)'s True Worth: Is It Really Priced Right?

As of September 15, 2023, Rambus Inc (NASDAQ:RMBS), a leading semiconductor solutions provider, experienced a day's loss of -6.31%, culminating in a 3-month loss of -8.32%. With an Earnings Per Share (EPS) (EPS) of 1.69, the question arises: Is Rambus (NASDAQ:RMBS) significantly overvalued? This article aims to provide an in-depth analysis of Rambus's valuation and financial health, offering valuable insights for potential investors.

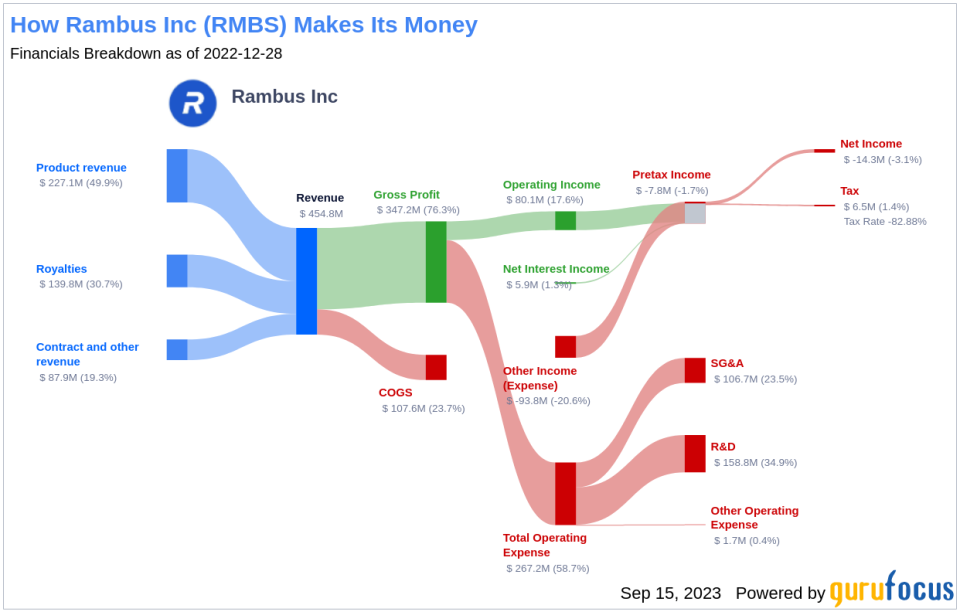

Company Introduction

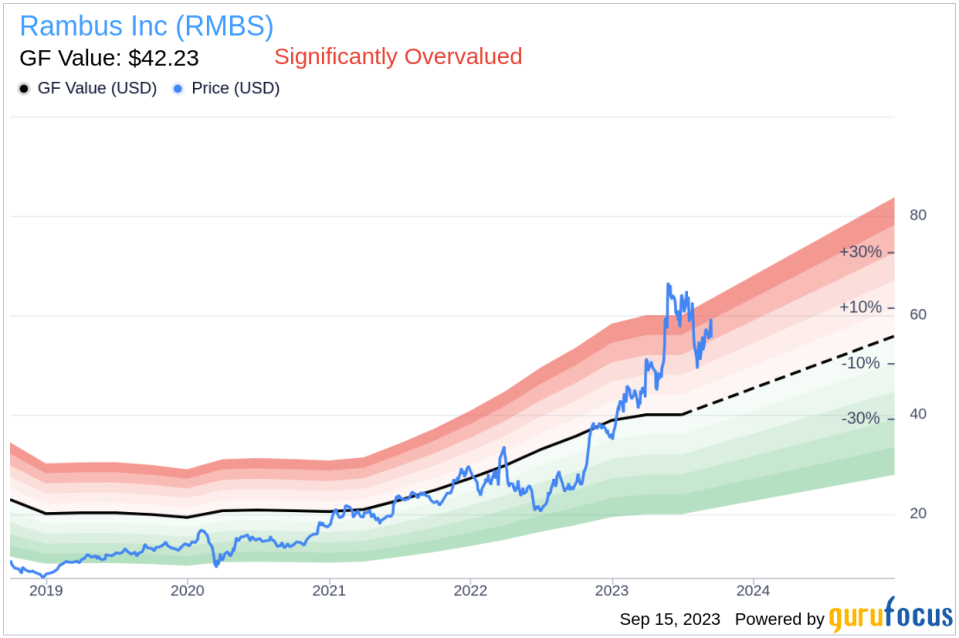

Rambus Inc (NASDAQ:RMBS) is renowned for its high-speed, high-security computer chips and Silicon intellectual property. Key products include memory interface chips, silicon IP, and architecture licenses. Despite a significant market presence in the United States, Taiwan, Asia-Other, Japan, and Singapore, Rambus's current stock price of $55.55 appears to exceed its fair value of $42.23, as estimated by the GF Value. This discrepancy prompts a deeper exploration into the company's intrinsic value.

Understanding GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value, considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it's considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, it's undervalued, and its future return will likely be higher.

According to GuruFocus, Rambus (NASDAQ:RMBS), with its current share price of $55.55 and a market cap of $6.10 billion, is significantly overvalued. This valuation suggests that the long-term return of its stock is likely to be much lower than its future business growth.

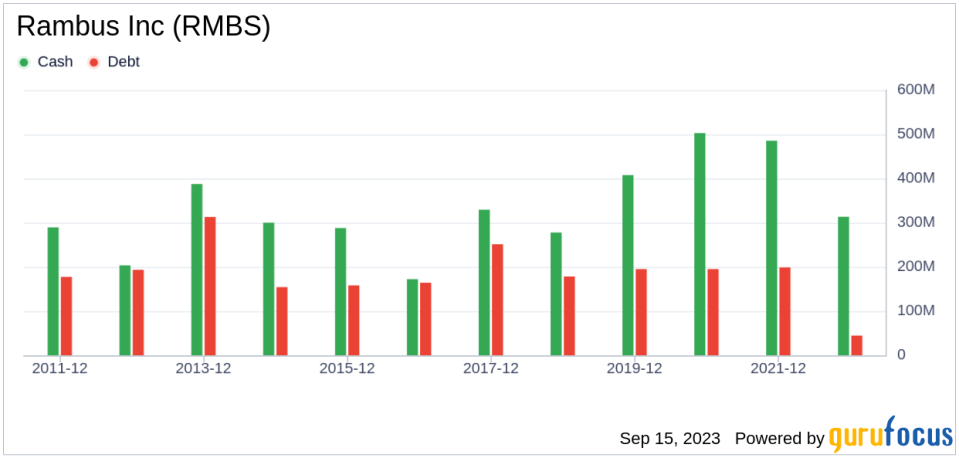

Assessing Financial Strength

Before investing, it's crucial to assess a company's financial strength. Companies with poor financial strength pose a higher risk of permanent loss. Rambus's cash-to-debt ratio of 10.64, better than 71.33% of 900 companies in the Semiconductors industry, indicates strong financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Rambus has been profitable 4 out of the past 10 years. With an operating margin of 16.52%, Rambus ranks better than 75.64% of 944 companies in the Semiconductors industry. However, its growth ranks worse than 0% of 772 companies in the same industry.

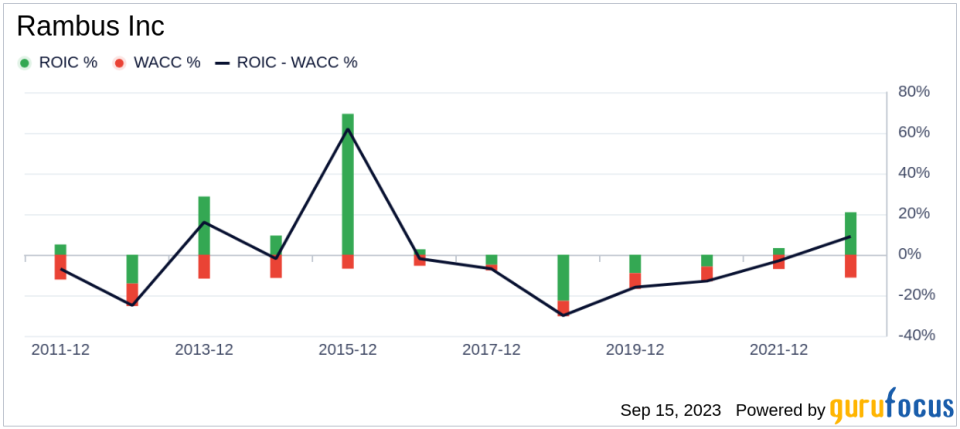

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted cost of capital (WACC) is another way to assess profitability. Rambus's ROIC of 59.17 is significantly higher than its WACC of 11.88, which is a positive sign for potential investors.

Conclusion

In conclusion, Rambus (NASDAQ:RMBS) appears to be significantly overvalued, despite its strong financial condition and fair profitability. Potential investors should consider these factors and review Rambus's 30-Year Financials for more detailed insights.

To discover high-quality companies that may deliver above-average returns, consider checking out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.