Unveiling Sabra Health Care REIT (SBRA)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 4.64%, a three-month gain of 22.14%, and a Loss Per Share of 0.54, Sabra Health Care REIT Inc (NASDAQ:SBRA) is a stock that demands attention. But the question remains: Is the stock fairly valued? In this article, we will delve into the financial analysis of Sabra Health Care REIT to answer this question. So, let's get started.

Company Introduction

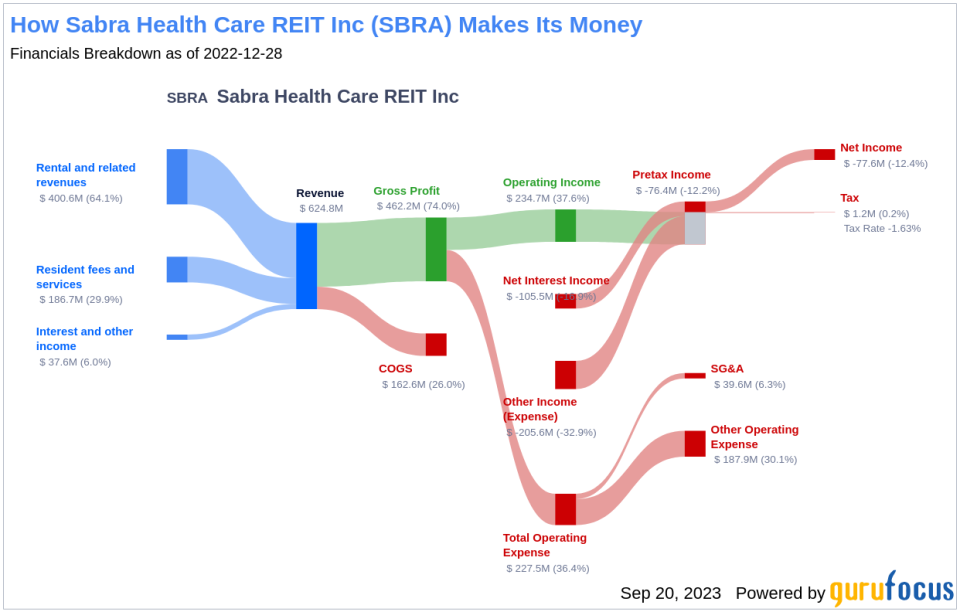

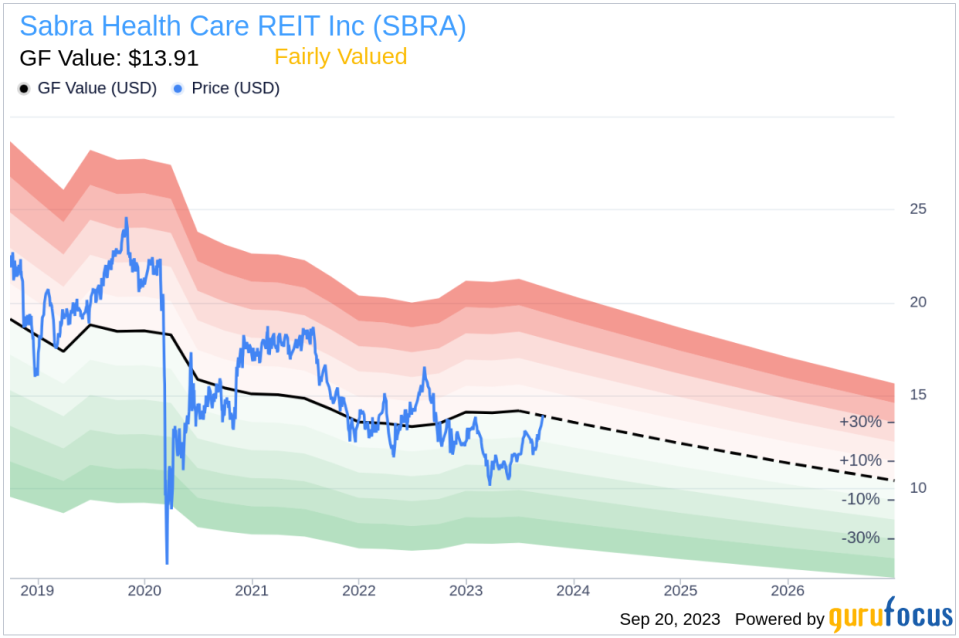

Sabra Health Care REIT Inc is a healthcare facility real estate investment trust. With its business operations primarily based in the United States, the company's portfolio includes nursing facilities, assisted living centers, and mental health facilities. Sabra Health Care REIT also considers mergers and acquisitions as a part of its growth strategy, working with existing operators to identify strategic development opportunities. The current stock price is $13.98, which is quite close to its GF Value of $13.91, suggesting that the stock is fairly valued.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides a visual representation of a stock's fair trading value.

Sabra Health Care REIT (NASDAQ:SBRA) appears to be fairly valued based on GuruFocus' valuation method. The stock's fair value is estimated considering historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. As the stock price is close to the GF Value Line, it indicates that the stock is fairly valued, and the long-term return is likely to be close to the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.

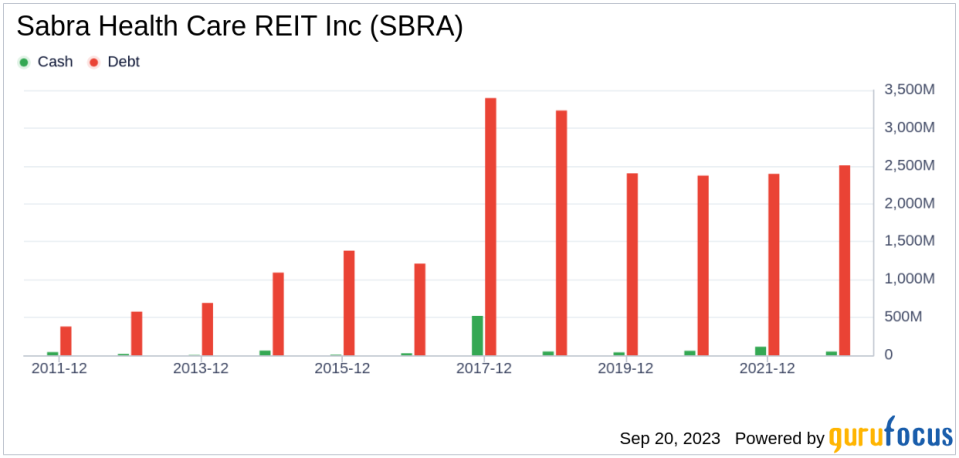

Financial Strength

Assessing a company's financial strength is crucial to avoid the risk of permanent capital loss. The cash-to-debt ratio and interest coverage are key indicators of a company's financial strength. Sabra Health Care REIT's cash-to-debt ratio of 0.01 ranks worse than 86.84% of companies in the REITs industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Sabra Health Care REIT has been profitable 8 over the past 10 years, indicating fair profitability. However, its growth ranks worse than 85.63% of companies in the REITs industry, indicating a need for improvement.

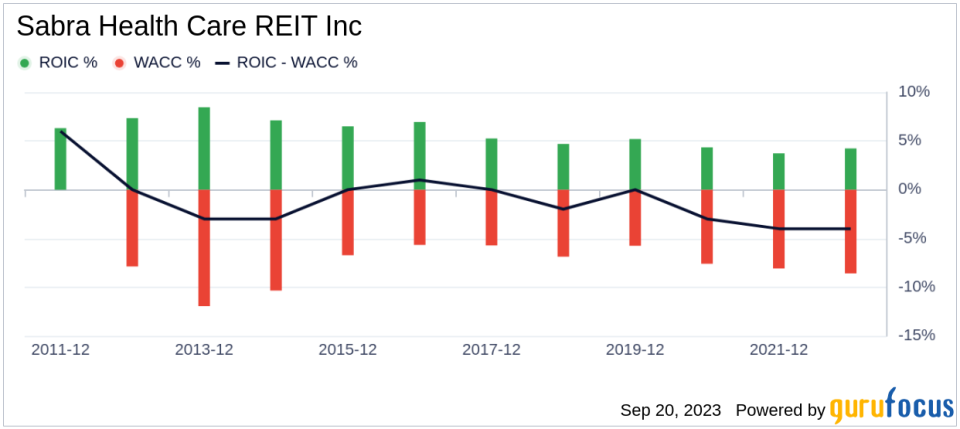

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted cost of capital (WACC) provides insight into its profitability. For the past 12 months, Sabra Health Care REIT's ROIC is 3.86, and its WACC is 7.97, indicating a need for improvement.

Conclusion

In conclusion, the stock of Sabra Health Care REIT (NASDAQ:SBRA) appears to be fairly valued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 85.63% of companies in the REITs industry. To learn more about Sabra Health Care REIT stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.