Unveiling Scholastic (SCHL)'s Value: Is It Really Priced Right? A Comprehensive Guide

On September 25, 2023, Scholastic Corp (NASDAQ:SCHL) reported a 3.85% gain, despite a 5.28% loss over the last three months. The company's Earnings Per Share (EPS) stands at 1.46. The question we aim to answer is whether the stock is modestly undervalued. The following analysis provides a detailed valuation of Scholastic (NASDAQ:SCHL).

Company Introduction

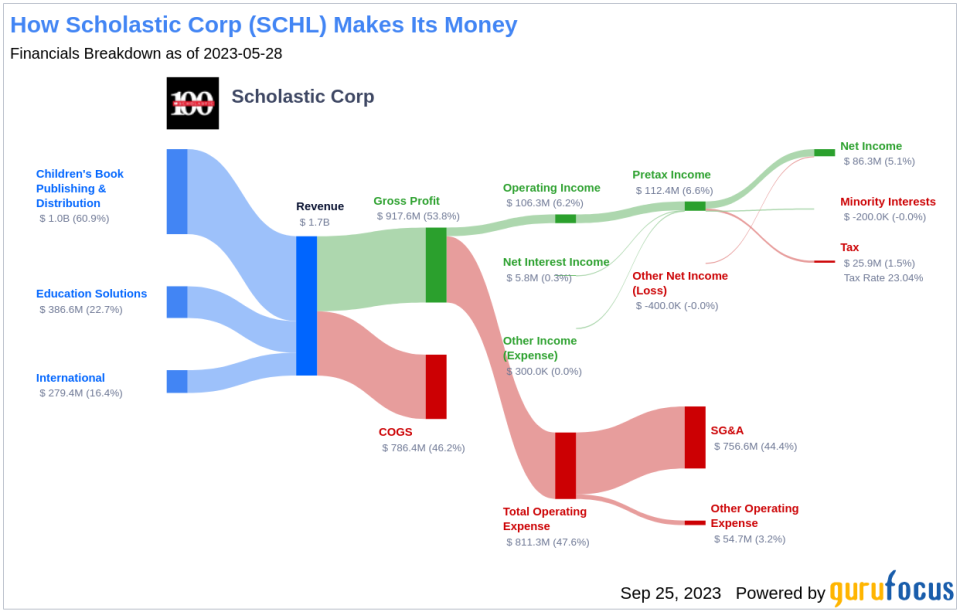

Scholastic Corp is a leading American publishing and education media company, specializing in books and educational material for schools, teachers, parents, and children. As one of the world's largest publishers of children's books, Scholastic holds exclusive rights to various books, including Harry Potter and The Hunger Games. The company's original titles include Clifford the Big Red Dog, Goosebumps, and The Magic School Bus. Scholastic operates in three segments: Children's Book Publishing and Distribution, Education Solutions, and International, with the majority of its revenue coming from the Children's Book Publishing and Distribution segment.

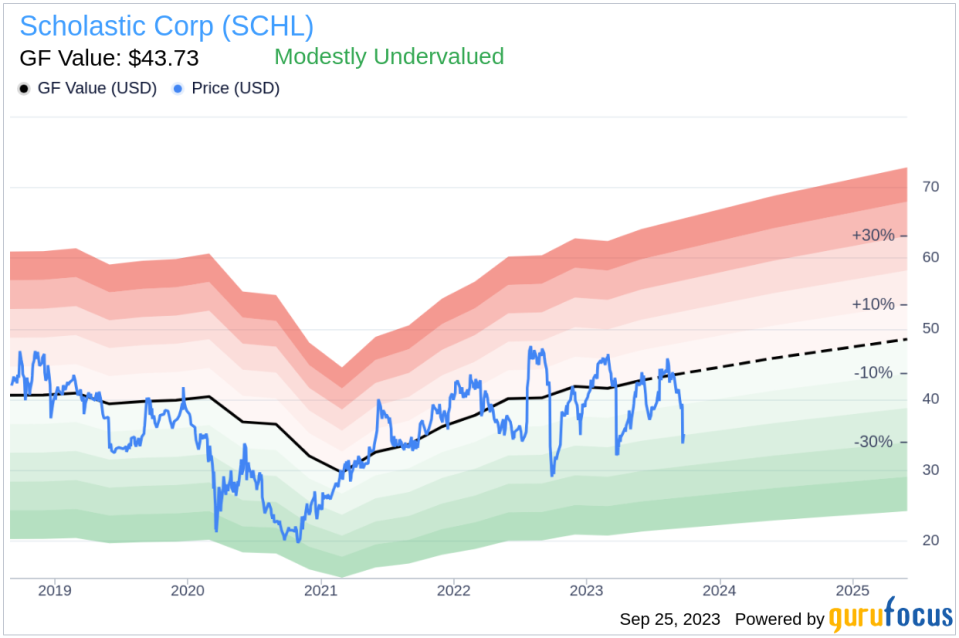

With a stock price of $35.1 and a market cap of $1.10 billion, Scholastic appears to be modestly undervalued compared to its GF Value of $43.73. This GF Value is an estimate of the fair value at which the stock should be traded.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should be traded.

If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. As Scholastic (NASDAQ:SCHL) appears to be modestly undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Assessing Scholastic's Financial Strength

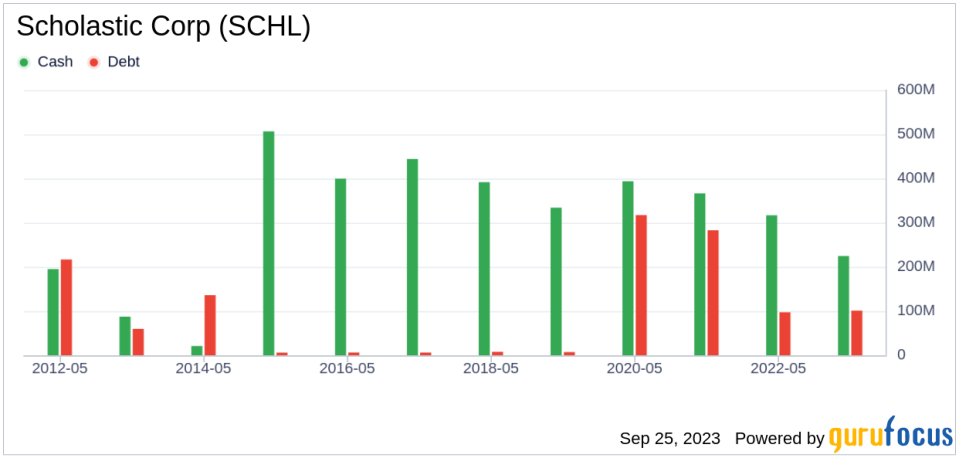

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before purchasing its stock. Scholastic's cash-to-debt ratio of 10000 is better than 99.9% of the companies in the Media - Diversified industry, indicating strong financial health.

Profitability and Growth

Investing in profitable companies carries less risk, especially those demonstrating consistent long-term profitability. Scholastic has been profitable for seven out of the past ten years. With an operating margin of 4.29%, Scholastic's profitability is fair when compared to 53.52% of the companies in the Media - Diversified industry.

Growth is a crucial factor in company valuation. Companies that grow faster create more value for shareholders, especially if that growth is profitable. Scholastic's average annual revenue growth is 4.5%, ranking better than 63.1% of the companies in the Media - Diversified industry. However, its 3-year average EBITDA growth is 0%, ranking worse than 0% of the companies in the industry.

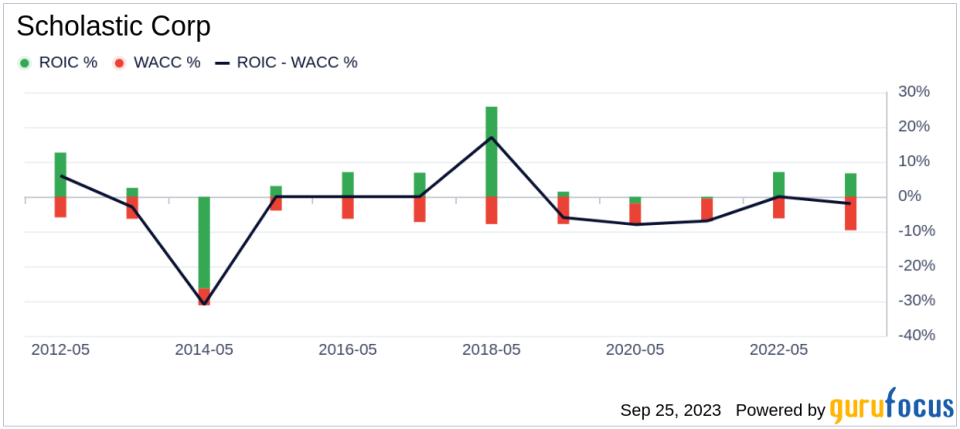

ROIC vs WACC

Return on invested capital (ROIC) and weighted average cost of capital (WACC) are key indicators of a company's profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. For the past 12 months, Scholastic's ROIC is 6.01, and its WACC is 11.14.

Conclusion

In conclusion, the stock of Scholastic (NASDAQ:SCHL) appears to be modestly undervalued. The company's financial condition is strong, and its profitability is fair. However, its growth ranks worse than 0% of the companies in the Media - Diversified industry. For more information about Scholastic stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.