Unveiling Seagate Technology Holdings PLC (STX)'s Value: Is It Really Priced Right? A ...

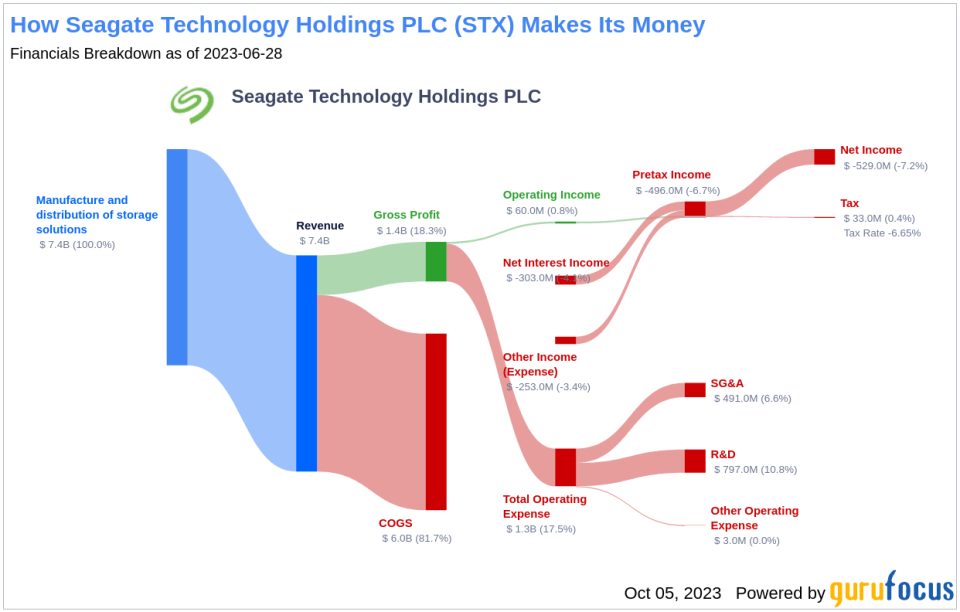

Seagate Technology Holdings PLC (NASDAQ:STX) has been in the limelight recently with a daily gain of 2.03% and a 3-month gain of 7.23%. Despite the positive momentum, the company reported a Loss Per Share of 2.55. This raises the question: Is the stock modestly overvalued? To answer this, we delve into a comprehensive valuation analysis of Seagate Technology Holdings PLC (NASDAQ:STX). Stay with us as we explore the company's financial performance, intrinsic value, and future prospects.

Company Overview

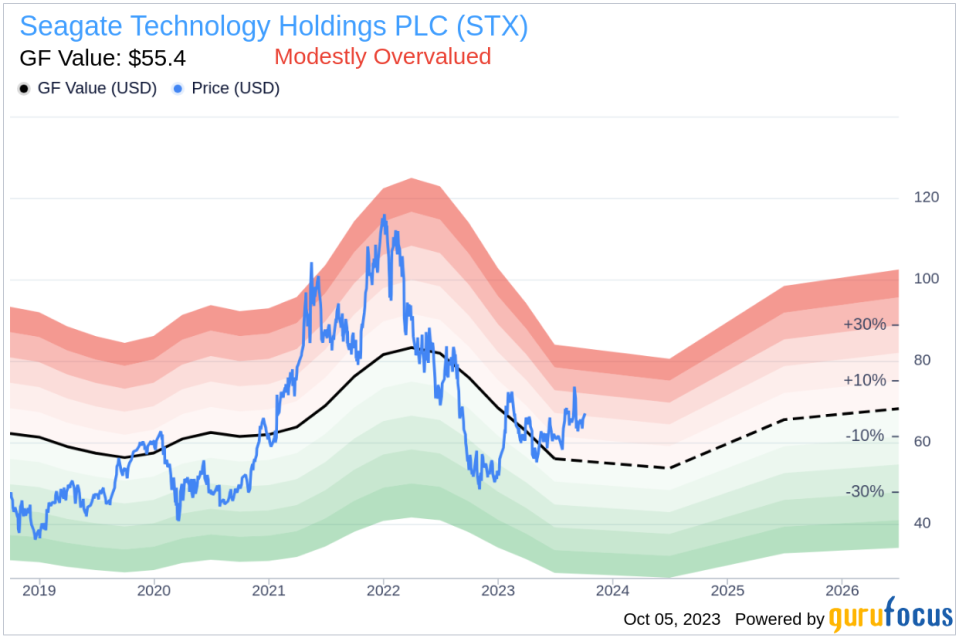

Seagate Technology Holdings PLC is a leading supplier of hard disk drives for data storage. With a significant presence in both the enterprise and consumer markets, it forms a practical duopoly with its main competitor, Western Digital. Both companies are vertically integrated, enhancing their competitive advantage in the market. With a current stock price of $67.31, the company has a market cap of $14 billion. However, the GF Value, an estimation of the company's fair value, stands at $55.4, suggesting a modest overvaluation.

Understanding GF Value

The GF Value represents the intrinsic value of a stock, derived from our exclusive method. The GF Value Line on our summary page provides an overview of the fair value that the stock should ideally trade at. This is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

According to our analysis, Seagate Technology Holdings PLC (NASDAQ:STX) appears to be modestly overvalued. This implies that the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

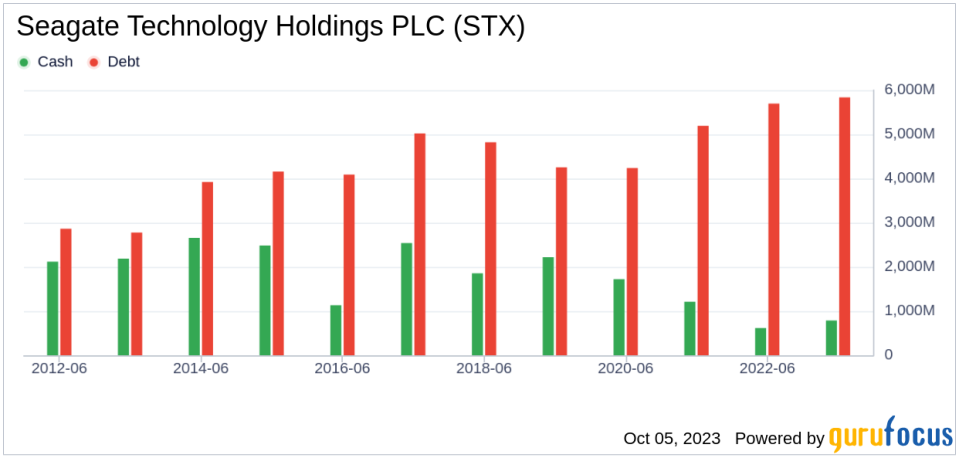

Financial Strength

Before investing in a company, it's crucial to assess its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. Key indicators such as the cash-to-debt ratio and interest coverage offer insights into a company's financial health. With a cash-to-debt ratio of 0.14, Seagate Technology Holdings PLC ranks worse than 91.99% of companies in the Hardware industry, indicating poor financial strength.

Profitability and Growth

Consistent profitability over the long term reduces investment risk. Higher profit margins usually suggest a better investment compared to a company with lower profit margins. Seagate Technology Holdings PLC has been profitable 9 out of the past 10 years, indicating fair profitability. However, the company's growth ranks worse than 72.1% of companies in the Hardware industry, which could be a concern for potential investors.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Unfortunately, Seagate Technology Holdings PLC's ROIC of 1.17 falls short of its WACC of 9.14, suggesting less than optimal profitability.

Conclusion

In conclusion, Seagate Technology Holdings PLC (NASDAQ:STX) appears to be modestly overvalued based on our analysis. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 94.43% of companies in the Hardware industry. To learn more about Seagate Technology Holdings PLC stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, visit our GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.