Unveiling Summit Materials (SUM)'s Value: Is It Really Priced Right? A Comprehensive Guide

Summit Materials Inc (NYSE:SUM) saw a daily loss of -8.28%, with a 3-month loss of -2.65%. With an Earnings Per Share (EPS) (EPS) of 1.41, the stock appears to be fairly valued. This article will provide an in-depth analysis of Summit Materials' valuation, encouraging readers to delve into the financial intricacies of the company.

Understanding Summit Materials

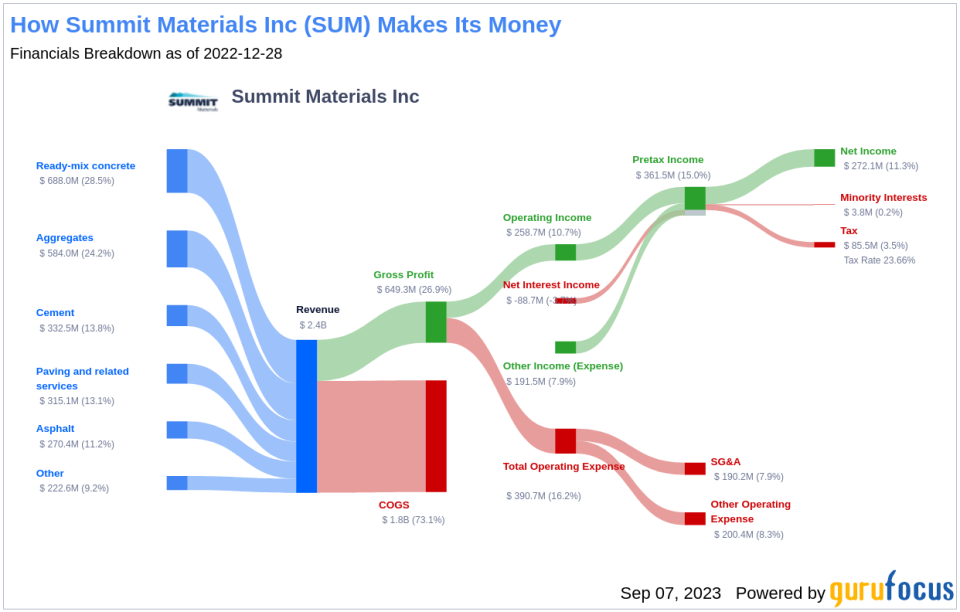

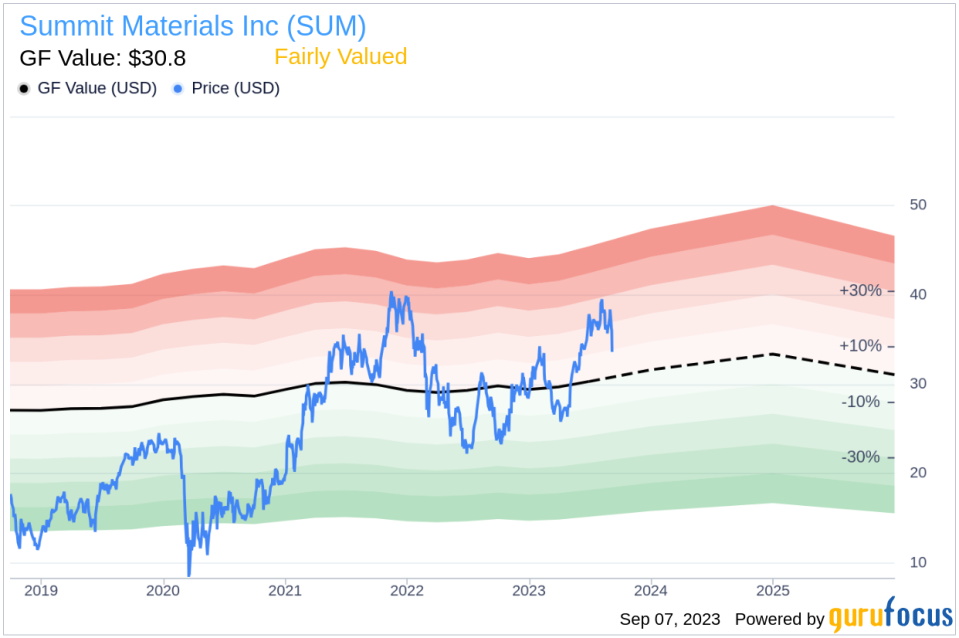

Summit Materials Inc is a prominent aggregates supplier and cement producer in the United States and British Columbia, Canada. The company also produces ready-mix concrete and asphalt paving mix, used either for external sales or in its paving and related services businesses. The stock price currently stands at $33.02, with a market cap of $3.90 billion. Comparing this to the GF Value of $30.8, we aim to explore whether the stock is fairly valued.

Decoding the GF Value

The GF Value represents the intrinsic value of a stock, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line, presented on our summary page, provides an overview of the stock's fair value.

According to our calculations, Summit Materials (NYSE:SUM) is fairly valued. This conclusion is based on the historical multiples at which the stock has traded, past business growth, and analyst estimates of future business performance. As the stock is fairly valued, the long-term return of its stock is likely to align with the rate of its business growth.

Financial Strength of Summit Materials

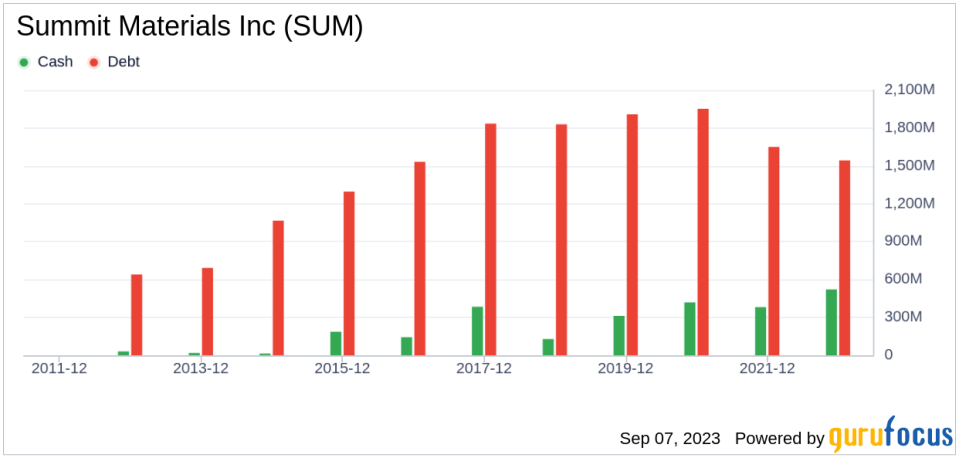

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to thoroughly review a company's financial strength before investing. Summit Materials' cash-to-debt ratio stands at 0.15, which is lower than 72.91% of companies in the Building Materials industry. Our ranking system rates the overall financial strength of Summit Materials as 5 out of 10, indicating fair financial strength.

Profitability and Growth of Summit Materials

Companies with consistent profitability over the long term offer less risk to investors. Summit Materials has been profitable for 8 out of the past 10 years, and its operating margin of 12.03% ranks better than 68.87% of companies in the Building Materials industry. The overall profitability of Summit Materials is ranked 6 out of 10, indicating fair profitability.

Growth is a crucial factor in a company's valuation. Summit Materials' 3-year average revenue growth rate is lower than 65.35% of companies in the Building Materials industry. However, its 3-year average EBITDA growth rate of 14.6% ranks better than 73.75% of companies in the industry.

Return on Invested Capital (ROIC) vs. Weighted Average Cost of Capital (WACC)

Comparing a company's ROIC to its WACC can provide insights into its profitability. In the last year, Summit Materials' ROIC was 6.3, while its WACC stood at 9.97.

Conclusion

In summary, Summit Materials' stock appears to be fairly valued. The company has fair financial condition and profitability, with its growth ranking better than 73.75% of companies in the Building Materials industry. To learn more about Summit Materials stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.