Unveiling TAL Education Group's True Worth: An In-Depth Exploration

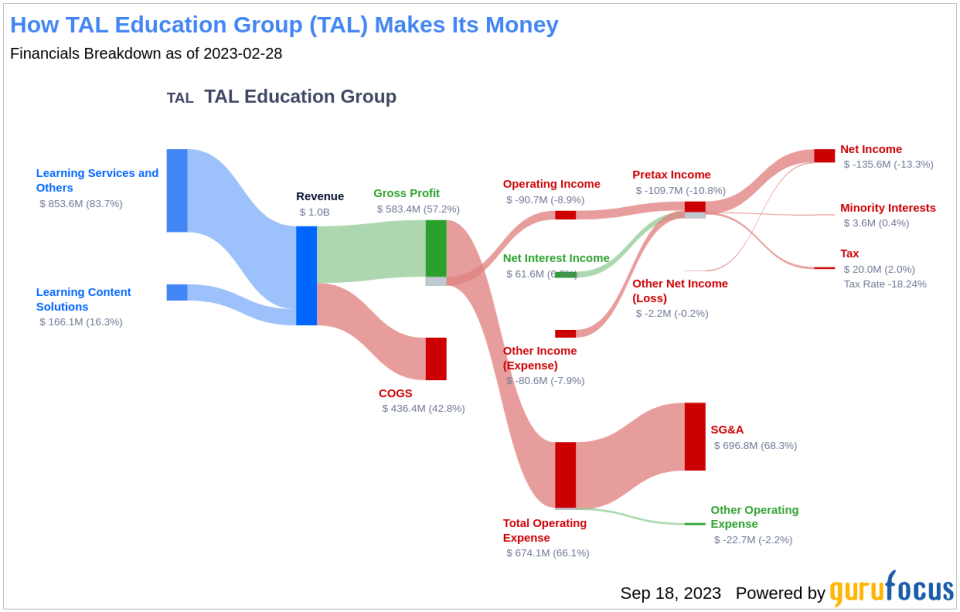

On September 18, 2023, the TAL Education Group (NYSE:TAL) stock recorded a daily gain of 5.23%, resulting in a three-month gain of 18.25%. However, the company reported a Loss Per Share of 0.21. With these figures, the question arises: is the stock significantly overvalued? This article will delve into the valuation analysis to answer this question. We encourage our readers to follow through the analysis for a comprehensive understanding of the company's valuation.

A Snapshot of TAL Education Group

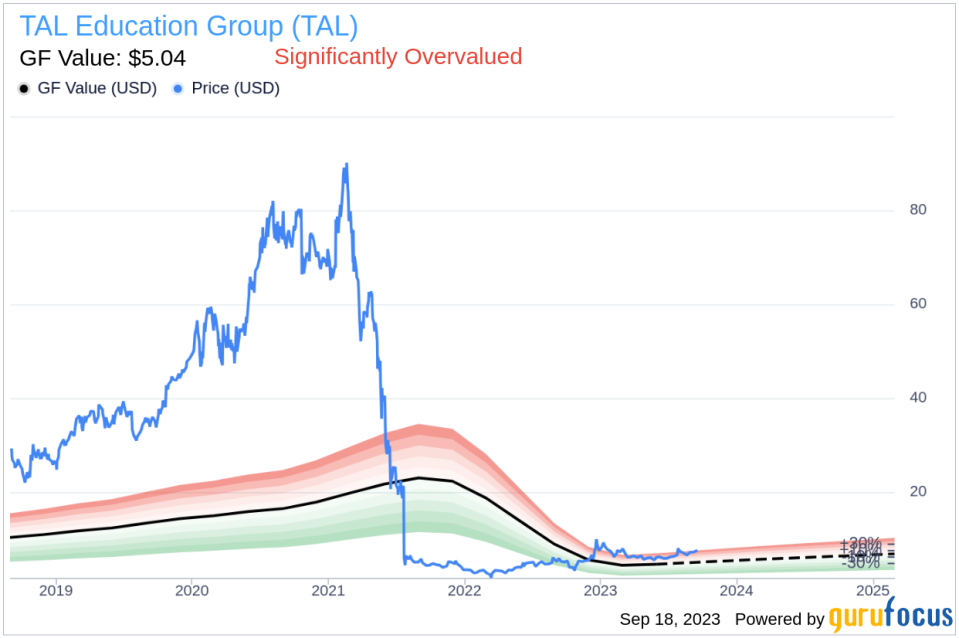

TAL Education Group is a leading smart learning solutions provider in China. The company had to realign its business model to focus on enrichment learning, content solutions, and learning technology solutions following the regulatory changes in 2021 that imposed a nonprofit requirement on K-9 academic afterschool tutoring, which was its main revenue source. Despite the changes, the company's stock price stands at $7.62, which is significantly higher than its fair value (GF Value) of $5.04. This discrepancy prompts a deeper exploration into the company's valuation.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's ideal fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

As per the GF Value, TAL Education Group's stock appears to be significantly overvalued. The company's current price of $7.62 per share and the market cap of $4.90 billion are considerably higher than the GF Value. This overvaluation suggests that the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

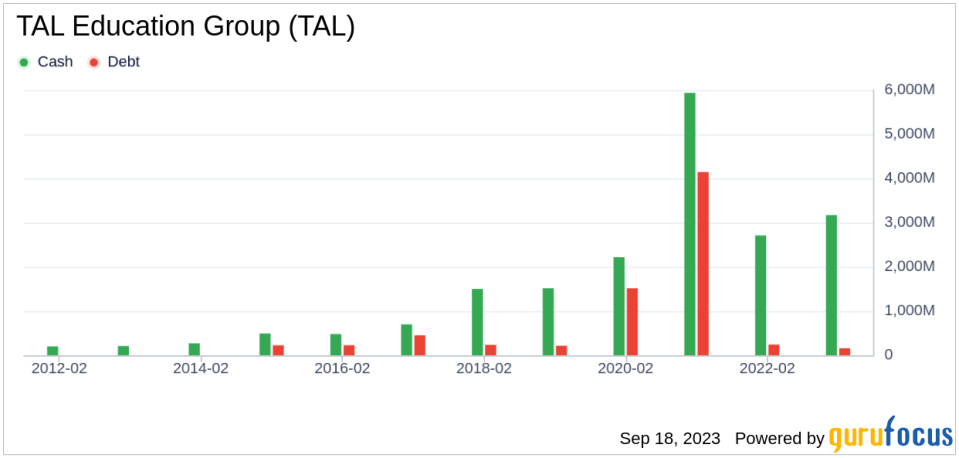

Financial Strength of TAL Education Group

Investing in companies with poor financial strength can lead to a high risk of permanent capital loss. Therefore, investors must review a company's financial strength before purchasing its shares. TAL Education Group's cash-to-debt ratio stands at 18.47, ranking better than 77.25% of 255 companies in the Education industry. Overall, the company's financial strength is rated 7 out of 10, indicating fair financial health.

Profitability and Growth of TAL Education Group

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. TAL Education Group has been profitable for 6 out of the past 10 years. However, the company's operating margin of -11.22% ranks worse than 78.31% of 249 companies in the Education industry. Overall, the company's profitability is rated 5 out of 10, indicating fair profitability.

Growth is a vital factor in a company's valuation. A faster-growing company creates more value for shareholders, especially if the growth is profitable. However, TAL Education Group's 3-year average annual revenue growth is -33.8%, ranking worse than 91.45% of 234 companies in the Education industry. The 3-year average EBITDA growth rate is 0%, ranking worse than all companies in the Education industry.

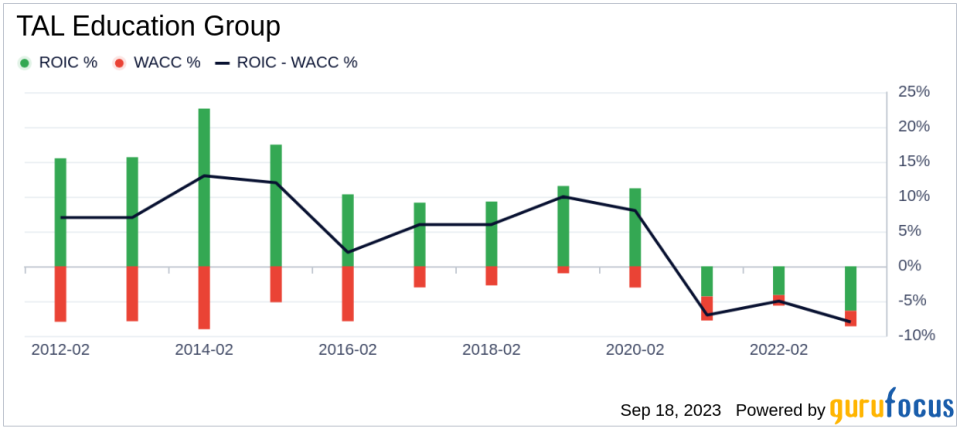

ROIC vs WACC

A company's profitability can also be evaluated by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, TAL Education Group's ROIC was -9.19, while its WACC stood at 2.59.

Conclusion

Overall, TAL Education Group (NYSE:TAL) stock appears to be significantly overvalued. The company's financial condition and profitability are fair, but its growth ranks worse than all companies in the Education industry. For more details about TAL Education Group stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.