Unveiling TAL Education Group's Value: Is It Really Priced Right? A Comprehensive Guide

Having experienced a daily gain of 3.79%, and a 3-month gain of 31.81%, TAL Education Group (NYSE:TAL) has been a focal point for investors. However, with a Loss Per Share of $0.21, questions arise about whether the stock is significantly overvalued. This article provides an in-depth valuation analysis to answer this question.

Company Introduction

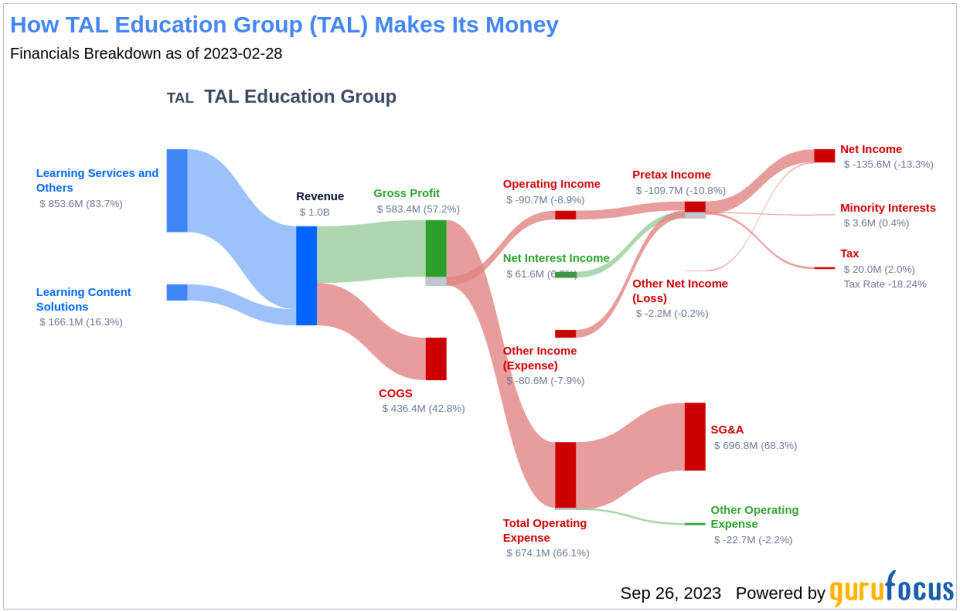

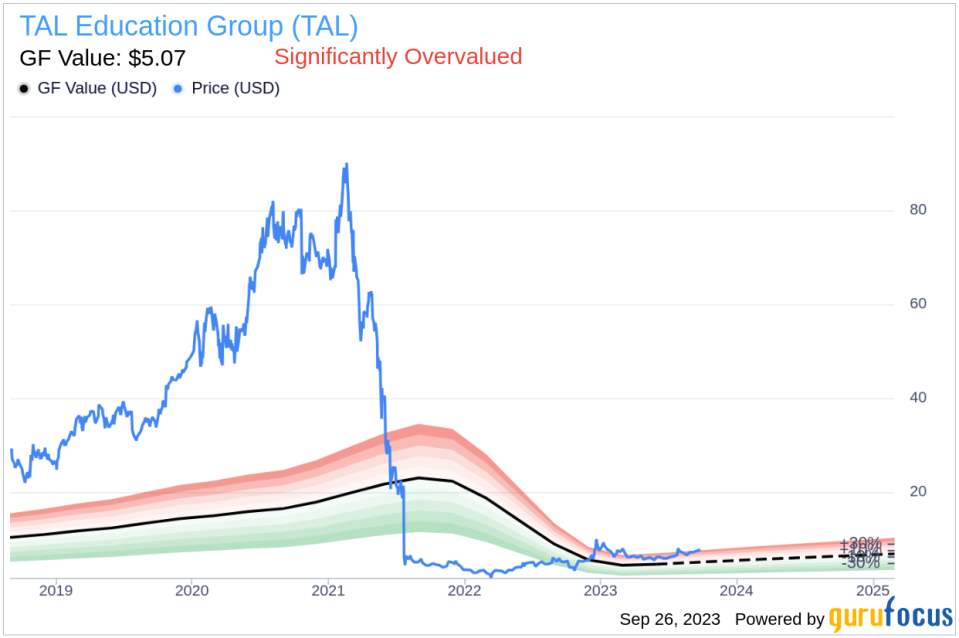

TAL Education Group is a leading provider of smart learning solutions in China. The company has shifted its focus towards enrichment learning, content solutions, and learning technology solutions following regulatory changes in 2021. With a stock price of $7.67 and a GF Value of $5.07, a significant disparity is noticeable. This article aims to delve deeper into this discrepancy and provide a comprehensive understanding of the company's value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. This value represents the ideal fair trading value of the stock.

According to this valuation method, TAL Education Group's stock appears to be significantly overvalued. This conclusion is based on the stock's current price of $7.67 per share, which is significantly above the GF Value Line. Consequently, the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

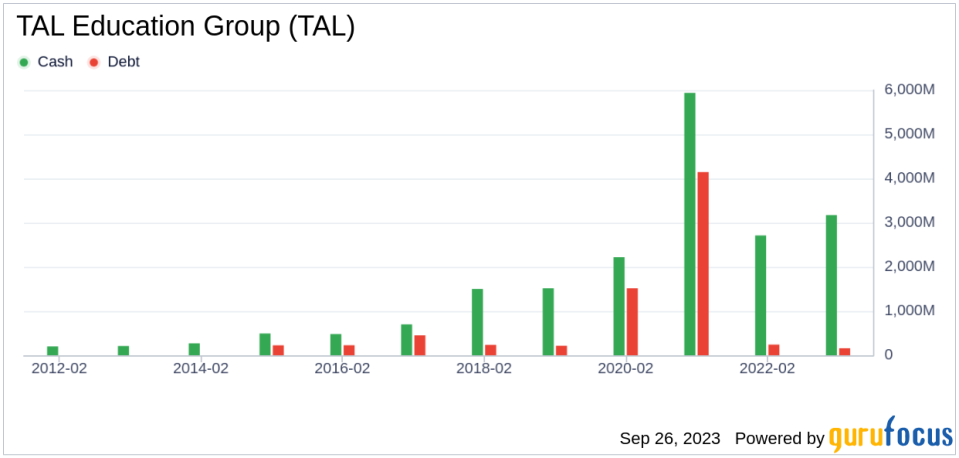

Before investing in a company, it's crucial to assess its financial strength. TAL Education Group boasts a cash-to-debt ratio of 18.47, surpassing 77.56% of companies in the Education industry. This ratio, along with its overall financial strength score of 7 out of 10, indicates the company's fair financial health.

Profitability and Growth

Investing in profitable companies, particularly those with consistent long-term profitability and high-profit margins, poses less risk. TAL Education Group has been profitable for 6 out of the past 10 years. However, with an operating margin of -11.22%, it ranks lower than 79.61% of companies in the Education industry. This results in a fair profitability score of 5 out of 10.

Regarding growth, TAL Education Group's 3-year average annual revenue growth rate is -33.8%, which is lower than 91.85% of companies in the Education industry. The 3-year average EBITDA growth rate is 0%, ranking lower than all companies in the industry.

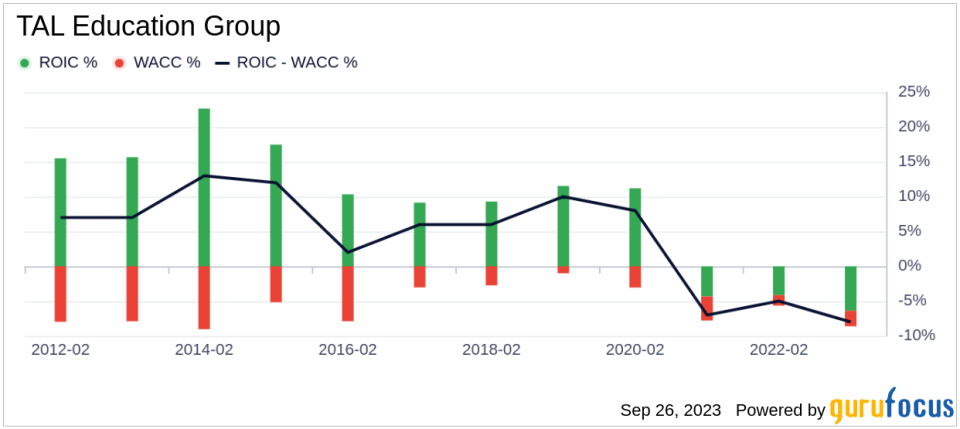

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. For TAL Education Group, the ROIC for the past 12 months is -9.19, and its cost of capital is 2.83.

Conclusion

In conclusion, TAL Education Group's stock appears to be significantly overvalued. The company's financial condition and profitability are fair, but its growth ranks lower than all companies in the Education industry. For more insights into TAL Education Group's financials, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.