Unveiling Titan Pharmaceuticals (TTNP)'s Value: Is It Really Priced Right? A Comprehensive Guide

Titan Pharmaceuticals Inc (NASDAQ:TTNP) experienced a loss of -8.52% in its daily trading and a 3-month loss of -30.01%. With a Loss Per Share of $0.57, the question arises: is the stock significantly overvalued? This article seeks to explore this valuation question by providing an in-depth analysis. Let's dive in.

Company Introduction

Titan Pharmaceuticals Inc is a pharmaceutical company that develops therapeutics utilizing its proprietary long-term drug delivery platform, ProNeura. This platform is used for the treatment of select chronic diseases where steady state delivery of a drug provides efficacy and/or safety benefits. The company's first product based on ProNeura technology, the Probuphine (buprenorphine) implant, has been approved in the United States, Canada, and the European Union for the maintenance treatment of opioid use disorder in clinically stable patients taking 8 mg or less a day of oral buprenorphine.

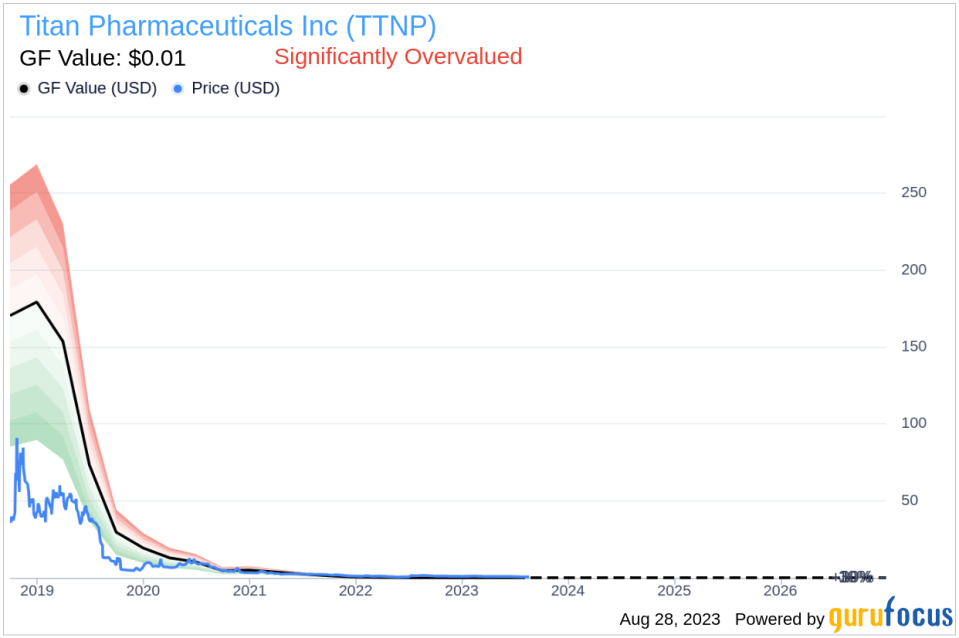

At a price of $0.5 per share, Titan Pharmaceuticals (NASDAQ:TTNP) has a market cap of $7.60 million. However, the GF Value, an estimation of its fair value, stands at $0.01, indicating that the stock may be significantly overvalued.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock, derived from our proprietary method. This value is calculated based on historical multiples, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance. In the case of Titan Pharmaceuticals (NASDAQ:TTNP), the stock appears to be significantly overvalued based on the GF Value calculation.

Because Titan Pharmaceuticals (NASDAQ:TTNP) is significantly overvalued, the long-term return of its stock is likely to be much lower than its future business growth.

Financial Strength

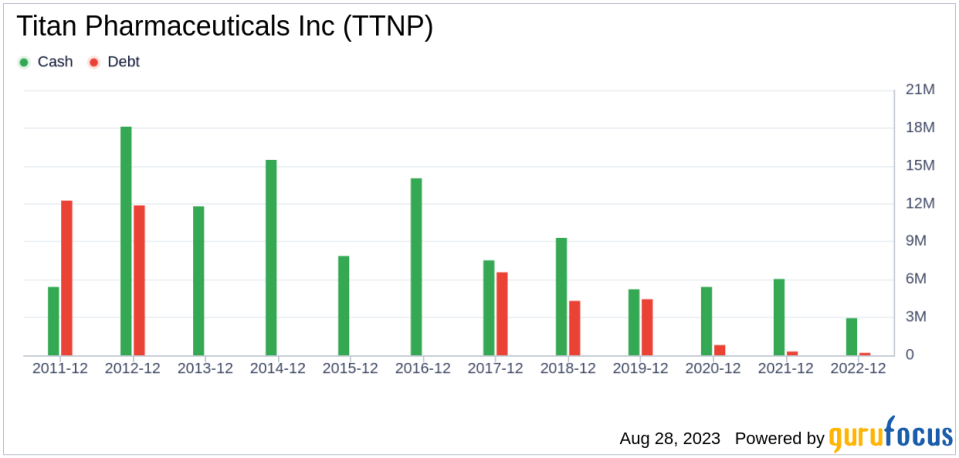

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. It's essential to review a company's financial strength before deciding whether to buy its stock. Titan Pharmaceuticals has a cash-to-debt ratio of 0.82, which is worse than 81.53% of companies in the Biotechnology industry. This indicates that the financial strength of Titan Pharmaceuticals is poor.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Titan Pharmaceuticals has been profitable 2 over the past 10 years. However, its operating margin is -15248.21%, which ranks worse than 92.93% of companies in the Biotechnology industry, indicating poor profitability.

Growth is a crucial factor in the valuation of a company. Titan Pharmaceuticals's 3-year average revenue growth rate is worse than 98.95% of companies in the Biotechnology industry. However, its 3-year average EBITDA growth rate is 55%, which ranks better than 92.63% of companies in the industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted cost of capital (WACC) is another way to assess its profitability. For the past 12 months, Titan Pharmaceuticals's ROIC is -669.31, and its WACC is 12.15.

Conclusion

In conclusion, the stock of Titan Pharmaceuticals (NASDAQ:TTNP) appears to be significantly overvalued. The company's financial condition is poor, and its profitability is weak. However, its growth ranks better than 92.63% of companies in the Biotechnology industry. For more information about Titan Pharmaceuticals stock, check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.