Unveiling Triton International (TRTN)'s Value: Is It Really Priced Right? A Comprehensive Guide

Despite a daily loss of 4.1% and a 3-month loss of 3.58%, Triton International Ltd (NYSE:TRTN) continues to display a robust Earnings Per Share (EPS) of 10.27. The question that begs to be answered is: Is the stock fairly valued? This article presents an in-depth analysis of Triton International's valuation. Stay with us as we unravel the company's financial intricacies.

Company Overview

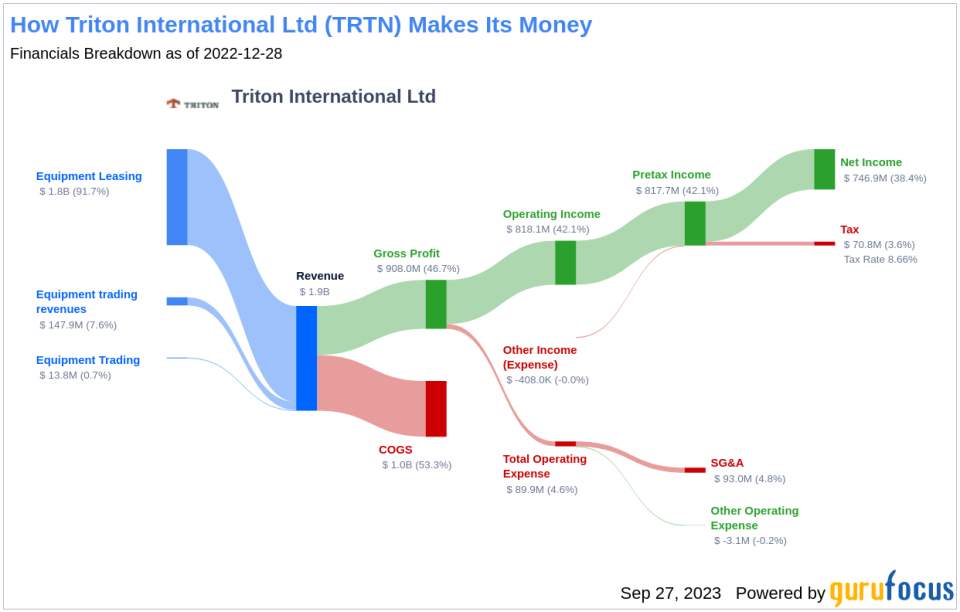

Triton International Ltd (NYSE:TRTN) is a leading lessor of intermodal containers. The company also leases chassis used for container transportation. It operates through two segments: Equipment Leasing and Equipment Trading. Triton International has a significant presence in Asia, Europe, America, Bermuda, and other countries. The company leases various types of equipment including Dry Freight, Refrigerated, Special, Chassis, and Tank containers. The Equipment Leasing segment generates most of the company's revenue.

As of September 27, 2023, Triton International's stock price stands at $79.55, with a market cap of $4.40 billion. The company's GF Value, an estimate of its fair value, is $76.6, indicating that the stock is fairly valued.

Understanding the GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. This value is computed based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's ideal fair trading value.

If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. At its current price of $79.55 per share, Triton International (NYSE:TRTN) is deemed to be fairly valued.

Given that Triton International is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

For potentially higher future returns at reduced risk, consider investing in these high-quality companies.

Assessing Triton International's Financial Strength

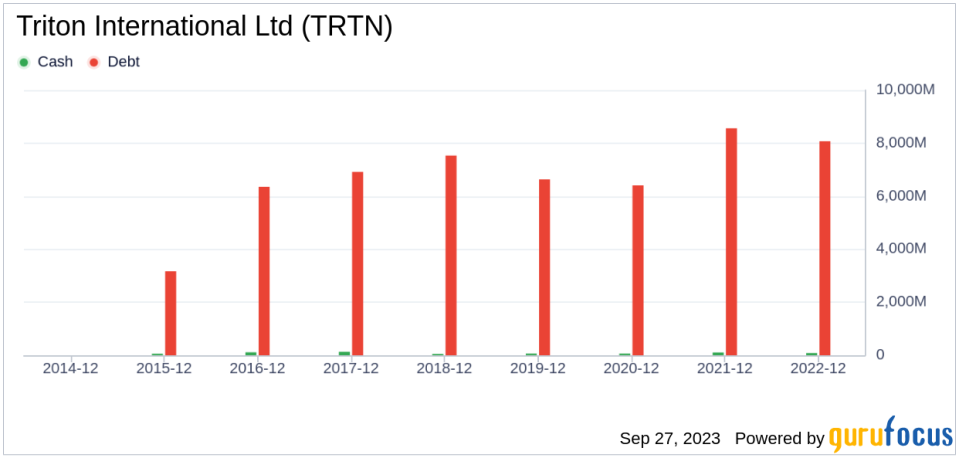

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before buying its stock. Triton International's cash-to-debt ratio stands at 0.01, which is worse than 97.81% of 1051 companies in the Business Services industry. This ratio, coupled with its overall financial strength rank of 2 out of 10, indicates that Triton International's financial strength is poor.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Triton International has been profitable 8 out of the past 10 years. The company's operating margin stands at 39.27%, ranking better than 96.43% of 1064 companies in the Business Services industry. Overall, Triton International's profitability rank is 8 out of 10, indicating strong profitability.

Growth is a critical factor in a company's valuation. Triton International's 3-year average annual revenue growth rate is 17%, ranking better than 81.26% of 982 companies in the Business Services industry. The company's 3-year average EBITDA growth rate is 22.5%, which ranks better than 70.51% of 851 companies in the same industry.

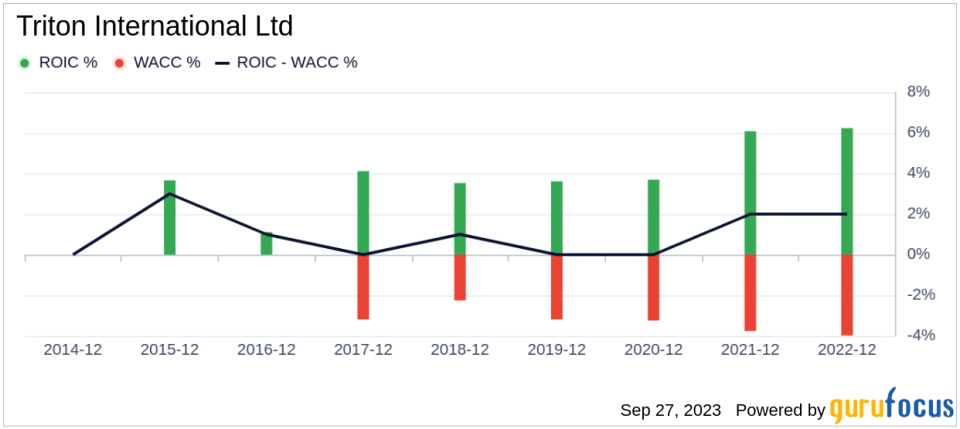

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to evaluate its profitability. Triton International's ROIC and WACC over the past 12 months were 5.42 and 4.14, respectively. This implies that the company is creating value for shareholders as its ROIC is higher than its WACC.

Conclusion

In conclusion, Triton International (NYSE:TRTN) stock is believed to be fairly valued. The company's financial condition is poor, but its profitability is strong. Its growth ranks better than 70.51% of 851 companies in the Business Services industry. To learn more about Triton International stock, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.