Unveiling Turkcell Iletisim Hizmetleri AS (TKC)'s Value: Is It Really Priced Right? A ...

With a daily gain of 2.6%, a three-month gain of 37.74%, and an Earnings Per Share (EPS) of 0.42, Turkcell Iletisim Hizmetleri AS (NYSE:TKC) appears to be on a positive trajectory. However, is the stock significantly overvalued? This article delves into the valuation analysis of Turkcell Iletisim Hizmetleri AS, providing insightful perspectives to guide your investment decisions.

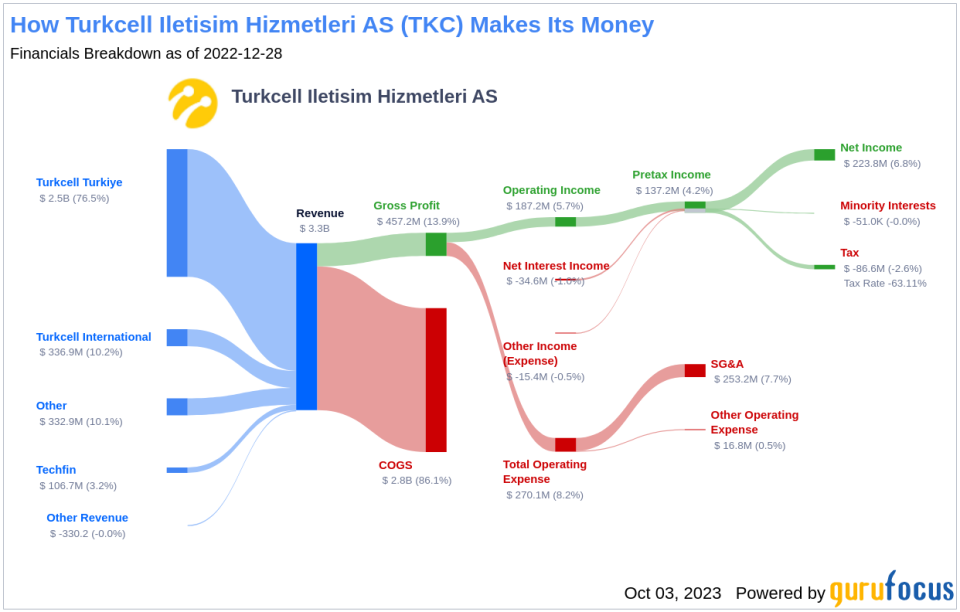

Company Introduction

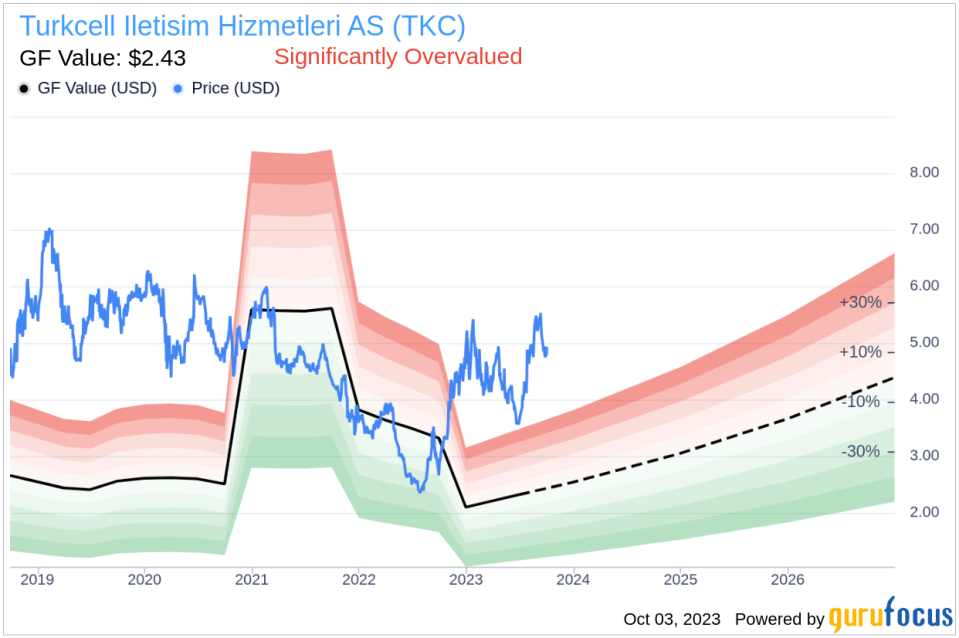

Turkcell Iletisim Hizmetleri AS operates in the telecommunication services industry, providing mobile telephone services in Turkey and extending its services to 208 countries through commercial roaming agreements. With 26 million prepaid subscribers and more than 9 million postpaid subscribers, the company has a significant market presence. However, despite a stock price of $4.93, the GF Value estimates the fair value at $2.43, suggesting that the stock is significantly overvalued.

Understanding GF Value

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

For Turkcell Iletisim Hizmetleri AS, the stock is estimated to be significantly overvalued. This suggests that the long-term return of its stock is likely to be much lower than its future business growth.

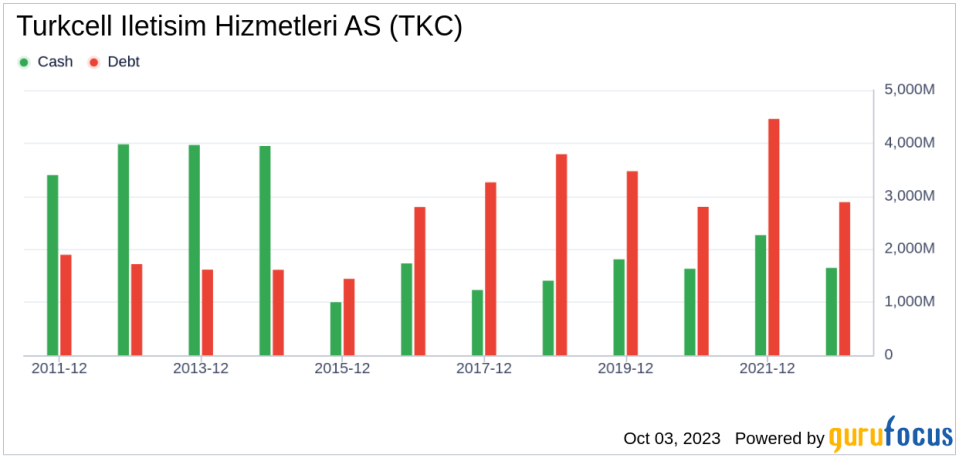

Financial Strength

Investing in companies with robust financial strength reduces the risk of permanent loss. A useful measure of financial strength is the cash-to-debt ratio. Turkcell Iletisim Hizmetleri AS has a cash-to-debt ratio of 0.6, which is better than 61.98% of 384 companies in the Telecommunication Services industry. Overall, the financial strength of Turkcell Iletisim Hizmetleri AS is fair.

Profitability and Growth

Profitable companies, especially those with consistent long-term profitability, pose less risk to investors. Turkcell Iletisim Hizmetleri AS has been profitable for 10 out of the past 10 years, demonstrating strong profitability . Additionally, the company has a promising growth trajectory. Its growth ranks better than 92.12% of 330 companies in the Telecommunication Services industry.

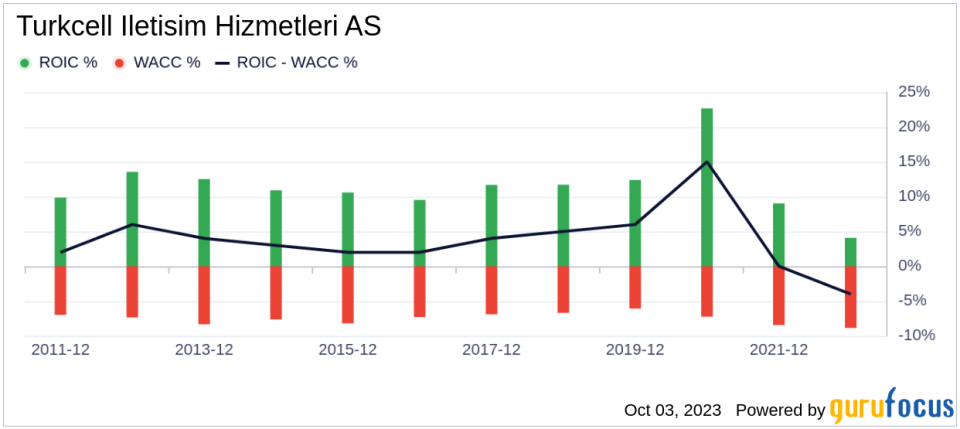

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) with its weighted average cost of capital (WACC) provides insight into its profitability. Turkcell Iletisim Hizmetleri AS's ROIC of 12.86 is higher than its WACC of 8.83, indicating efficient cash flow generation relative to its invested capital.

Conclusion

In summary, the stock of Turkcell Iletisim Hizmetleri AS (NYSE:TKC) is estimated to be significantly overvalued. The company's financial condition is fair, and its profitability is strong. To learn more about Turkcell Iletisim Hizmetleri AS stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.