Unveiling Worthington Industries (WOR)'s Value: Is It Really Priced Right? A Comprehensive Guide

Worthington Industries Inc (NYSE:WOR) witnessed a daily loss of -11.83% and a modest 3-month gain of 0.23%. Despite this fluctuation, the company reported an Earnings Per Share (EPS) (EPS) of 5.18. But, is the stock modestly undervalued? This analysis delves into the financials of Worthington Industries, aiming to provide a comprehensive understanding of its valuation. Read on to explore the financial strength, growth, and profitability of the company.

Company Introduction

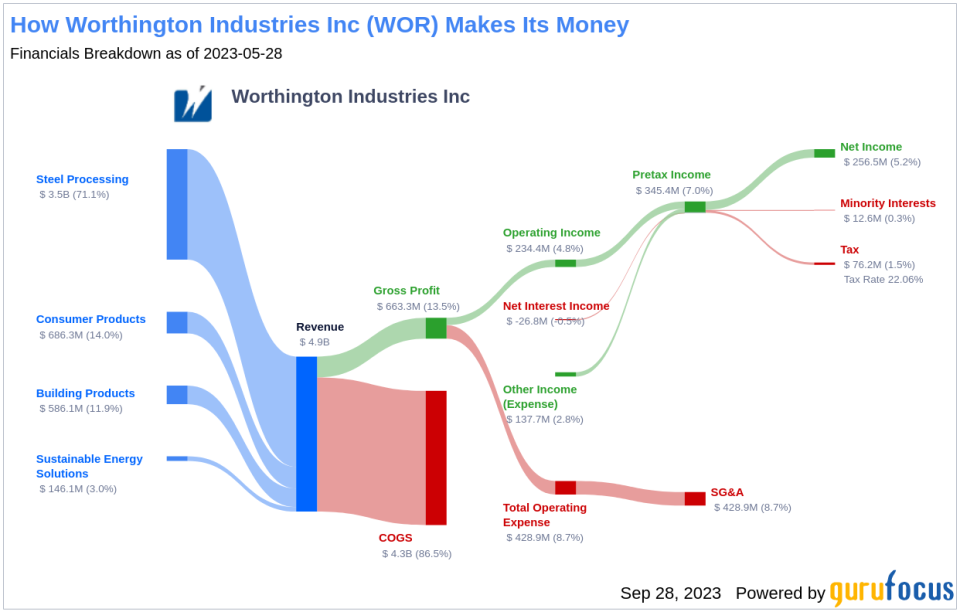

Worthington Industries Inc is a diversified metals manufacturing company based in America. It focuses on value-added steel processing and the manufacturing of metal products. These products range from pressure cylinders for various gas storage applications, steel and fiberglass tanks for the oil and gas industry, to light gauge steel framing for construction. The firm operates through four segments: Steel Processing, Consumer Products, Building Products, and Sustainable Energy Solutions.

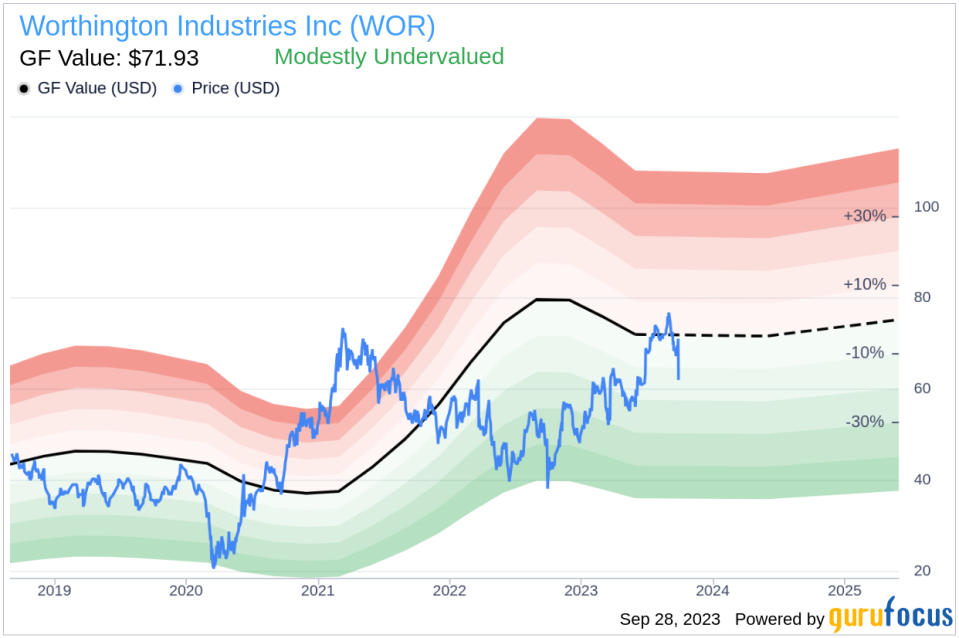

With a current stock price of $62.67, Worthington Industries has a market cap of $3.10 billion. The estimated fair value of the stock, as per the GF Value, stands at $71.93, suggesting that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It's calculated based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

If the stock price is significantly above the GF Value Line, the stock may be overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, the stock may be undervalued, and its future return will likely be higher. In the case of Worthington Industries, the stock appears to be modestly undervalued, suggesting that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Assessing Financial Strength

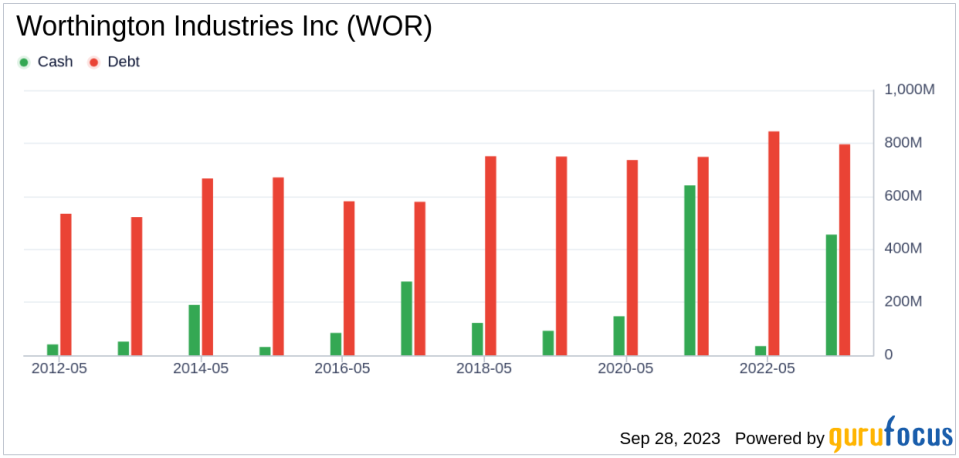

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's essential to review a company's financial strength before deciding to buy shares. Key indicators such as the cash-to-debt ratio and interest coverage can provide an initial perspective on the company's financial strength.

Worthington Industries has a cash-to-debt ratio of 0.57, which ranks worse than 65.32% of 2849 companies in the Industrial Products industry. Based on this, GuruFocus ranks Worthington Industries's financial strength as 7 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Higher profit margins usually dictate a better investment compared to a company with lower profit margins. Worthington Industries has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $4.90 billion and Earnings Per Share (EPS) of $5.18. Its operating margin is 4.77%, which ranks worse than 61.15% of 2901 companies in the Industrial Products industry. Overall, the profitability of Worthington Industries is ranked 8 out of 10, which indicates strong profitability.

Growth is probably the most important factor in the valuation of a company. A faster-growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Worthington Industries is 22.1%, which ranks better than 84.05% of 2740 companies in the Industrial Products industry. The 3-year average EBITDA growth rate is 32.7%, which ranks better than 82.26% of 2430 companies in the Industrial Products industry.

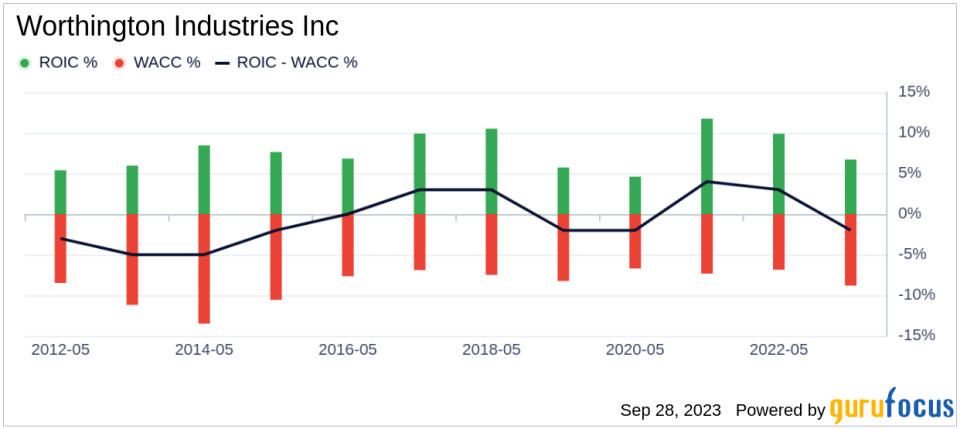

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) to its weighted cost of capital (WACC). Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Worthington Industries's ROIC was 6.71, while its WACC came in at 10.28.

Conclusion

In conclusion, the stock of Worthington Industries appears to be modestly undervalued. The company's financial condition is fair and its profitability is strong. Its growth ranks better than 82.26% of 2430 companies in the Industrial Products industry. To learn more about Worthington Industries stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.