Unveiling Xylem (XYL)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 1.69%, a three-month gain of 5.6%, and Earnings Per Share (EPS) of 1.88, Xylem Inc (NYSE:XYL) is a stock to watch. But is it modestly undervalued? This article will present a comprehensive analysis of Xylem's valuation and financial health. Let's dive in.

Company Overview

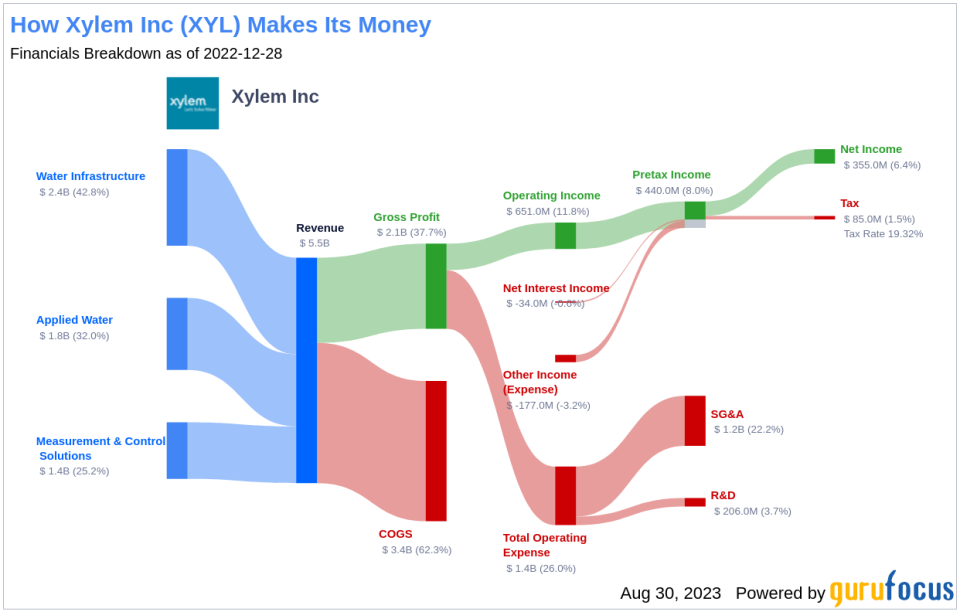

Xylem Inc (NYSE:XYL), a global leader in water technology, offers a wide range of solutions, including the transport, treatment, testing, and efficient use of water. With a presence in over 150 countries, Xylem caters to customers in the utility, industrial, commercial, and residential sectors. The company has a market cap of $25 billion and generated $5.5 billion in revenue in 2022.

Comparing the stock price of $103.69 to the GF Value of $118.34, Xylem appears to be modestly undervalued. This valuation is based on the company's historical trading multiples, past performance, and future business performance estimates. Here's the income breakdown of Xylem:

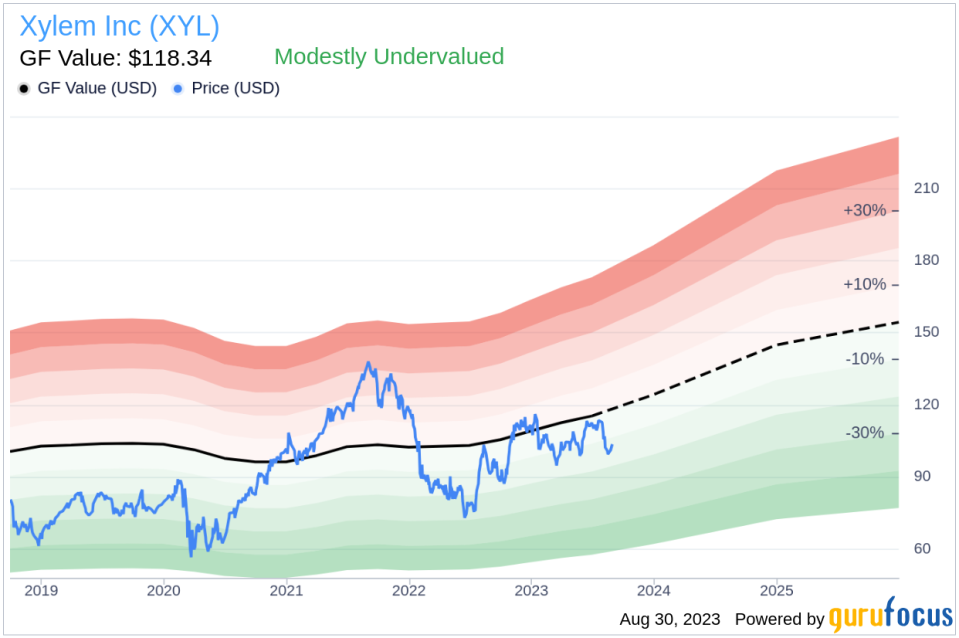

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line represents the ideal fair trading value of the stock.

According to GuruFocus' valuation method, Xylem (NYSE:XYL) appears to be modestly undervalued. If the stock price is significantly above the GF Value Line, the stock may be overpriced and likely to yield poor future returns. Conversely, if it's significantly below the GF Value Line, the stock may be undervalued, indicating higher future returns. Given Xylem's current price of $103.69 per share, the stock seems modestly undervalued.

As Xylem is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

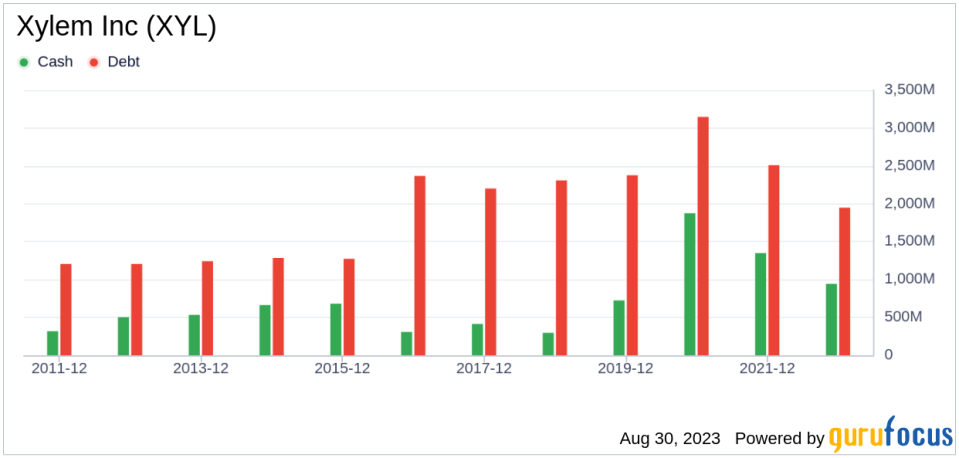

Investing in companies with low financial strength could result in permanent capital loss. Thus, it's crucial to review a company's financial strength before purchasing shares. Xylem's cash-to-debt ratio of 0.27 ranks worse than 79.91% of companies in the Industrial Products industry. GuruFocus ranks Xylem's financial strength as 7 out of 10, indicating a fair balance sheet.

Here's a look at Xylem's debt and cash over the past years:

Profitability and Growth

Investing in profitable companies is less risky, especially those demonstrating consistent profitability over the long term. Xylem, with its high profit margins and consistent profitability over the past 10 years, appears to be a safe investment. However, the company's 3-year average revenue growth rate is worse than 67.17% of companies in the Industrial Products industry.

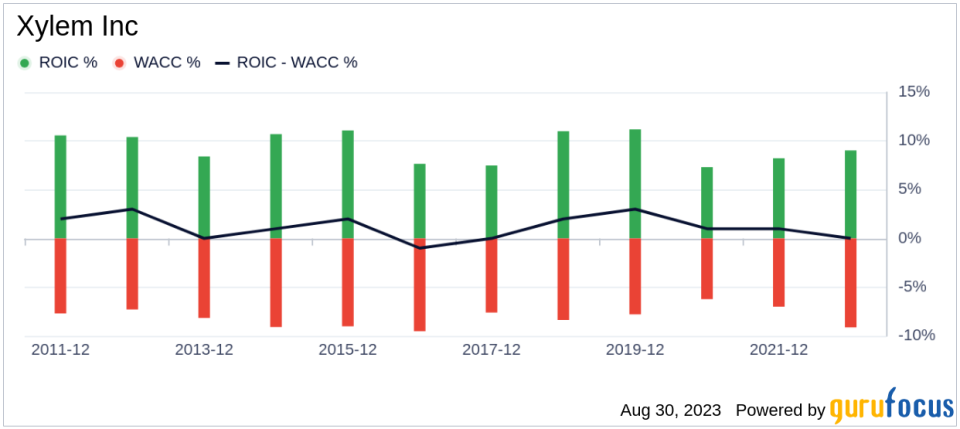

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) is another way to assess its profitability. For the past 12 months, Xylem's ROIC is 7.14, and its WACC is 9.66. Ideally, the ROIC should be higher than the WACC.

Here's a historical comparison of Xylem's ROIC and WACC:

Conclusion

In conclusion, Xylem (NYSE:XYL) stock appears to be modestly undervalued. The company's fair financial condition and profitability, coupled with its growth prospects, make it a compelling investment option. To learn more about Xylem stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.