Unveiling Zebra Technologies (ZBRA)'s Value: Is It Really Priced Right? A Comprehensive Guide

Zebra Technologies Corp (NASDAQ:ZBRA) has seen a daily loss of -2.75% and a 3-month loss of -22.05%. Despite this, the company's Earnings Per Share (EPS) stands at 12.51. This raises the question: is the stock significantly undervalued? Our valuation analysis aims to provide a comprehensive answer to this question. We invite you to delve into the following analysis for a deeper understanding of Zebra Technologies' value.

Company Introduction

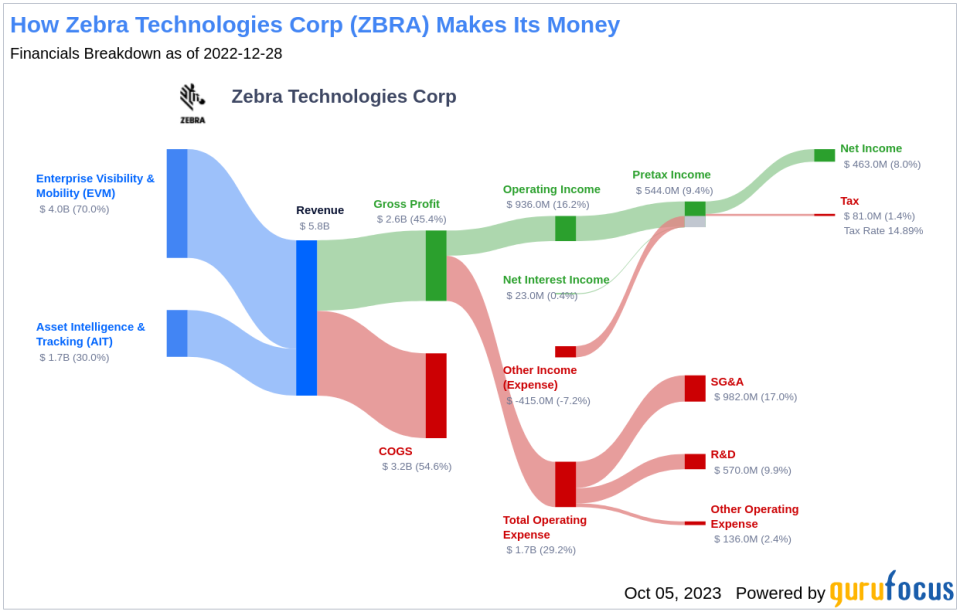

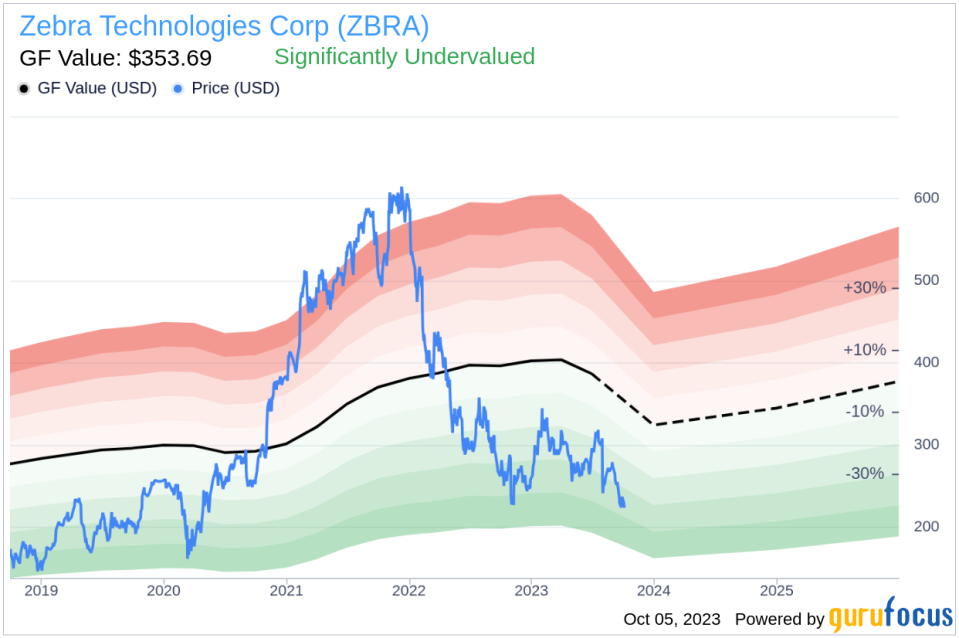

Zebra Technologies Corp (NASDAQ:ZBRA) is a leading provider of automatic identification and data capture technology to enterprises. The firm's solutions, including barcode printers and scanners, mobile computers, and workflow optimization software, primarily serve the retail, transportation logistics, manufacturing, and healthcare markets. They design custom solutions to improve efficiency at its customers. With a current stock price of $224.6 per share, Zebra Technologies has a market cap of $11.50 billion. However, the GF Value estimates its fair value at $353.69. This discrepancy paves the way for a deeper exploration of the company's value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock, derived from our exclusive method. This value is calculated based on historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance. We believe the GF Value Line is the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Zebra Technologies (NASDAQ:ZBRA) stock is believed to be significantly undervalued based on the GuruFocus Value calculation. At its current price of $224.6 per share, Zebra Technologies has a market cap of $11.50 billion and the stock is believed to be significantly undervalued. Because Zebra Technologies is significantly undervalued, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

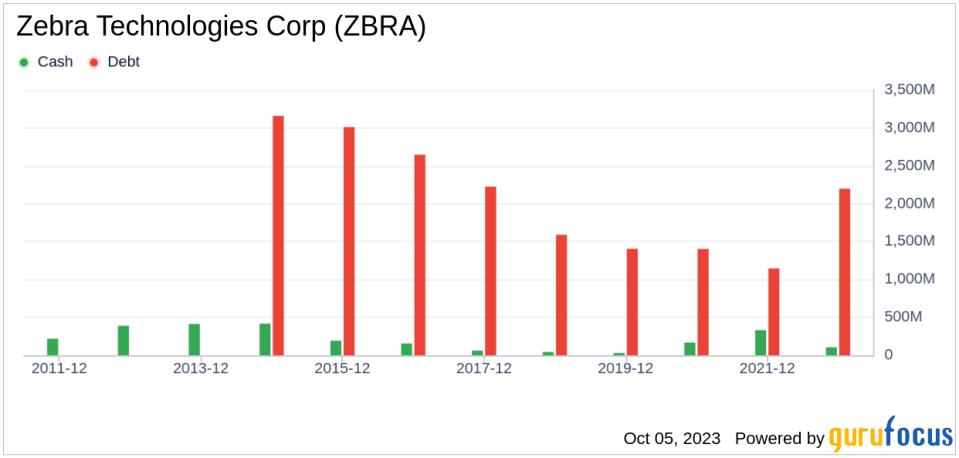

Companies with poor financial strength offer investors a high risk of permanent capital loss. To avoid permanent capital loss, an investor must do their research and review a company's financial strength before deciding to purchase shares. Both the cash-to-debt ratio and interest coverage of a company are a great way to understand its financial strength. Zebra Technologies has a cash-to-debt ratio of 0.03, which ranks worse than 97.76% of 2361 companies in the Hardware industry. The overall financial strength of Zebra Technologies is 6 out of 10, which indicates that the financial strength of Zebra Technologies is fair.

Profitability and Growth

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. A company with high profit margins is also typically a safer investment than one with low profit margins. Zebra Technologies has been profitable 8 over the past 10 years. Over the past twelve months, the company had a revenue of $5.50 billion and Earnings Per Share (EPS) of $12.51. Its operating margin is 16.76%, which ranks better than 89.48% of 2444 companies in the Hardware industry. Overall, GuruFocus ranks the profitability of Zebra Technologies at 8 out of 10, which indicates strong profitability.

Growth is probably the most important factor in the valuation of a company. A faster growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Zebra Technologies is 10.2%, which ranks better than 66.68% of 2326 companies in the Hardware industry. The 3-year average EBITDA growth rate is 11.2%, which ranks better than 50.97% of 1956 companies in the Hardware industry.

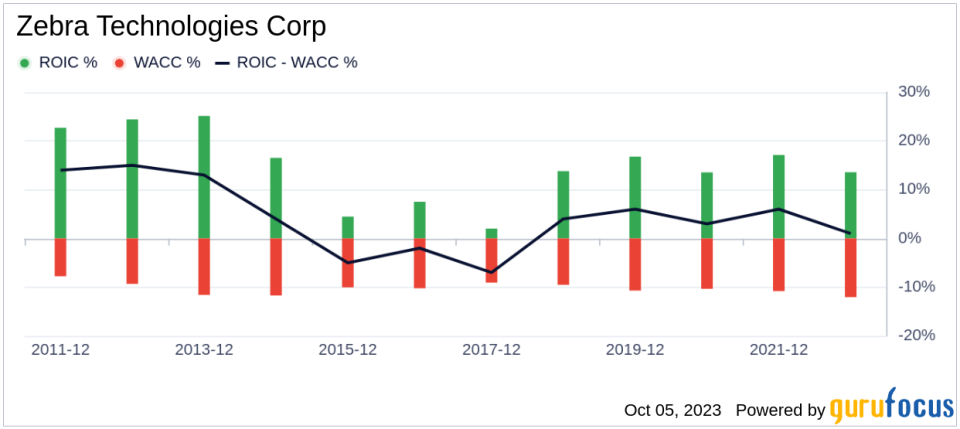

Another way to look at the profitability of a company is to compare its return on invested capital and the weighted cost of capital. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. We want to have the return on invested capital higher than the weighted cost of capital. For the past 12 months, Zebra Technologies's return on invested capital is 11.67, and its cost of capital is 13.44.

Conclusion

In short, the stock of Zebra Technologies (NASDAQ:ZBRA) is believed to be significantly undervalued. The company's financial condition is fair and its profitability is strong. Its growth ranks better than 50.97% of 1956 companies in the Hardware industry. To learn more about Zebra Technologies stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.