Upland Software Inc (UPLD) Reports Decline in Q4 Revenue and Adjusted EBITDA

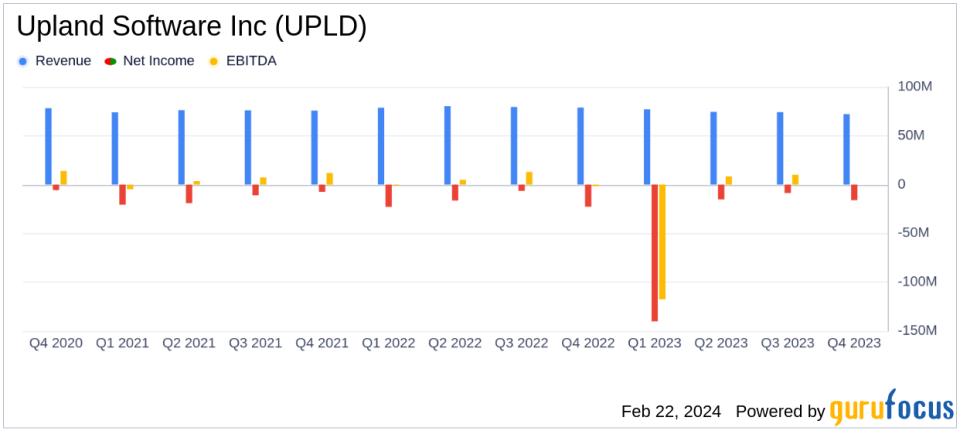

Total Revenue: $72.2 million in Q4 2023, down 8% from Q4 2022.

Subscription and Support Revenue: Decreased by 8% year-over-year to $68.2 million.

GAAP Net Loss: Improved to $16.0 million in Q4 2023 from $22.7 million in Q4 2022.

Adjusted EBITDA: Declined to $14.1 million, or 19% of total revenue.

Free Cash Flow: Increased to $8.6 million, up from $5.7 million in the prior year's quarter.

Guidance: Q1 2024 revenue expected to decline by 12% at the mid-point from Q1 2023.

On February 22, 2024, Upland Software Inc (NASDAQ:UPLD), a provider of cloud-based enterprise work management software, released its 8-K filing, detailing financial results for the fourth quarter of 2023. The company, which serves a diverse range of customers including corporations, government agencies, and small- to medium-sized businesses across various industries, reported a decrease in total revenue and adjusted EBITDA compared to the same period in the previous year.

Financial Performance and Challenges

Upland Software's total revenue for the fourth quarter was $72.2 million, an 8% decrease from $78.8 million in the fourth quarter of 2022. Subscription and support revenue, which is a critical metric for software companies as it indicates recurring revenue stability, also saw an 8% decrease to $68.2 million. The company's GAAP net loss showed improvement, decreasing to $16.0 million from a net loss of $22.7 million in the prior year's quarter. Adjusted EBITDA was $14.1 million, or 19% of total revenue, a significant decrease from $24.3 million, or 31% of total revenue, in the fourth quarter of 2022.

The decline in revenue and adjusted EBITDA is a concern as it may indicate challenges in customer acquisition and retention, pricing pressure, or increased competition. These factors are important as they can affect the company's long-term growth and profitability.

Financial Achievements

Despite the decline in revenue and adjusted EBITDA, Upland Software reported an improved GAAP net loss and an increase in free cash flow, which rose to $8.6 million from $5.7 million in the fourth quarter of 2022. The company also highlighted its cash position, with $236.6 million on hand at the end of the quarter, after repurchasing $10.8 million of its common stock. These achievements are important as they demonstrate the company's ability to manage costs and generate cash from its operations, which is vital for sustaining operations and investing in growth initiatives.

Key Financial Metrics

Upland Software's balance sheet showed a cash and cash equivalents balance of $236.6 million. The income statement revealed a net loss of $16.0 million for the quarter, an improvement over the previous year's net loss. The cash flow statement showed an operating cash flow of $8.8 million, with free cash flow at $8.6 million. These metrics are crucial for investors as they provide insight into the company's financial health and its ability to fund operations and growth without additional financing.

"We continue to make progress on our growth plan and remain focused on building great software and delivering value for customers," said Jack McDonald, Upland's chairman and chief executive officer. "We are proud to see continued and increasing recognition of our products as evidenced by the 44 badges earned in G2's Winter 2024 market reports."

Analysis of Company's Performance

Upland Software's performance in the fourth quarter shows a mixed picture. While the company has managed to reduce its GAAP net loss and increase its free cash flow, the decline in total revenue and adjusted EBITDA raises concerns about its growth trajectory. The company's guidance for the first quarter and full year of 2024 suggests that these challenges may persist in the near term, with expected declines in total revenue and adjusted EBITDA.

The company's achievements in customer expansion and product recognition, such as the awards from SoftwareReviews and badges from G2, indicate that Upland Software continues to invest in product development and customer satisfaction. However, the company will need to address the underlying causes of revenue decline to reassure investors of its growth potential.

For a more detailed analysis of Upland Software Inc's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Upland Software Inc for further details.

This article first appeared on GuruFocus.