Upstart Faces Challenges and Opportunities

Shares of artificial intelligence lender Upstart Holdings Inc. (NASDAQ:UPST) is trading nearly 92% lower than its October 2021 highs. In early August, the stock dropped after the company announced preliminary second-quarter results that fell far short of its previous revenue and net income projections.

The company went public in December 2020 and its market value appreciated nearly 1,000% before things started to go south.

In early August, the stock dropped after the company announced preliminary second-quarter results that fell far short of its previous revenue and net income projections.

What caused the initial upward trend?

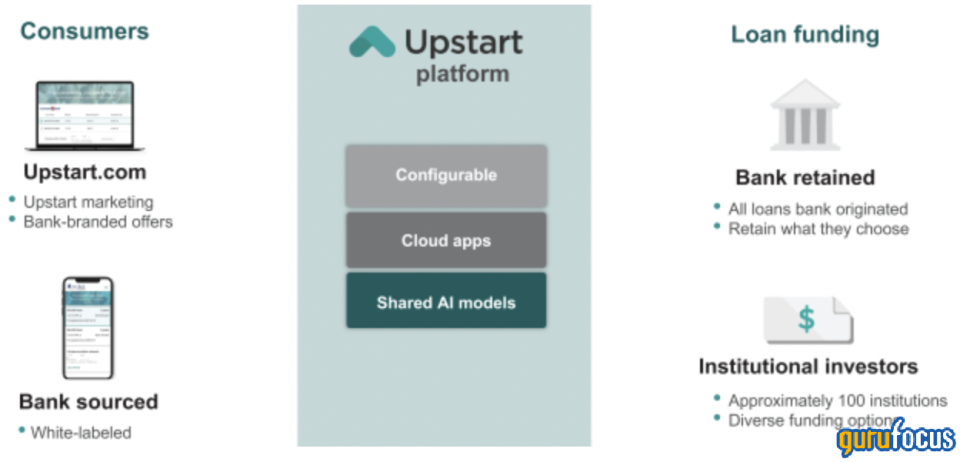

After going public, Upstart quickly became an investor favorite due to the promising technological developments it introduced to reduce loan default rates. The cloud-based AI lending platform works with banks to offer personal loans to eligible customers. The company advertises that its lending model broadens credit availability by considering more than a borrower's FICO score. According to Upstart, 80% of Americans who have never defaulted on a loan do not have access to credit because they do not meet credit evaluation criteria from the scoring method, which takes a very narrow view of creditworthiness.

Upstart is attempting to change this by analyzing data from all of its bank partners using machine learning to assess potential borrowers' creditworthiness in greater detail. The company's income and default prediction model reduces loss rates for Upstart-powered banks by considering non-traditional criteria such as education, the field of study, GPA and employment history in addition to income when determining a borrower's ability to repay a loan. According to the results of its credit assessment tool, the tested Upstart model approves 26% more borrowers than traditional models and exhibits 10% lower average APRs for authorized loans.

The company acts as an intermediary between bank partners and borrowers, earning the majority of its revenue from fees for software and services used by its partner banks, and thus carries far less credit risk in comparison to traditional banks. The number of banking and credit union partners grew from 18 at the end of the first quarter of 2021 to 71 at the end of the second quarter of 2022. From June 2021 to March 2022, Upstart reported triple-digit year-over-year revenue growth for four consecutive quarters, which indicates investors' enthusiasm for Upstart was backed by stellar financial performance.

The Upstart ecosystem

Source: Prospectus

In 2021, the company expanded from the personal loans market into the automotive finance market by paying $89 million to acquire Prodigy, a car dealership sales platform. Upstarts auto retail business clocked in better-than-expected growth as a result with the dealership on the platform increasing from 162 at the end of the first quarter of 2021 to 640 at the end of the second quarter of 2022. The company's revenue and earnings growth rates were exceptional, and its entry into the $727 billion auto loan market was welcomed by investors. However, recessionary concerns seem to be slowing the company's growth today.

The company intends to enter the $644 billion small business lending market as well, but the current economic environment may make it difficult.

What is causing Upstart shares to tumble?

Regardless of Upstart's success and the potential of its AI-based risk assessment model, there are risks to be considered. The share price began to fall after the company issued a bleak outlook last October. Despite recording triple-digit growth, shareholders were not pleased with the slow growth projected by the company. The problem elevated in May following the release of the company's first-quarter earnings report, when management revealed they had added a sizable position to the loans held on its books. Because Upstart is not a bank, its lack of credit exposure was viewed positively previously, and this revelation forced investors to view Upstart as more of a financial services company and less of a tech company.

The slowdown in growth is caused by recessionary fears and rising interest rates. Low interest rates and stimulus checks issued during the pandemic allowed fintech companies to lend money to consumers at competitive rates with little risk of default. Today, rising interest rates, job loss and the discontinuation of government support programs are discouraging borrowers impacting Upstart's profits. The company earns money by charging a fee on loans processed by its AI platform, so it is not surprising that revenue growth is slowing with consumer demand for loans drying down.

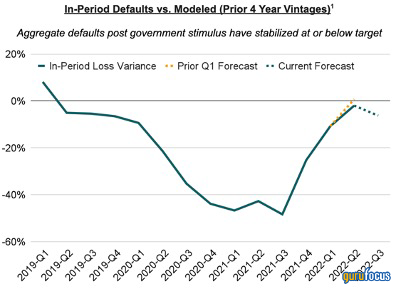

Upstart is also under pressure due to the skyrocketing rate of missed loan payments since the end of stimulus programs. According to the management team, in some cases, default rates have surpassed pre-pandemic levels. With more loans on its books and rising interest rates, the company faces a higher risk of default. Furthermore, this will discourage banks and lending partners from approving loans to Upstart customers as accurately assessing creditworthiness becomes more difficult under the current macroeconomic environment.

Loan default trends

Source: Business Wire

Another factor affecting revenue is Upstart's conversion of some of the loans on its books into cash. However, this should be a one-time occurrence because management has stated that it is no longer keeping loans on its own balance sheet.

The revenue trajectory could deteriorate further in the coming quarters as lenders are hesitant to lend money and customers are likely to avoid paying high interest rates. However, the current issue is not one of demand, but of supply as loan partners appear to be more risk-averse given the current economic climate. A drop in interest rates may make other types of loans more affordable as well, causing customers to switch from Upstart, which is a risk the company has to deal with in the recovery phase of the economy in the next business cycle.

The rising default rates that have shaken investor confidence are not only a problem for Upstart. Fintech businesses in general appear to be impacted, making it more difficult for these companies to attract investors. However, this is only a short-term headwind. But the question remains whether Upstart can regain lenders' trust by improving the accuracy of its technology in determining borrowers' creditworthiness. Upstart's success is determined not only by macroeconomic factors, but also by the performance of its core technology. There is no doubt that if the company is successful in facilitating higher-quality loan books in the current economic environment, it will emerge as the undisputed leader in the digital lending platform. So far, the company has handled the uncertainty admirably thanks to its AI platform, which ensures higher approval rates with lower fraud and default rates. However, rising defaults may call into question the role played by AI in the financial services industry.

Takeaway

Investor interest in Upstart has waned in recent months, and with the company expected to report lackluster growth in the next few quarters, the trend is expected to continue until the company can start facilitating loan books with lower default rates and expand its customer base.

In the short run, the biggest obstacle for Upstart is winning the trust of bank partners. If the company successfully overcomes this challenge, it will likely attract investors once again.

The long-term picture remains promising for Upstart as its success in the last few years demonstrates the inefficiency of traditional credit scoring models. The company could revolutionize the relationship between banks and borrowers, which should open many doors for it to thrive and reward shareholders handsomely.

This article first appeared on GuruFocus.