Ur-Energy Inc (URG) Announces Year-End Results and New Uranium Sales Agreements

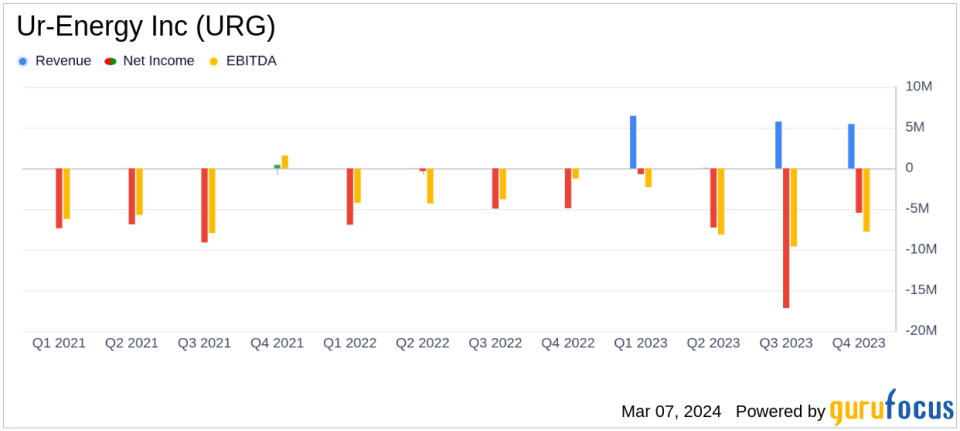

Revenue: Ur-Energy Inc (URG) reported $17.3 million in revenues for 2023.

U3O8 Sales: The company sold 280,000 pounds of U3O8 at an average price of $61.89 per pound.

Gross Profit Margin: Achieved an average gross profit margin of nearly 50% for 2023.

Cash Resources: Increased to $59.7 million as of December 31, 2023, up from $33.0 million the previous year.

Production: Captured approximately 103,487 pounds of U3O8 in 2023, with significant ramp-up in Q4.

2024 Guidance: Expects production of 650,000 to 750,000 pounds of U3O8, with sales commitments for 570,000 pounds.

Strategic Sales Agreements: Signed two new long-term sales agreements, strengthening the sales contract book through 2030.

On March 6, 2024, Ur-Energy Inc (URG) released its 8-K filing, detailing the company's financial performance for the year ended December 31, 2023. Ur-Energy, a uranium mining and recovery company, operates the Lost Creek in-situ recovery uranium facility in Wyoming and is progressing towards expanding its operations with the Shirley Basin Project.

CEO John Cash expressed satisfaction with the company's ability to meet sales guidance and the successful ramp-up at Lost Creek, which has resumed commercial production. The company's strategic positioning in the uranium market has led to the signing of two additional sales agreements, ensuring a robust sales contract book extending to 2030.

Operational and Financial Highlights

Ur-Energy's operational achievements in 2023 included the operation of new header houses in Mine Unit 2 (MU2) at Lost Creek, with Q4 reflecting significant progress in wellfield operations. The company captured approximately 103,487 pounds of U3O8, with 68,448 pounds in Q4 alone. The average production grade for Q4 stood at 93.9 mg/l U3O8.

Financially, Ur-Energy ended the year with a strong cash position, reporting cash resources of $59.7 million, a notable increase from the previous year. The company's financing activities generated $46.1 million, while operating and investing activities used $17.0 million and $2.0 million, respectively.

Ur-Energy's U3O8 sales, cost of sales, and gross profit data for 2023 are as follows:

Unit | 2023 Q1 | 2023 Q2 | 2023 Q3 | 2023 Q4 | 2023 Total |

|---|---|---|---|---|---|

U3O8 Pounds Sold | 100,000 | - | 90,000 | 90,000 | 280,000 |

U3O8 Sales ($000) | 6,447 | - | 5,440 | 5,441 | 17,328 |

U3O8 Cost of Sales ($000) | 3,629 | - | 2,523 | 2,524 | 8,676 |

U3O8 Gross Profit ($000) | 2,818 | - | 2,917 | 2,917 | 8,652 |

The company sold a total of 280,000 pounds of U3O8 in 2023 at an average price per pound of $61.89, with an average cost per pound of $30.99, resulting in an average gross profit per pound of $30.90 and a gross profit margin of nearly 50%. Excluding net realizable value (NRV) adjustments, Ur-Energy realized gross profits of $8.7 million.

Looking Ahead to 2024

For 2024, Ur-Energy anticipates production from MU2 to be between 650,000 and 750,000 pounds, with the company already having contractual commitments for deliveries of 570,000 pounds U3O8. The company plans to build inventory and monitor spot market pricing, potentially making spot sales if warranted.

With uranium spot prices strengthening and term pricing exceeding $70 per pound U3O8, Ur-Energy is well-positioned to respond to increasing demand. The company has secured five sales agreements that call for combined annual delivery of 550,000 to 1,100,000 pounds of U3O8 over a six-year period, beginning in 2025.

Ur-Energy's strategic focus on securing well-priced, long-term contracts and participating in a strong spot market underscores its commitment to delivering value to shareholders and capitalizing on the growing global recognition of nuclear energy's role in achieving net-zero carbon emissions.

For further information on Ur-Energy's financials and operations, interested parties can access the full filings on the company's website or request a hard copy of the consolidated financial statements.

As Ur-Energy continues to navigate the evolving uranium market, it remains committed to safe and compliant operations, with a keen eye on opportunities for further expansion and sales contracts that justify such growth.

For more detailed insights and analysis, readers are encouraged to visit here) from Ur-Energy Inc for further details.

This article first appeared on GuruFocus.