Urban Edge Properties (UE) Reports Strong 2023 Results and Positive Outlook for 2024

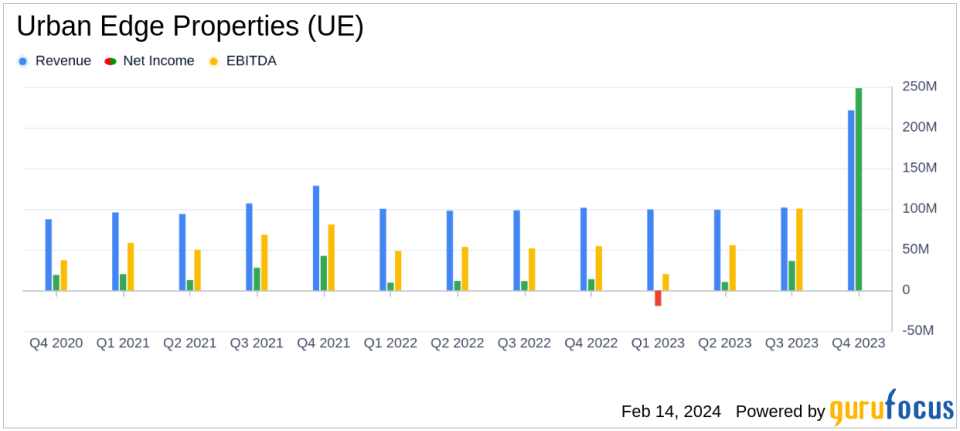

Net Income: Skyrocketed to $248.5 million in FY 2023 from $46.2 million in FY 2022.

Funds from Operations (FFO): Increased to $184.4 million in FY 2023, up from $145.2 million in FY 2022.

Same-Property NOI Growth: Reported a 1.1% growth for FY 2023, indicating stable operational performance.

Leasing Activity: Executed 51 new leases, renewals, and options totaling 647,000 square feet in Q4 2023.

Dividend Increase: Quarterly cash dividend raised by 6%, reflecting confidence in financial stability and future earnings.

2024 Outlook: Anticipates net income of $0.12 to $0.17 per diluted share, with FFO of $1.20 to $1.25 per diluted share.

On February 14, 2024, Urban Edge Properties (NYSE:UE) released its 8-K filing, announcing a remarkable year of financial performance for the period ended December 31, 2023. The real estate investment trust, which specializes in managing and developing retail properties in urban communities, particularly in the Northeastern U.S., has reported significant growth in net income and funds from operations (FFO).

Financial Highlights and Performance

For the fiscal year 2023, Urban Edge Properties reported a net income attributable to common shareholders of $248.5 million, or $2.11 per diluted share, a substantial increase from the $46.2 million, or $0.39 per diluted share, recorded in the previous year. FFO for the year stood at $184.4 million, or $1.51 per diluted share, compared to $145.2 million, or $1.19 per diluted share, in FY 2022. Adjusted FFO saw a modest rise to $153.1 million from $148.5 million year-over-year.

Urban Edge's same-property net operating income (NOI) experienced a slight decline of 2.0% in Q4 2023 but grew by 1.1% for the full year. This growth was primarily driven by new lease commencements, higher net recovery income, and lower operating expenses. The company's leasing activity remained robust, with 51 new leases and renewals executed in the fourth quarter, contributing to a same-property portfolio leased occupancy of 96.0%.

Strategic Acquisitions and Dispositions

The company's strategic maneuvers included the acquisition of two high-quality shopping centers in Boston for $309 million and the sale of two properties and one property parcel for an aggregate sales price of $318 million. These transactions were part of a 1031 exchange, allowing for the deferral of capital gains.

Balance Sheet and Liquidity

As of December 31, 2023, Urban Edge Properties boasted total liquidity of approximately $791 million, with $174 million in cash and $617 million available under its revolving credit agreement. The company's total market capitalization stood at approximately $4.0 billion, with a net debt to total market capitalization of 39%.

2024 Earnings Outlook

Looking ahead, Urban Edge Properties provided an optimistic outlook for 2024, projecting net income of $0.12 to $0.17 per diluted share and FFO of $1.20 to $1.25 per diluted share. The company's board also declared a regular quarterly dividend of $0.17 per common share, up 6% from the previous rate, demonstrating confidence in the company's financial health and future prospects.

Jeff Olson, Chairman and CEO, expressed satisfaction with the company's performance, stating,

2023 was a year of outstanding execution for Urban Edge. We look forward to building on our momentum and continuing to successfully execute on our growth strategy in 2024."

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to review Urban Edge Properties' 8-K filing and join the earnings conference call or access the webcast on the company's investor relations website.

Urban Edge Properties' strong financial results and proactive management strategies position the company well for continued success in the competitive retail real estate market. Value investors and potential GuruFocus.com members may find the company's performance and outlook indicative of a solid investment opportunity.

Explore the complete 8-K earnings release (here) from Urban Edge Properties for further details.

This article first appeared on GuruFocus.