Urban Outfitters (URBN) Appears a Promising Stock: Here's Why

Urban Outfitters, Inc. URBN seems a lucrative bet, thanks to its robust business strategies and solid fundamentals. URBN’s strategic growth initiative, which is the FP Movement, and store-growth endeavors are also impressive.

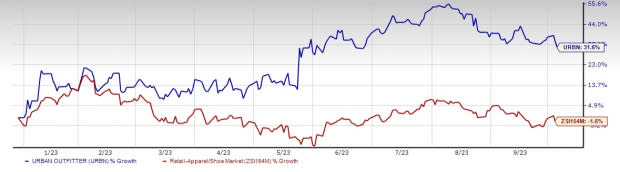

Management has been strengthening its direct-to-consumer business, enhancing productivity across existing channels and optimizing inventory levels. Such strengths have aided the shares of this Philadelphia, PA-based company to rally 31.6% in the year-to-date span, outperforming the industry’s 1.6% drop.

Let’s Delve Deeper

Management has been making investments in the FP Movement with digital and creative brand prospects. It believes that the FP Movement will lure a wider base of customers to the Free People brand. Having a differentiated position in the fitness and wellness space, the FP Movement offers a major growth opportunity and is expected to boost Free People’s brand revenues.

In addition, management remains optimistic about the prospects of Nuuly, which comprises the Nuuly Rent and Nuuly Thrift brands. During the second quarter of fiscal 2024, Nuuly, the subscription-based rental service for women’s clothes, contributed $55.8 million to net sales. This reflected an increase from $28.8 million recorded in the earlier fiscal year’s comparable period, backed by an 85% rise in active subscribers. Going forward, management remains optimistic about the prospects of Nuuly.

Image Source: Zacks Investment Research

Being a multi-brand and multi-channel retailer, Urban Outfitters offers a flexible merchandising strategy. The company also has a significant domestic and international presence with rapidly expanding e-commerce activities. It also makes rational store-expansion endeavors. In fiscal 2024, management plans to open about 28 stores and close nearly 21 outlets.

Management is pleased with the sturdy overall consumer demand at the start of the fiscal third quarter, which is likely to continue throughout the quarter. The third-quarter total company sales growth will be in the high-single digits, driven by mid-single-digit increase in Retail segment comp sales and high-double-digit growth in Nuuly.

Further, the company anticipates the gross margin for the quarter to improve more than 400 basis points year over year, backed by increased initial product margins from reduced inbound freight costs and merchandise markdowns. We foresee an increase of 410 basis points in the margin. Additionally, management believes that the total Retail segment comparable sales in the third quarter could be very similar to both the preceding quarters. The strength at all the apparel and accessory categories has continued in August, which makes the company optimistic about Anthropologie to deliver strong comparable sales in the third quarter.

Analysts seem optimistic about this Zacks Rank #1 (Strong Buy) company. For fiscal 2024, the Zacks Consensus Estimate for URBN’s sales and earnings per share (EPS) is currently pegged at $5.11 billion and $3.21, respectively, suggesting 6.6% and 83.4% growth from the year-ago period’s corresponding figures.

For fiscal 2025, the consensus estimate for sales and EPS presently stands at $5.29 billion and $3.37, respectively, indicating an increase of 3.6% and 5.1% each from the previous fiscal year’s actuals.

All in all, Urban Outfitters’ stock proves to be a solid investment bet now on the aforesaid strengths.

Eye These Solid Picks Too

We have highlighted three other top-ranked stocks, namely American Eagle Outfitters AEO, Abercrombie & Fitch ANF and Boot Barn BOOT.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year EPS suggests growth of 33% from the year-ago reported figure. AEO delivered an average trailing four-quarter earnings surprise of 43.2%.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank of 1. ANF has delivered an earnings surprise of 724.8% in the last four quarters.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10% from the year-ago reported figures.

Boot Barn, a leading apparel and footwear retailer, currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 7.8% from the year-ago reported figure. BOOT delivered an average trailing four-quarter earnings surprise of 13.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report