UroGen Pharma Ltd.'s (NASDAQ:URGN) Prospects Need A Boost To Lift Shares

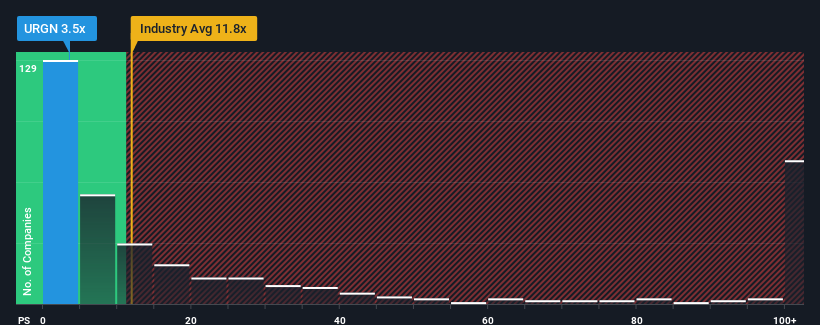

With a price-to-sales (or "P/S") ratio of 3.5x UroGen Pharma Ltd. (NASDAQ:URGN) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 11.8x and even P/S higher than 53x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for UroGen Pharma

How Has UroGen Pharma Performed Recently?

UroGen Pharma could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on UroGen Pharma will help you uncover what's on the horizon.

How Is UroGen Pharma's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like UroGen Pharma's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 36% per annum during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 95% each year, which is noticeably more attractive.

With this information, we can see why UroGen Pharma is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does UroGen Pharma's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that UroGen Pharma maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 4 warning signs for UroGen Pharma (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on UroGen Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here