UroGen Pharma Ltd (URGN) Reports Solid JELMYTO Growth Amidst Financial Challenges

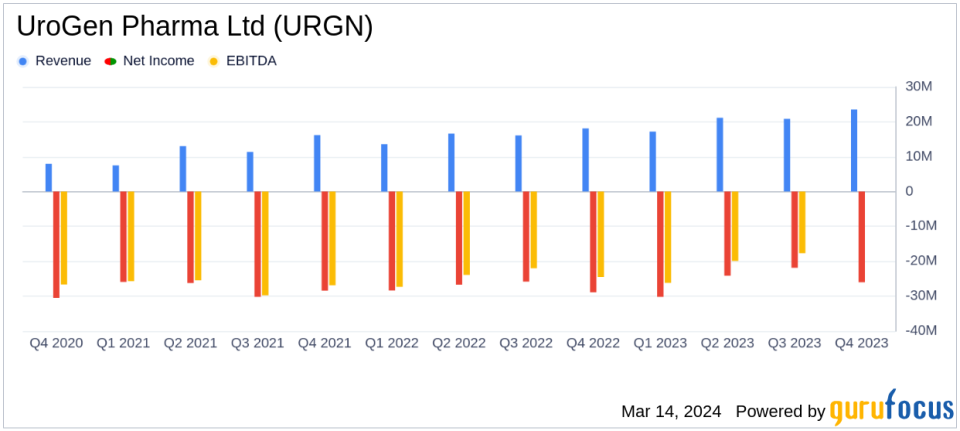

Revenue Growth: JELMYTO net product revenues increased to $23.5 million in Q4 2023, up from $18.1 million in the same period last year.

Annual Revenue: Full year 2023 net revenues for JELMYTO reached $82.7 million, a rise from $64.4 million in 2022.

Net Loss Improvement: Net loss narrowed to $26.0 million in Q4 2023, compared to a net loss of $28.9 million in Q4 2022.

Research and Development: R&D expenses decreased to $45.6 million in 2023 from $52.9 million in 2022.

Liquidity Position: Cash, cash equivalents, and marketable securities totaled $141.5 million as of December 31, 2023.

On March 14, 2024, UroGen Pharma Ltd (NASDAQ:URGN) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative approach to treating urothelial and specialty cancers, has reported significant growth in its JELMYTO product revenues, alongside a reduction in net loss compared to the previous year.

UroGen Pharma Ltd (NASDAQ:URGN) is a clinical-stage biopharmaceutical company that has been making strides in the development and commercialization of treatments for urothelial cancers. With a focus on uro-oncology, the company's lead product candidates, UGN-101 and UGN-102, are based on proprietary formulations of the chemotherapy drug Mitomycin C, designed to overcome the limitations of current treatment options.

Financial Performance and Challenges

The company's financial results show a promising increase in JELMYTO net product revenues, which rose to $23.5 million in the fourth quarter of 2023, up from $18.1 million in the same period in 2022. The full-year net revenues for JELMYTO also saw an increase to $82.7 million in 2023, compared to $64.4 million in the previous year. Despite this growth, the company faced challenges with higher than expected 340B chargebacks and estimated Medicare refunds for discarded drugs, which impacted the full-year net revenues.

Research and development expenses for the full year 2023 were $45.6 million, a decrease from $52.9 million in 2022, reflecting a more efficient allocation of resources towards the company's key projects. Selling, general, and administrative expenses saw an increase to $93.3 million in 2023 from $82.8 million in 2022, indicating an investment in commercial activities and administrative infrastructure.

The company also reported a net loss of $26.0 million, or ($0.72) per basic and diluted share, for the fourth quarter of 2023, which is an improvement from a net loss of $28.9 million, or ($1.25) per basic and diluted share, for the same period in 2022. The full-year net loss also improved to $102.2 million, or ($3.55) per basic and diluted share, compared to $109.8 million, or ($4.81) per basic and diluted share, in 2022.

Financial Achievements and Importance

The biotechnology industry is marked by high research and development costs and a long path to profitability. UroGen Pharma's achievements in revenue growth and the reduction of net loss are significant as they indicate the company's ability to increase market penetration and manage expenses effectively. The growth in JELMYTO revenues is particularly important as it reflects the increasing adoption of the company's products by patients and physicians, which is crucial for long-term success.

As of December 31, 2023, UroGen Pharma's liquidity position remains strong, with cash, cash equivalents, and marketable securities totaling $141.5 million. This financial stability is essential for the company to continue its research and development efforts and to prepare for the potential commercialization of UGN-102, which is expected to address a market opportunity exceeding $3 billion.

Key Financial Metrics and Their Importance

Understanding the key financial metrics from UroGen Pharma's earnings report provides insights into the company's operational efficiency and market position. The following are some of the important metrics from the Income Statement and Balance Sheet:

"In 2023, UroGen achieved important operational and clinical milestones, setting us up for further success in the coming years," said Liz Barrett, President, and Chief Executive Officer of UroGen.

The company's gross profit for the fourth quarter of 2023 was $21.2 million, up from $15.8 million in the same period in 2022, demonstrating an improved margin. The reduction in research and development expenses reflects a strategic focus on advancing key product candidates while managing costs effectively. Selling, general, and administrative expenses increased as the company invested in expanding its commercial operations, which is necessary for the growth of a biotech company transitioning from development to commercialization.

UroGen Pharma's net loss per share improvement is a critical metric for investors, as it indicates the company's progress towards profitability. The decrease in net loss per share suggests that the company is moving in the right direction, despite the inherent risks and long development cycles of the biotech industry.

Analysis of UroGen Pharma's Performance

UroGen Pharma's performance in 2023 reflects a company that is successfully navigating the challenges of the biotech sector. The growth in product revenues and the reduction in net loss are positive signs that the company's strategic initiatives are bearing fruit. The anticipated completion of an NDA submission for UGN-102 in September 2024 and the potential FDA decision in the first quarter of 2025 are key milestones that could significantly impact the company's future.

However, the company also faces challenges, such as increased discounts related to Medicare refunds for discarded drugs and 340B purchases, which are expected to impact net revenues in 2024. The company's guidance for full-year 2024 net product revenues from JEL

Explore the complete 8-K earnings release (here) from UroGen Pharma Ltd for further details.

This article first appeared on GuruFocus.