UroGen Pharma (URGN) Stock Surges 89% in a Month: Here's Why

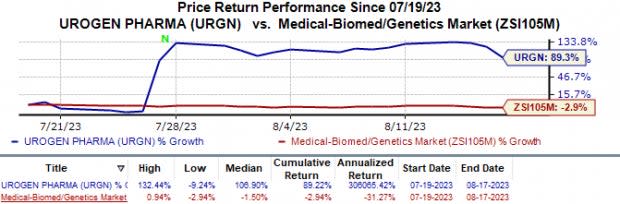

Shares of UroGen Pharma URGN have surged 89.2% in the past month against the industry’s 2.9% fall.

Image Source: Zacks Investment Research

This upside was attributable to encouraging data announced by UroGen last month from two phase III studies — ATLAS and ENVISION — evaluating UGN-102, an intravesical solution for treating patients with low-grade, intermediate-risk non-muscle-invasive bladder cancer (“LG-IR-NMIBC”). Both studies met their primary endpoints.

The ATLAS study met its primary endpoint of disease-free survival, reducing the risk of recurrence, progression or death by 55%. Data from the study demonstrated the superiority of UGN-102 over TURBT (transurethral resection of bladder tumor), the current standard of care for treating LG-IR-NMIBC. Patients who only received UGN-102 achieved a complete response rate (CRR) of 64.8% at three months, compared to 63.6% CRR for those who only received a TURBT.

Data from the ENVISION study showed that treatment with UGN-102 achieved 79.2% CRR three months after the initial treatment. The study evaluated the safety and efficacy of UGN-102 as a primary chemoablative therapy in patients with LG-IR-NMIBC. Additional data on the ENVISION study is expected next year.

Assuming positive findings from the ENVISION study, UroGen plans to file a new drug application (NDA) for UGN-102 with the FDA in 2024.

Unlike TURBT, a surgical procedure, UGN-102 offers a non-surgical option for the disease. Since LG-IR-NMIBC is a recurrent disease, patients require multiple surgeries with risks, especially for the older patient population. An approval for UGN-102 is likely to change the treatment paradigm for patients since no non-surgical treatment option is currently available. Per management, around 82,000 new patients are afflicted with LG-IR-NMIBC annually in the United States.

If approved, UGN-102 will be UroGen’s second marketed product. Currently, the company has only one marketed product Jelmyto, which is approved for treating adult patients with low-grade Upper Tract Urothelial cancer (“LG-UTUC”). During the second-quarter, the company generated total revenues of $21 million, entirely from Jelmyto product sales, which were up around 27% year over year.

Recently, UroGen completed a private placement of ordinary shares and pre-funded warrants of around $120 million in gross proceeds. The company intends to use these proceeds to fund its business operations.

Zacks Rank & Other Stocks to Consider

UroGen currently carries a Zacks Rank #2 (Buy). Some other better-ranked stocks in the overall healthcare sector include Alector ALEC, Eton Pharmaceuticals ETON and Pieris Pharmaceuticals PIRS, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alector’s loss estimates for 2023 have narrowed from $3.06 to $1.85 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.89 to $2.36. Year to date, Alector’s stock has lost 23.6%.

Alector beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. On average, the company’s earnings witnessed an earnings surprise of 20.56%. In the last reported quarter, Alector’s earnings beat estimates by 102.47%.

In the past 30 days, estimates for Eton Pharmaceuticals’ 2023 loss per share have narrowed from 31 cents to 10 cents. During the same period, the earnings per share estimates for 2024 have risen from 9 cents to 26 cents. Year to date, shares of Eton have surged 41.5%.

Earnings of Eton Pharmaceuticals beat estimates in each of the last four quarters, witnessing an earnings surprise of 162.14%, on average. In the last reported quarter, Eton’s earnings beat estimates by 300.00%.

In the past 30 days, estimates for Pieris Pharmaceuticals’ 2023 loss per share have narrowed from 68 cents to 35 cents. During the same period, the loss estimates per share for 2024 have improved from 67 cents to 41 cents. Year to date, shares of Pieris have lost 75.0%.

Earnings of Pieris Pharmaceuticals beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 34.20% on average. In the last reported quarter, Pieris’ earnings beat estimates by 131.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urogen Pharma (URGN) : Free Stock Analysis Report

Pieris Pharmaceuticals, Inc. (PIRS) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report

Alector, Inc. (ALEC) : Free Stock Analysis Report