US Dollar Attempts Rebound Before FOMC Rate Decision

THE TAKEAWAY: The US Dollar has found interim support and attempted a recovery as markets position for the much-anticipated Federal Reserve monetary policy announcement.

Capitalize on Shifts in Market Mood with the DailyFX Speculative Sentiment Index.

US DOLLAR TECHNICAL ANALYSIS– Prices moved lower as expected after putting in a Bearish Engulfing candlestick pattern. Prices found interim support above a rising trend line set from late February and pulled up to retest resistance in the 10565-576 area, marked by the 23.6% Fibonacci retracement and the March 11 high. A break above that aims for the 38.2% level at 10625. Trend line support is now at 10454.

Daily Chart - Created Using FXCM Marketscope 2.0

S&P 500 TECHNICAL ANALYSIS – Prices edged through resistance marked by the top of a falling channel set from late May and the 23.6% Fibonacci retracement (1645.50). Sellers now aim to challenge the 38.2% level at 1675.30. Alternatively, a move back below 1646.50 exposes channel resistance-turned-support at 1629.90.

Daily Chart - Created Using FXCM Marketscope 2.0

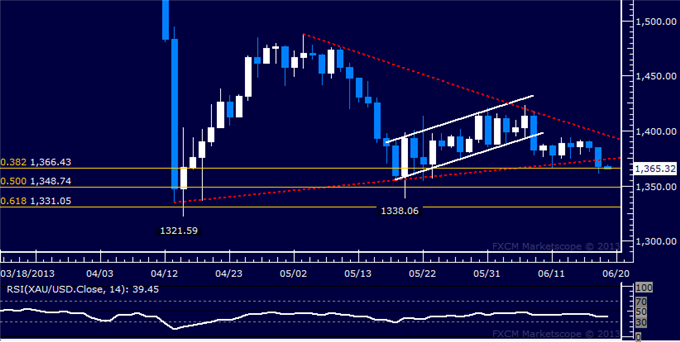

GOLD TECHNICAL ANALYSIS – Prices edged past support at a rising trend line set from mid-April to challenge the 38.2% Fibonacci expansion at 1366.43. A break below that exposes the 50% level at 1348.74. A move back above trend line support-turned-resistance (now at 1374.70) eyes a downward sloping barrier at 1395.72.

Daily Chart - Created Using FXCM Marketscope 2.0

CRUDE OIL TECHNICAL ANALYSIS– Prices cleared falling trend line set from late January and the 50% Fibonacci expansion at 97.09, exposing the 61.8% level at 98.47. A further push above that eyes the 76.4% Fib at 100.18. The 97.09 mark has been recast as near-term support, with a reversal back beneath that eyeing the trend line (now at 96.56) anew.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

New to FX? Watch this Video. For live market updates, visit the Real Time News Feed

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.