US Physical Therapy Inc (USPH) Posts Mixed Fourth Quarter and Full Year 2023 Results

Net Revenue: Increased by 9.3% to $604.8 million for Full Year 2023.

Operating Income: Decreased to $52.1 million for Full Year 2023, including a non-cash impairment charge.

Net Income: USPH net income was $28.2 million for Full Year 2023, down from $32.2 million for Full Year 2022.

Earnings Per Share: Earnings per share was $1.28 for Full Year 2023 compared to $2.25 for Full Year 2022.

Adjusted EBITDA: Increased to $77.7 million for Full Year 2023 from $73.7 million in Full Year 2022.

Dividend: Quarterly dividend increased from $0.43 per share to $0.44 per share.

2024 Guidance: Adjusted EBITDA expected to be in the range of $80 million to $85 million.

On February 28, 2024, US Physical Therapy Inc (NYSE:USPH) released its 8-K filing, announcing its financial results for the fourth quarter and the full year ended December 31, 2023. USPH operates outpatient physical therapy clinics and provides industrial injury prevention services, with a focus on orthopedic and sports-related injuries, as well as workers' compensation cases.

Fourth Quarter and Full Year 2023 Performance

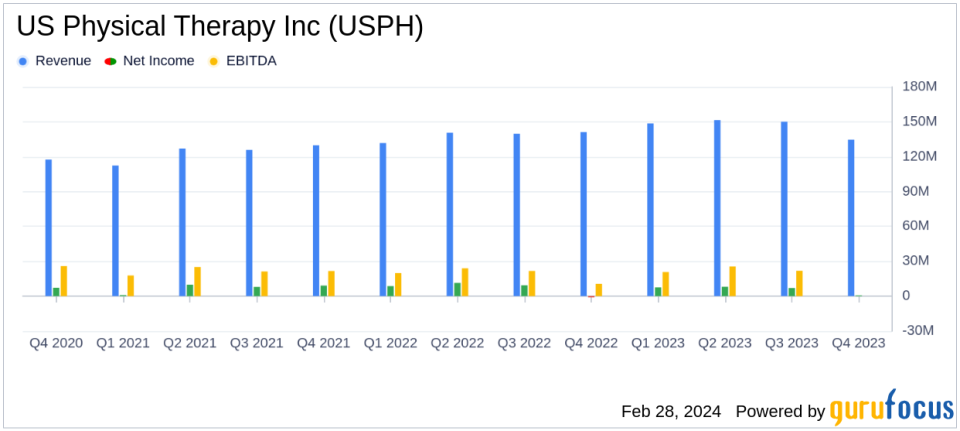

USPH reported a net revenue increase of 9.3% to $604.8 million for the full year 2023 compared to the previous year. However, the company faced challenges, including a Medicare rate reduction that impacted net income, which decreased to $28.2 million for the full year 2023 from $32.2 million in 2022. Earnings per share also declined to $1.28 from $2.25 year-over-year.

Despite these challenges, USPH saw growth in clinic volumes, with a record-high average daily visits per clinic for a full year in the company's history. This growth contributed to an increase in Adjusted EBITDA to $77.7 million for the full year 2023 from $73.7 million in the previous year.

Financial Highlights and Challenges

USPH's financial achievements include a significant increase in net revenue and Adjusted EBITDA. The company's performance is crucial in the competitive healthcare providers and services industry, where efficient operations and strategic growth are key to success.

However, the Medicare rate reduction presents a challenge that may lead to problems, as it directly impacts the company's revenue and profitability. USPH's management is confident in their ability to produce EBITDA growth in 2024, despite these headwinds, through rate negotiations, growth in volumes at existing clinics, and a focus on cost efficiencies.

Balance Sheet and Cash Flow

As of December 31, 2023, USPH had $152.8 million in cash and cash equivalents, a significant increase from $31.6 million the previous year. The company also completed a secondary offering of its common stock, resulting in net proceeds of $163.6 million, which will be used primarily for acquisitions.

2024 Outlook and Dividend Increase

Looking ahead to 2024, USPH expects Adjusted EBITDA to be in the range of $80 million to $85 million. The company also increased its quarterly dividend from $0.43 per share to $0.44 per share, demonstrating confidence in its financial stability and commitment to shareholder returns.

For a more detailed analysis of USPH's financial performance and future prospects, investors are encouraged to review the company's full earnings release and listen to the conference call scheduled for February 29, 2023.

For additional insights and investment analysis, visit GuruFocus.com, where value investors can find comprehensive financial news and stock market updates.

Explore the complete 8-K earnings release (here) from US Physical Therapy Inc for further details.

This article first appeared on GuruFocus.