USCB Financial Holdings Inc Reports Mixed Results Amid Economic Headwinds

Net Income: USCB reported a decrease in net income to $2.7 million in Q4 2023 from $4.4 million in Q4 2022.

Diluted EPS: Earnings per share fell to $0.14, down from $0.22 year-over-year.

Loan Growth: Total loans increased by 18.1% to $1.8 billion.

Net Interest Margin: Improved by 5 basis points from the previous quarter, though down year-over-year.

Asset Quality: Non-performing loans to total loans was 0.03%, up from 0.00% in the previous year.

Stock Repurchase: USCB repurchased shares under its stock repurchase program, signaling confidence in its value.

Capital Ratios: Total risk-based capital ratios remained strong at 12.78% for the company and 12.65% for the bank.

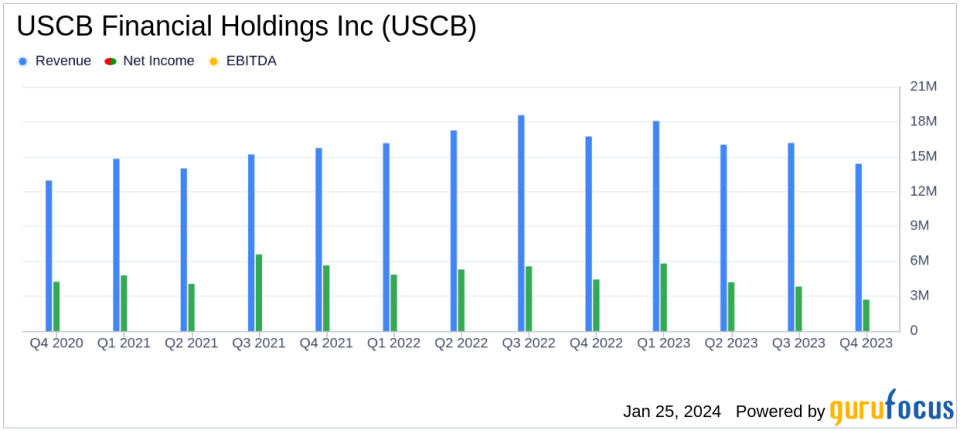

On January 25, 2024, USCB Financial Holdings Inc (NASDAQ:USCB) released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The community bank, known for its wide range of financial products and services, faced a challenging economic environment characterized by aggressive Federal Reserve tightening. Despite these headwinds, USCB achieved significant loan production and took strategic actions to improve its net interest margin (NIM).

Financial Performance Overview

USCB's net income for the quarter was $2.7 million, or $0.14 per diluted share, a decrease from the $4.4 million, or $0.22 per diluted share, reported for the same period in the previous year. The bank's annualized return on average assets and equity also saw declines, coming in at 0.48% and 5.88%, respectively. The efficiency ratio deteriorated to 68.27%, up from 59.81% in the prior year, indicating higher costs relative to revenue.

Despite the dip in earnings, USCB's balance sheet grew, with total assets increasing by 12.1% to $2.3 billion. The loan portfolio expanded significantly, with total loans reaching $1.8 billion, an 18.1% increase. Deposits also grew by 5.9% to $1.9 billion. The bank's total stockholders' equity increased by 5.2% to $192 million, inclusive of a comprehensive loss of $44.3 million.

Strategic Actions and Asset Quality

Chairman, President, and CEO Luis de la Aguilera commented on the bank's strategic initiatives, including a $10 million loss trade transaction aimed at addressing NIM compression. The bank's asset quality remained solid, with a slight increase in non-performing loans to 0.03% of total loans, up from 0.00% the previous year. The allowance for credit losses increased to $21.1 million, representing 1.18% of total loans.

"Despite facing one of the most aggressive Federal Reserve tightening periods in history, we've observed a steady improvement in our operating environment," said Luis de la Aguilera.

Capital Management

USCB continued its capital management strategy, repurchasing 92,317 shares of common stock at an average price of $10.45 per share during the fourth quarter. For the full year, the bank repurchased 669,920 shares at an average price of $11.28 per share. The tangible book value per common share increased to $9.81, up from $9.12 at the end of 2022.

Conclusion

In conclusion, USCB Financial Holdings Inc navigated a challenging quarter with a strategic focus on loan growth and margin improvement. While net income and EPS declined, the bank's balance sheet expansion and proactive capital management demonstrate resilience and a commitment to shareholder value. Investors and analysts will continue to monitor USCB's performance as it adapts to the evolving economic landscape.

For a more detailed analysis of USCB Financial Holdings Inc's financial results, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from USCB Financial Holdings Inc for further details.

This article first appeared on GuruFocus.