Utilities Q2 Earnings Due on Aug 1: PEG, FE & WEC

The Zacks Utilities sector’s second-quarter 2023 earnings are expected to have been adversely impacted by unfavorable weather conditions, inflation, offset marginally by new utility rates and usage of new technologies that assisted in reducing operating expenses.

Per the latest Earnings Preview, the Zacks Utilities sector’s second-quarter earnings and revenues are expected to decline 5.7% and 0.7%, respectively. While the capital-intensive utility stocks were impacted by the ongoing rise in interest rates, new rates implemented in their service territories and customer growth boosted profits.

Factors That Likely Impacted Performances

Domestic-focused companies operating in the sector are concentrating on cost management and the implementation of energy-efficiency programs. New rates and customer additions are creating fresh demand and assisting the utilities. Investments in strengthening the infrastructure are allowing utilities to provide services even during extreme conditions, leading to stable earnings.

Capital-intensive utilities need massive funds to upgrade, maintain and expand their infrastructure and operations. The performances of the utilities are likely to have been adversely impacted by an increase in interest rates from near-zero levels.

Utilities have been focused on improving productivity and their cost structures through investments in digital technologies, integrating key systems and analyzing data to make proper decisions to improve overall operations. The utilities continue to invest smart capital that helps reduce operating and maintenance expenses, and fuel costs. This, in turn, helps customers save money on their utility bills.

Utilities have been adding more renewable and clean energy sources to their production portfolios, and cutting down the use of coal and other polluting sources in their generation portfolios. Weather in the second quarter was mild that adversely impacted the use per customer during the period.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Public Service Enterprise Group Incorporated’s PEG second-quarter earnings are likely to have benefited from new rates implemented in the prior quarters. Adverse weather conditions might have disrupted the smooth flow of electricity to its customers, which is likely to have negatively impacted PEG’s second-quarter revenues.(read more: PSEG Set to Report Q2 Earnings: What's in the Cards?)

Our proven model predicts an earnings beat for Public Service Enterprise Group this time around. PEG has an Earnings ESP of +0.66% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

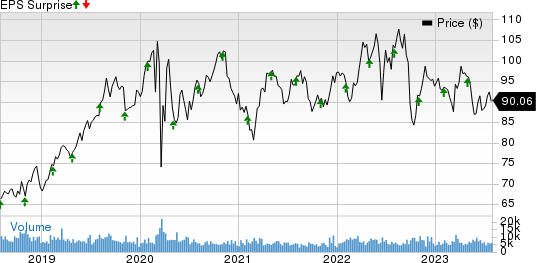

Public Service Enterprise Group Incorporated Price and EPS Surprise

Public Service Enterprise Group Incorporated price-eps-surprise | Public Service Enterprise Group Incorporated Quote

FirstEnergy’s FE second-quarter earnings are likely to have benefited from its ongoing upgrade and maintenance of transmission and distribution lines, reducing possibility of outages. The company’s subsidiary, American Transmission Systems, upgraded a high-voltage transmission line in Clark County, OH, during the quarter. This is expected to further strengthen the regional transmission system and improve service reliability. ( Read More: FirstEnergy to Report Q2 Earnings: What's in the Cards? )

Our proven model does not conclusively predict an earnings beat for FirstEnergy this time around. FE has an Earnings ESP of 0.00% and a Zacks Rank #2 at present.

FirstEnergy Corporation Price and EPS Surprise

FirstEnergy Corporation price-eps-surprise | FirstEnergy Corporation Quote

WEC Energy Group’s WEC second-quarter earnings are likely to have benefited from rate base growth of its utility operations. However, unfavorable weather and higher interest expenses might have offset some of the positives.

Our proven model does not conclusively predict an earnings beat for WEC Energy this time around. WEC has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

WEC Energy Group, Inc. Price and EPS Surprise

WEC Energy Group, Inc. price-eps-surprise | WEC Energy Group, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report