Utilities Stocks Reporting Q2 Earnings on Aug 3: PNW, LNT & More

The Zacks Utilities sector’s second-quarter 2023 earnings are expected to have been adversely impacted by unfavorable weather conditions and ongoing interest rate hikes. However, some of the companies are likely to have gained from cost-saving initiatives and usage of new technologies that helped in increasing the reliability of their services and lowering operating and maintenance expenses.

Per the latest Earnings Preview, the Zacks Utilities sector’s second-quarter earnings and revenues are expected to have declined 5.7% and 0.7%, respectively. While the capital-intensive utility stocks might have been impacted by the ongoing rise in interest rates, new rates implemented in their service territories and customer growth are likely to have boosted profits.

Factors to Note

The performance of capital-intensive domestic-focused utilities is expected to have been adversely impacted by an increase in interest rates as capital servicing costs rise substantially from the current levels.

Except in the case of any major weather variation, demand for utility services remains more or less steady, regardless of economic cycles. Per the U.S. Energy Information Administration report, mild weather conditions during the first half of 2023 are likely to have resulted in a 3% decline in electricity usage, year over year. Thus, mild weather might have adversely impacted utility earnings during the second quarter.

However, Utilities continue to benefit from various favorable factors, such as new electric rates, customer additions, cost management and the implementation of energy-efficiency programs. Also, the ongoing investments to improve the resiliency of electric infrastructure against extreme weather conditions and the transition to cost-effective, renewable energy sources to produce electricity aid the power industry. Furthermore, the government is assisting in increasing the use of renewable energy through tax credits.

The Inflation Reduction Act will support and accelerate the Utilities’ transition toward clean-energy sources. The Act has removed uncertainties related to federal incentives for the usage of renewable sources. It also entails an opportunity for a wide range of low-cost clean energy solutions in a predictable way and is expected to boost earnings potential.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Pinnacle West Capital Corporation’s PNW second-quarter earnings are likely to have been benefited by increased residential customer growth and sales volume. However, higher operations and maintenance expense might have a negative impact in the to-be-reported quarter. (read more: What's in Store for PNW in Q2 Earnings?)

Our proven model does not conclusively predict an earnings beat for Pinnacle West Capital this time around. PNW has an Earnings ESP of -3.98% and a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

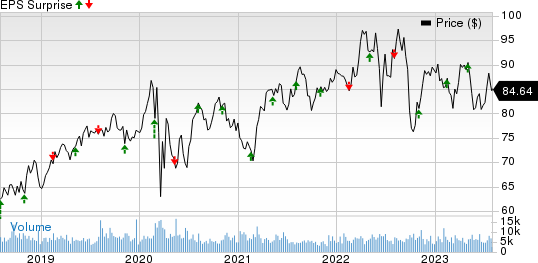

Pinnacle West Capital Corporation Price and EPS Surprise

Pinnacle West Capital Corporation price-eps-surprise | Pinnacle West Capital Corporation Quote

Alliant Energy’s LNT second-quarter earnings are expected to have gained from stable economic conditions, which are likely to have boosted demand. The company might have also benefited from planned investment returns. However, higher interest expenses are likely to have offset some positives. (read more: LNT to Report Q2 Earnings: What's in Store?)

Our proven model does not conclusively predict an earnings beat for Alliant Energy this time around. LNT has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

Alliant Energy Corporation Price and EPS Surprise

Alliant Energy Corporation price-eps-surprise | Alliant Energy Corporation Quote

Sempra Energy’s SRE second-quarter earnings are likely to have been benefited by increased total gas customers and total gas deliveries. It is also expected to have gained from increased electricity demand as some of its service territories witnessed warmer-than-normal temperatures. Strong demand growth at Oncor and increased retail transmission interconnection requests are also likely to have favorably contributed to Sempra Energy’s revenue performance. (read more: What's in the Cards for SRE This Earnings Season?)

Our proven model does not conclusively predict an earnings beat for SRE this time around. The company has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

Sempra Energy Price and EPS Surprise

Sempra Energy price-eps-surprise | Sempra Energy Quote

Consolidated Edison’s ED second-quarter earnings are expected to have been benefited by warmer-than-normal weather pattern, accompanied with drought-like conditions. This is likely to have increased electricity demand for cooling purposes. However, higher interest expenses and increased revenue taxes might have negatively impacted ED’s bottom-line performance. (read more: ED to Post Q2 Earnings: What's in Store?)

Our proven model does not conclusively predict an earnings beat for Consolidated Edison this time around. ED has an Earnings ESP of -1.11% and a Zacks Rank #2 at present.

Consolidated Edison Inc Price and EPS Surprise

Consolidated Edison Inc price-eps-surprise | Consolidated Edison Inc Quote

Ameren Corporation’s AEE second-quarter revenues are likely to have been boosted by strong rate-based growth plans, supported by strategic infrastructure investments across all its business segments. During the quarter, Ameren’s operational regions witnessed warmer-than-normal temperature patterns. This, in turn, is expected to have favorably contributed to the company’s revenues. (read more: AEE to Report Q2 Earnings: What's in the Cards?)

Our proven model does not conclusively predict an earnings beat for Ameren this time around. AEE has an Earnings ESP of 0.00% and a Zacks Rank #3 at present.

Ameren Corporation Price and EPS Surprise

Ameren Corporation price-eps-surprise | Ameren Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Sempra Energy (SRE) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report