Utility Stocks' Q2 Earnings to Watch on Aug 4: D, PNM & More

As of Aug 2, 57.1% of the S&P 500 members from the Zacks Utilities sector have released their second-quarter results, with 68.8% beating earnings estimates and 31.3% outpacing revenue estimates. Another cohort of major utility stocks, including Dominion Energy D, PNM Resources PNM, TransAlta TAC, Evergy EVRG and AES Corp. AES, is set to announce earnings on Aug 2.

Factors to Consider

Domestic-based utility companies are focused on cost management and implementation of energy-efficiency programs. Favorable rate revision and customer additions have been creating fresh demand as well as assisting the utilities. Investment in infrastructure strengthening has been allowing utilities to provide services even during extreme conditions, leading to stable earnings. Domestic-focused operations also insulate utilities against the adverse impact of currency fluctuation. These factors are likely to have contributed to this sector’s second-quarter results.

Utilities have been aggressively adding more renewable and clean energy sources to their production portfolios, and cutting down the use of coal and other polluting sources in their generation portfolios.

Many utilities have already pledged to provide 100% electricity from clean sources in the next few decades. We expect the second-quarter results from utility companies to reflect such clean energy developments.

The utility companies have also been focused on improving productivity and cost structures through investments in digital technologies, integrating key systems and analyzing data to make proper decisions to improve overall operations. They continue to invest smart capital that helps reduce operating and maintenance expenses and fuel costs. This, in turn, helps customers save money on their utility bills. This is likely to get reflected in the customer growth rate for these utility providers in their second-quarter results.

However, the fact that utilities need massive funds to upgrade, maintain and expand their infrastructure and operations, has made their operations difficult in the current interest rate scenario. Thus, the capital-intensive utilities are likely to have experienced higher borrowing costs, thanks to the rise in interest rates from near-zero levels. This, in turn, might have hurt their bottom-line performance. Also, fluctuating weather conditions across major parts of the United States are expected to have unfavorably impacted the utilities’ performance in the April-June quarter.

Q2 Expectations

Total second-quarter earnings and revenues are expected to decline 4.7% and 4.1%, respectively, on a year-over-year basis.

For more details on quarterly releases, you can go through our latest Earnings Outlook.

Utilities' Earnings in Focus

Let's take a look at the following utility companies that are scheduled to post their quarterly report on Aug 4 and find out how things might have shaped up prior to the announcements.

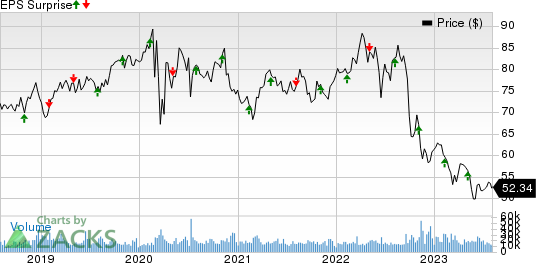

Dominion Energy delivered a four-quarter average earnings surprise of 1.68%. Regulated investments, higher sales volume and efficient cost management are expected to have boosted D’s second-quarter earnings.

However, the longer-than-expected planned outage of Millstone Power Station Unit 2 and Millstone Power Station Unit 3’s automatic reactor trip might have had hurt D’s overall results (read more: Dominion Energy to Post Q2 Earnings: What's in the Offing?).

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Dominion Energy has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Dominion Energy Inc. Price and EPS Surprise

Dominion Energy Inc. price-eps-surprise | Dominion Energy Inc. Quote

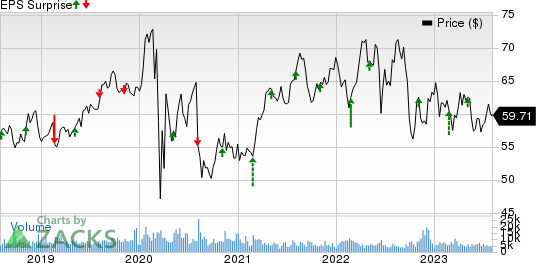

PNM Resources delivered a four-quarter average earnings surprise of 19.28%. The bottom-line estimate for second-quarter 2023 earnings is pinned at 50 cents, implying a deterioration of 12.3% from the year-ago quarter’s reported figure.

The consensus mark for revenues is pegged at $528.1 million, indicating a 16.5% year-over-year decline.

PNM has an Earnings ESP of 0.00% and a Zacks Rank #2 at present.

PNM Resources, Inc. Price and EPS Surprise

PNM Resources, Inc. price-eps-surprise | PNM Resources, Inc. Quote

TransAlta delivered a four-quarter average negative earnings surprise of 84.53%. During the second quarter, TransAlta started providing 100% of power generated from its 130 MW Garden Plain wind project, under Virtual Power Purchase Agreements. This is expected to have boosted its earnings in the to-be-reported quarter

However, higher operations, maintenance and administration expenses might hurt its second quarter earnings.

TAC currently has an Earnings ESP of +440.01% and a Zacks Rank #3 (read more: TransAlta to Report Q2 Earnings: Here's What to Expect).

TransAlta Corporation Price and EPS Surprise

TransAlta Corporation price-eps-surprise | TransAlta Corporation Quote

Evergy delivered a four-quarter average earnings surprise of 16.02%. Its ongoing cost saving initiatives are likely to have lowered operating and maintenance expenses, thereby benefiting EVRG’s second-quarter earnings.

However, higher interest expenses and depreciation and amortization costs might have offset some of these positives.

EVRG currently has an Earnings ESP of -3.80% and a Zacks Rank #3 (read more: Evergy to Report Q2 Earnings: Here's What to Expect ).

Evergy Inc. Price and EPS Surprise

Evergy Inc. price-eps-surprise | Evergy Inc. Quote

AES delivered a four-quarter average earnings surprise of 6.14%. Its service territories witnessed a mostly warmer-than-normal weather pattern accompanied with a drought-like situation. This, in turn, might have favorably contributed to the company’s top-line performance in the soon-to-be-reported quarter.

Lower contributions from LNG sales, higher interest expense from incremental debt, higher rates on its revolving credit facility and a marginally higher tax rate this year, are expected to have hurt the company’s bottom line.

AES currently has an Earnings ESP of -12.84% and a Zacks Rank #3 (read more: AES to Announce Q2 Earnings: Here's What You Need to Know).

The AES Corporation Price and EPS Surprise

The AES Corporation price-eps-surprise | The AES Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dominion Energy Inc. (D) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

Evergy Inc. (EVRG) : Free Stock Analysis Report