Vail Resorts (MTN) to Buy Crans-Montana Resort in Switzerland

Vail Resorts, Inc. MTN has announced its strategic acquisition of Crans-Montana Mountain Resort in Switzerland, a premier ski destination, renowned for its breathtaking Alpine views and outdoor events.

The deal is expected to close during 2023-2024 ski and ride season, pending specific third-party approvals. Crans-Montana Mountain Resort will operate as usual during the winter season of 2023-24, following the standard course of business.

With an 84% stake in lift operations and an 80% ownership in a key ski school, Vail Resorts aims to leverage its global reach and Epic Pass offerings to elevate the Swiss resort's international profile.

The deal, valued at CHF 118.5 million ($136 million), positions Vail Resorts for robust growth. The resort's inclusion in Epic Pass products is expected to attract a broader international audience seeking a luxurious Alpine experience.

Management plans to invest approximately CHF 30 million over the next five years, focusing on guest experience enhancements and snowmaking capabilities. This strategic investment is projected to yield over CHF 15 million in annual EBITDA.

MTN remains committed to retaining local expertise and operational infrastructure. The acquisition aligns with its broader strategy, integrating data analytics, accessibility through Epic Pass products and best practices from its global mountain operations.

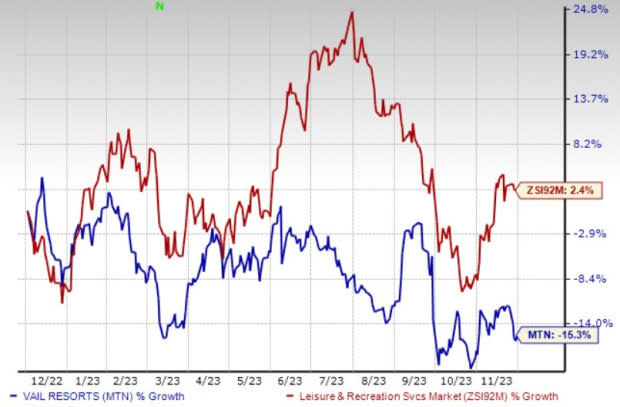

Image Source: Zacks Investment Research

Stock Performance

Shares of the company have declined 15.3% in the past year against the industry’s 2.4% growth. High costs are hurting MTN.

In fourth-quarter fiscal 2023, its margins were affected by inflationary labor costs. The mountain segment’s labor-related costs increased 26.3% compared with the prior-year levels. Segmental operating expenses jumped 22.4% year over year due to investments in employee wages and salaries, impact of inflation and incremental expenses associated with Andermatt-Sedrun and Seven Springs Resorts. Moving ahead, management anticipates the inflationary costs to persist for some time.

The company currently has a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are mentioned below.

Royal Caribbean Cruises Ltd. RCL presently sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 77.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc. LYV currently flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have gained 13.9% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests an improvement of 28.7% and 137.5%, respectively, from the year-earlier period’s levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have jumped 36.3% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS implies a gain of 8.2% and 44.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Vail Resorts, Inc. (MTN) : Free Stock Analysis Report