Vail Resorts (MTN) Q4 Earnings Miss, Mountain Segment Hurts

Vail Resorts, Inc. MTN fourth-quarter fiscal 2023 results were hurt by bleak performance of the Mountain segment. However, the company reported solid season pass sales for the upcoming 2023/24 North American ski season.

MTN reported fourth-quarter fiscal 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. Nonetheless, the top line increased on a year-over-year basis. The bottom line declined from the prior-year quarter’s figure.

Mountain Segment’s Poor Performance Hurts

The Mountain segment generated revenues of $181 million in the quarter under review, down 2% year over year. We projected the metric to be $207.7 million. During the quarter, revenues from dining rose 2.2% year over year to $17.7 million.

Revenues from Ski school improved 6.1% year over year to $9.8 million. Lift and retail/rental revenues decreased 1.5% and 12.9%, respectively, on a year-over-year basis. Our model predicted revenues from Ski school, lift and retail/rental to gain 3%, 16.9% and 3.3% year over year, respectively.

Segmental EBITDA amounted to ($91.1) million in the quarter under discussion compared with ($62.4) million reported in the prior-year quarter. Operating expenses totaled $272.2 million, up 10.2% year over year. Our model suggested segmental EBITDA to be ($84.4) million.

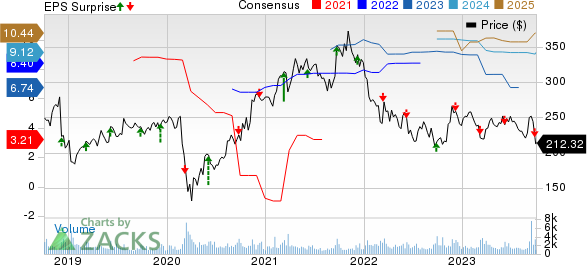

Vail Resorts, Inc. Price, Consensus and EPS Surprise

Vail Resorts, Inc. price-consensus-eps-surprise-chart | Vail Resorts, Inc. Quote

An escalation in the Mountain segment’s expenses also affected the company’s performance. Total expenses in this segment jumped 10.2% year over year to $272.2 million owing to a sharp rise in labor and labor-related benefits as well as resort related fees.

Season-to-date (through Sep 22, 2023), management stated that pass product sales had climbed approximately 7% and 11%, respectively, in units and sales dollars compared with the year-ago period’s (through Sep 23, 2022) levels. It reported strong unit growth concerning its renewing pass holders in destination markets. Also, it noted benefits from an 8% price hike (relative to the 2022/23 season).

Zacks Rank and Stocks to Consider

Currently, Vail Resorts carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector include:

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 34.6% on average. Shares of LYV have increased 4.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT currently carries a Zacks Rank #2 (Buy). HLT has a trailing four-quarter earnings surprise of 12.5% on average. The stock has gained 18.5% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS suggests improvements of 14.8% and 23.7%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW currently carries a Zacks Rank #2. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have risen 32.1% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS implies 44.5% and 117.9% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Vail Resorts, Inc. (MTN) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report