Vale (VALE) Q3 Iron Ore Production Declines 4% Year Over Year

Vale S.A. VALE reported iron ore production of 86.2 million tons (Mt) for the third quarter of 2023, which was down 4% year over year. This was mainly due to lower run-of-mine production from the Paraopeba complex, a temporary stoppage at the Viga operations due to one-off maintenance of the tailings pipeline and lower output from Serra Norte.

A one-time failure in the conveyor belt system at S11D in August impacted output by 2 Mt. Despite this setback, S11D’s production improved 2% in the quarter, as a result of consistent improvement in leading performance indicators including record mine movement in September.

Vale reported improvement in the overall quality with iron content increasing 87 basis points year over year. This was attributed to higher production at S11D and higher pellet feed output from Brucutu with the commissioning of the Torto dam, which led to an 11% year-over-year rise in pellet production to 9.2 Mt.

Total sales volumes of iron ore fines and pellets rose 6% from the prior-year quarter to 78 Mt, aided by favorable market conditions.

Copper Output Up, Nickel Lags

In the third quarter of 2023, Vale produced 81.6 kt of copper, which marked 9.8% year-over-year growth benefiting from the steady ramp-up of Salobo III. The Salobo complex attained the highest monthly production level in September, since July 2019. Sossego copper production decreased due to lower copper grades. Vale sold 73.8 kt of copper, which was up 4.7% from the last-year quarter aided by higher production. However, this was somewhat negated by the postponement of one shipment of copper concentrates from the third quarter to the fourth quarter of 2023.

Production of nickel declined 18.7% year over year to 42.1 kt in the July-September period. This was due to the ongoing transitioning of Voisey’s Bay mine to underground operations and maintenance at the Sudbury refinery. Nickel sales were recorded at 39.2 kt, which were down 11.5% from the last year comparable quarter’s figure.

Guidance for 2023

The company’s iron ore production guidance for 2023 is 310-320 Mt. Vale’s total iron ore production was around 308 Mt in 2022.

The copper production guidance for 2023 is 315-325 kt, lower than the previously stated 335-370 kt. Copper production was 253 kt in 2022. VALE expects nickel production in 2023 to be between 160 kt and 175 kt. The company had produced 179 kt of nickel in 2022. Pellets production is projected to be between 36 Mt and 40 Mt for 2023.

Peer Performance

Rio Tinto Group RIO recently reported a 1% year-over-year drop in third-quarter 2023 iron ore production to 83.5 Mt (on a 100% basis). Rio Tinto’s share was 70.9 million tons. Iron ore shipments, however, rose 1% to 83.9 Mt from the year-ago quarter’s shipment. RIO has witnessed a 4% improvement in iron in the first nine-month period of 2023.

Iron ore shipments have improved 5% year over year to 245.5 Mt in the first nine months of 2023 ,reflecting improved performance across the Pilbara system, ramp-up of the Gudai-Darri mine and improved productivity as a result of the implementation of the Safe Production System. Backed by this performance, the company expects Pilbara iron ore shipments (100% basis) to be at the upper end of its stated range of 320 Mt to 335 Mt in 2023. Shipments in 2022 were reported at 322 Mt.

BHP Group’s BHP iron ore production declined 3% year over year to 63.2 Mt in the first quarter of fiscal 2024 (ended Sep 30, 2023). Production was down 3% year over year to 62 Mt (69 Mt at 100% basis) at Western Australia Iron Ore (WAIO). The decline was due to tie-in activity for the Rail Technology Program, the ongoing ramp-up and maintenance at the Central Pilbara hub (South Flank and Mining Area C) and the timing of track renewal maintenance.

BHP’s iron ore production guidance for fiscal 2024 remains at 254-264.5 Mt. WAIO's production is expected to be between 250 Mt and 260 Mt (282 Mt and 294 Mt on a 100% basis).

Price Performance

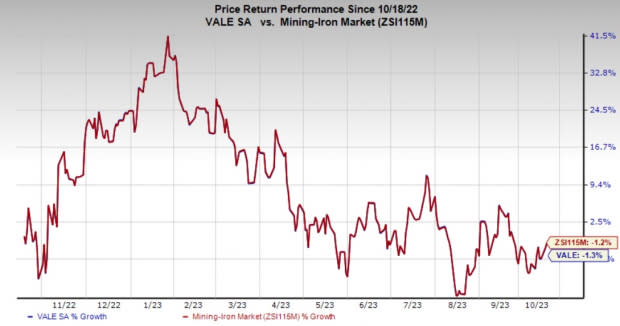

Shares of Vale have declined 1.3% in a year compared with the industry's 1.2% fall.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Vale currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Another top-ranked stock in the basic materials space is Ecolab ECL, which currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for ECL’s earnings for the current fiscal year is pegged at $5.09 per share, implying year-over-year growth of 13.4%. The estimate has moved up 2% over the past 90 days. Ecolab has a trailing four-quarter earnings surprise of roughly 1.04%, on average. The ECL stock has gained around 12% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report