Valero Energy: A Strong Investment Thesis

Valero Energy Corp (NYSE:VLO) is a large petroleum refining group, and a member of the S&P 500 index. The company discloses information to the market in a very transparent manner and for the most part is a bet on refining margins. However, it has growing ethanol and renewable diesel segments. The stock has a GF Score of 88 meaning it has good outperformance potential. Refining margins fluctuate but tend to be driven by the demand for gasoline, making Valero Energy Corp (NYSE:VLO) an inherent bet on the US consumer.

SWOT Analysis

Strengths:

Valero Energy Corp (NYSE:VLO) stands as the largest independent refiner in the United States, boasting an impressive refining capacity exceeding 3.3 million barrels per day. Complemented by a vast network of over 7,000 convenience stores, Valero Energy Corp (NYSE:VLO) commands a substantial market share in the refining and marketing of transportation fuels. Valero Energy Corp (NYSE:VLO) also has a refinery in Europe meaning it is slightly more diversified compared to other US refiners.

Valero Energy Corp (NYSE:VLO)'s consistent track record of operational efficiency has been a cornerstone of its success. This efficiency is derived from factors such as its scale, focus on health and safety, and integration of advanced technologies, resulting in optimized cost structures.

A strong balance sheet and a Gurufocus Financial Strength score of 8 out of 10 positions Valero Energy Corp (NYSE:VLO) favorably. This financial stability equips the company to navigate economic uncertainties and invest in emerging technologies. The stock also has a Piotroski F-Score of 7 out of 9 and an Altman Z-Score of 5.4, which are both attractive scores.

Valero Energy Corp (NYSE:VLO)'s strategic commitment to technological advancement is noteworthy. Investments in renewable energy, carbon capture and storage, and digitalization underscore its proactive approach to refining and marketing operations, and future proofing its business.

Despite these strengths, Valero Energy Corp (NYSE:VLO) also faces inherent weaknesses and external threats that investors should take into consideration.

Weaknesses:

Valero Energy Corp (NYSE:VLO)'s profitability is vulnerable to fluctuations in crude oil and refined product prices. Given its largely fixed cost structure, decreases in these refining margins directly erode profit margins.

Emissions stemming from Valero Energy Corp (NYSE:VLO)'s refining operations do expose the company to environmental scrutiny and regulatory pressure to mitigate its environmental footprint.

The refining industry is marked by fierce competition, with established players vying for market share. This competitive landscape poses challenges for Valero Energy Corp (NYSE:VLO)'s market maintenance and profit expansion. Valero Energy Corp (NYSE:VLO)s refineries are typically more complex however, which gives their refineries more optionality and profitability relative to the simple refineries owned by smaller refining companies.

Opportunities:

Valero Energy Corp (NYSE:VLO) is well positioned to harness the rising renewable energy market. Valero Energy Corp (NYSE:VLO)'s investments in ethanol production and exploratory forays into biodiesel and bio-jet fuel underscore its potential to align with evolving consumer preferences and tap into new revenue streams.

Valero Energy Corp (NYSE:VLO)s Gulf Coast refineries can supply international markets, such as Asia, presenting Valero Energy Corp (NYSE:VLO) with opportunities to extend its customer base and revenue sources, diversifying its operations beyond current domains.

By acquiring refining or marketing entities, Valero Energy Corp (NYSE:VLO) could foster growth and access new markets, fostering synergies that elevate its market reach and asset portfolio.

Threats:

The possibility of increased government regulations, including carbon taxes and emissions limits, poses a threat to Valero Energy Corp (NYSE:VLO)'s profitability and operational ease.

In the face of a significant economic downturn, the demand for gasoline and refined products could diminish, subsequently impacting Valero Energy Corp (NYSE:VLO)'s earnings.

The emergence of new technologies, particularly electric vehicles, carries the potential to disrupt the refining industry, reducing demand for traditional gasoline and refined products, which in turn affects Valero Energy Corp (NYSE:VLO)'s profits. However, with the growth of carbon capture and storage, the petroleum industry is set to continue for decades.

Financial Results so far in 2023

Valero Energy Corp (NYSE:VLO)'s financial performance in 2023 thus far showcases favorable trends, buoyed by robust global demand for petroleum-based transportation fuels. This heightened demand, coupled with constraints on worldwide supply, kept refining margins robust.

During Q2 2023, Valero Energy Corp (NYSE:VLO) reported net income of $1.9 billion although this was down on the $4.7 billion recorded in the same period of 2022. This shift of $2.8 billion primarily resulted from a $3.5 billion reduction in operating income, tempered by a decrease of $747 million in income tax expenses.

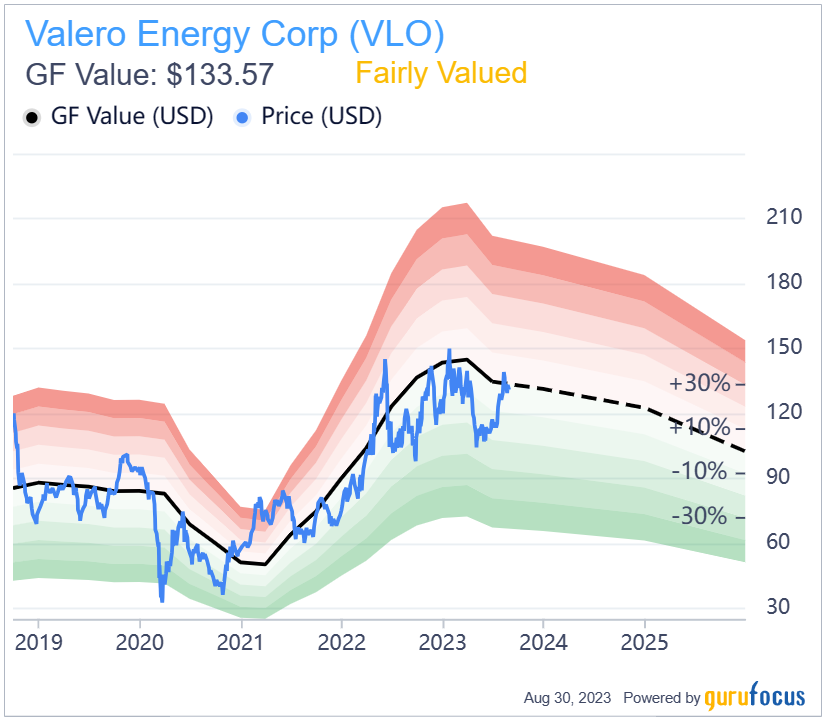

Valuation

GF Value shows the stock as Fairly Valued.

However, the stock scores well for profitability, growth and financial strength, scoring 8 out of 10 in each of these categories.

Outlook

As Valero Energy Corp (NYSE:VLO) charts its course into the latter half of 2023 and beyond, a series of significant factors are poised to shape its operational trajectory.

Demand Dynamics: The resurgence of gasoline and diesel demand to pre-pandemic levels is anticipated to align with customary seasonal patterns. Jet fuel demand, particularly in the U.S., is showing promising signs of approaching pre-pandemic levels.

Inventory Considerations: Light product inventories (gasoline, diesel, and jet fuel) remain below historical benchmarks in both the U.S. and Europe. This scarcity underscores continued robust utilization of refining capacity.

Renewable Energy: Valero Energy Corp (NYSE:VLO) anticipates ongoing consistent renewable diesel margins, reflective of its proactive investments in renewable energy sectors.

Ethanol Demand: Ethanol demand is poised to adhere to customary seasonal patterns, mirroring historical trends. There has also been speculation that airlines want to start blending ethanol into sustainable aviation fuel which might create a demand boost for ethanol.

In conclusion, Valero Energy Corp (NYSE:VLO) stands as a resilient player in the energy sector, marked by strengths that bolster its market influence and operational efficiency. While navigating weaknesses and threats, Valero Energy Corp (NYSE:VLO) is well-positioned to harness opportunities in the renewable energy market, potential market expansions, and strategic acquisitions. As it moves forward, Valero Energy Corp (NYSE:VLO) remains able to respond to changing demands, economic shifts, and the transformative impact of new technologies on the refining industry. The stock should be high on your investment watchlist.

This article first appeared on GuruFocus.