Valero (VLO) Q3 Earnings Beat Estimates, Revenues Fall Y/Y

Valero Energy Corporation VLO has reported third-quarter 2023 adjusted earnings of $7.49 per share, beating the Zacks Consensus Estimate of $7.36 per share. The bottom line increased from the $7.14 reported in the year-ago quarter.

Total quarterly revenues dipped from $44,454 million in the prior-year quarter to $38,404 million. The top line also lagged the Zacks Consensus Estimate of $38,957 million.

Strong quarterly earnings were primarily driven by increased refining throughput volumes and a decline in total costs of sales.

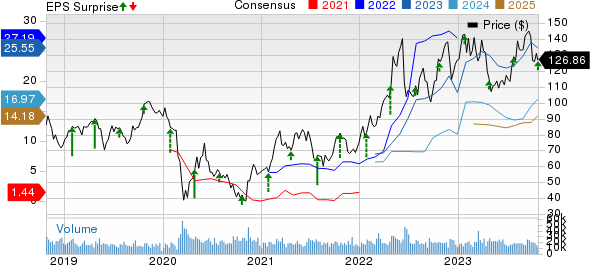

Valero Energy Corporation Price, Consensus and EPS Surprise

Valero Energy Corporation price-consensus-eps-surprise-chart | Valero Energy Corporation Quote

Segmental Performance

Adjusted operating income in the Refining segment was $3,451 million, declining from $3,816 million in the year-ago quarter. A lower refining margin per barrel of throughput affected the segment.

In the Ethanol segment, Valero reported an adjusted operating profit of $197 million, significantly up from $1 million in the year-ago quarter. Higher ethanol production volumes aided the segment.

Operating income in the Renewable Diesel segment declined to $123 million from $212 million in the year-ago quarter. Renewable diesel sales volumes increased to 2,992 thousand gallons per day from 2,231 thousand gallons per day a year ago.

Throughput Volumes

In the quarter, Valero’s refining throughput volumes were 3,022 thousand barrels per day (MBbls/d), marginally up from the 3,005 MBbls/d reported in the third quarter of 2022.

In terms of feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 50%, 10.3% and 16.4% of the total volume, respectively. The remaining volume came from residuals, other feedstock, and blendstocks and others.

The Gulf Coast contributed 60.7% to the total throughput volume. Mid-Continent, North Atlantic and West Coast regions accounted for 15%, 15.3% and 9%, respectively, of the total throughput volume.

Throughput Margins

The refining margin per barrel of throughput declined to $19.47 from the year-ago level of $21.34. Refining operating expenses per barrel of throughput was $4.91 compared with $5.48 in the year-ago quarter.

Depreciation and amortization expenses increased to $2.15 a barrel from $2.06 in the prior-year quarter. As such, Valero’s adjusted refining operating income was $12.41 per barrel of throughput compared with $13.80 in the prior-year quarter.

Cost of Sales

Valero’s total cost of sales declined to $34,634 million in the third quarter from the year-ago figure of $40,431 million primarily due to lower material costs and operating expenses.

Capital Investment & Balance Sheet

The third-quarter capital investment was $394 million. Of the total, $303 million was allotted for sustaining the business.

At the third-quarter end, the company had cash and cash equivalents of $5,831 million. As of Sept 30, 2023, it had total debt and finance lease obligations of $11,441 million.

Zacks Rank & Other Stocks to Consider

Valero currently carries a Zacks Rank #2 (Buy).

Investors interested in the energy sector may look at some other top-ranked companies mentioned below. The three companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty Energy Inc. LBRT reported third-quarter 2023 earnings of 85 cents per share, which beat the Zacks Consensus Estimate of 74 cents. The Denver-CO-based oil and gas equipment company’s outperformance reflects the impacts of strong execution and increased service pricing.

Liberty’s board of directors announced a cash dividend of 7 cents per common share, payable on Dec 20, 2023, to stockholders of record as of Dec 6, 2023. The dividend increased 40% from the previous quarter’s level.

Matador Resources Company MTDR reported third-quarter 2023 adjusted earnings of $1.86 per share, which beat the Zacks Consensus Estimate of $1.59. MTDR’s milestone led to better-than-expected third-quarter results, with the highest-ever total production averaging more than 135,000 barrels of oil and natural gas equivalent per day.

For the fourth quarter of 2023, Matador expects an average daily oil equivalent production of 145,000 BOE. The recent guidance indicates a 2% upward revision from the prior mentioned 143,000 BOE/D.

APA Corp. APA released supplemental information regarding its financial and operational results for the third quarter of 2023. The company anticipates its quarterly total adjusted production and adjusted oil production to be in the upper half of its guidance range. This can be mainly attributed to strong Permian oil and U.K. North Sea volumes.

The company expects its adjusted production and adjusted oil production figures to fall within the upper half of its guided range. It anticipates adjusted production of 337-339 Mboe/d and adjusted oil production of 159-161 Mboe/d. APA is scheduled to release third-quarter results on Nov 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APA Corporation (APA) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report