Valley National Bancorp (VLY) Reports Q4 2023 Earnings: Net Income Declines Amidst Rising ...

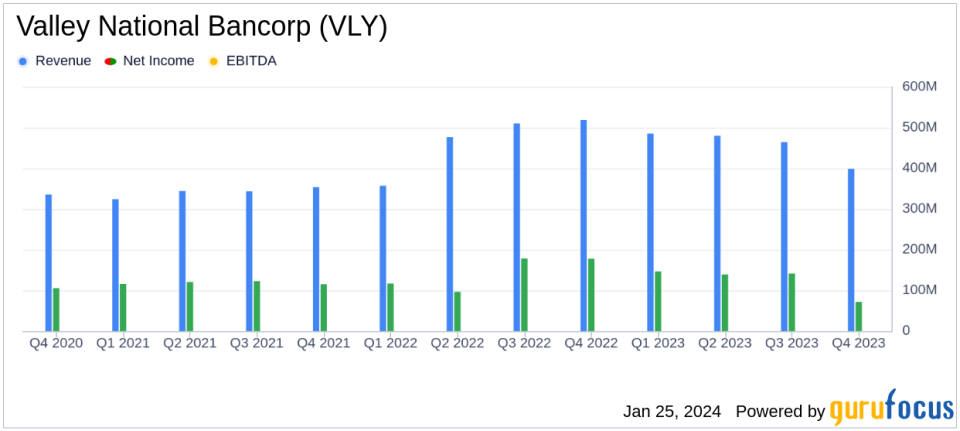

Net Income: Reported at $71.6 million for Q4 2023, down from $177.6 million in Q4 2022.

Diluted Earnings Per Share (EPS): Decreased to $0.13 in Q4 2023 from $0.34 in the same quarter the previous year.

Loan Portfolio: Grew modestly by $112.8 million to $50.2 billion, with annualized growth of 7.0% for the year.

Net Interest Margin: Compressed to 2.82% in Q4 2023 from 2.91% in Q3 2023 and 3.57% in Q4 2022.

Deposits: Decreased by $642.5 million to $49.2 billion at the end of Q4 2023.

Provision for Credit Losses: Increased to $20.7 million in Q4 2023, up from $9.1 million in Q3 2023 and $7.3 million in Q4 2022.

Efficiency Ratio: Worsened to 60.70% in Q4 2023 from 56.72% in Q3 2023 and 49.30% in Q4 2022.

On January 25, 2024, Valley National Bancorp (NASDAQ:VLY) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The bank holding company, which operates through its principal subsidiary Valley National Bank, reported a decline in net income to $71.6 million, or $0.13 per diluted common share, compared to $177.6 million, or $0.34 per diluted common share, in the fourth quarter of 2022. Adjusted net income, a non-GAAP measure, was $116.3 million, or $0.22 per diluted common share, for the fourth quarter of 2023.

Valley National Bancorp, with its diversified business model, provides a range of commercial, retail, trust, and investment services. The company has been focusing on acquisitions and wealth and capital management to enhance its service offerings.

Financial Performance and Challenges

The bank's performance in the fourth quarter reflects the broader challenges faced by the banking industry, including the impact of elevated market interest rates. Loan growth remained modest due to these conditions, with total loans increasing by 1.0 percent on an annualized basis to $50.2 billion. The commercial real estate and consumer loan categories were the primary contributors to this growth.

Valley National Bancorp's net interest income on a tax equivalent basis decreased by $15.1 million compared to the third quarter of 2023 and by $68.7 million compared to the fourth quarter of 2022. The net interest margin also decreased, reflecting the ongoing repricing of interest-bearing deposits and a slight increase in the yield of average interest-earning assets.

Non-interest income decreased by $6.0 million due to a reduction in net gains on sales of assets, while non-interest expense increased by $73.3 million, largely due to non-core charges related to the FDIC special assessment and the termination of certain technology contracts.

The provision for credit losses for loans increased to $20.7 million, reflecting an increase in quantitative reserves related to classified loans within the commercial portfolios and higher specific reserves associated with collateral-dependent loans.

Financial Achievements and Importance

Despite the challenges, Valley National Bancorp's loan portfolio showed resilience with a 7.0 percent annualized growth for the year ended December 31, 2023. The bank's effective tax rate improved to 19.6 percent for the fourth quarter of 2023, primarily due to an increase in tax credits from additional tax credit investments.

The bank's capital adequacy ratios remained strong, reflecting its well-capitalized position. The total risk-based capital, Tier 1 capital, common equity Tier 1 capital, and Tier 1 leverage capital ratios were 11.76 percent, 9.72 percent, 9.29 percent, and 8.16 percent, respectively, at December 31, 2023.

Analysis and Outlook

CEO Ira Robbins commented on the bank's ability to respond to early-year challenges and enhance its funding and capital position as the year progressed. Looking forward to 2024, Valley National Bancorp aims to build the value of its franchise by diversifying its loan portfolio, enhancing its core funding base, and improving non-interest income sources.

The bank's strategic priorities, along with its emphasis on providing premier relationship banking services, are expected to further differentiate Valley National Bancorp as a leading regional bank.

Valley National Bancorp's financial stability and strategic initiatives position it to navigate the evolving economic landscape and continue serving its customers effectively.

"The year of 2023 presented significant challenges for most of the banking industry and Valley. That said, I am pleased with our ability to respond to the challenges early in the year, and find opportunities to enhance our funding and capital position as the year progressed. This, along with our asset quality, is a testament to our dedicated associates and diversified business model," said Ira Robbins, CEO of Valley National Bancorp.

For more detailed information on Valley National Bancorp's financial results, investors and interested parties can access the full earnings release and join the investor conference call hosted by the company.

Explore the complete 8-K earnings release (here) from Valley National Bancorp for further details.

This article first appeared on GuruFocus.