Valley National (VLY) Announces New Share Repurchase Plan

Valley National Bancorp VLY has announced a new share repurchase program. The plan authorizes the company to buy back up to 25 million shares. This plan will be effective from Apr 26, 2024 and is set to expire on Apr 26,2026.

Prior to this, VLY had announced a repurchase plan in 2022 for 25 million shares. The plan will expire on Apr 25, 2024. As of Dec 31, 2023 almost 24.7 million shares remained available under the authorisation.

Concurrently, Valley National announced a quarterly cash dividend of 11 cents per share. The dividend will be paid out on Apr 2, 2024, to shareholders of record as of Mar 14, 2024. Since 2018, the company has been paying out the same dividend to its shareholders.

Based on yesterday’s closing price of $8.28, the annualised dividend yield currently stands at 5.31%. This is impressive compared with the industry’s yield of 3.03%. Also, VLY has a dividend payout ratio of 42%.

As of Dec 31, 2023, Valley National had a total debt of $3.25 billion (the majority being long-term in nature), while its cash and due from banks, and interest-bearing deposits with banks were $891.2 million. The common equity tier 1 ratio as of Dec 31, 2023, was 9.29%, up from 9.01% as of Dec 31, 2022.

Given its strong balance sheet and decent liquidity position, Valley National is expected to be able to keep boosting shareholder value through sustainable capital distribution activities.

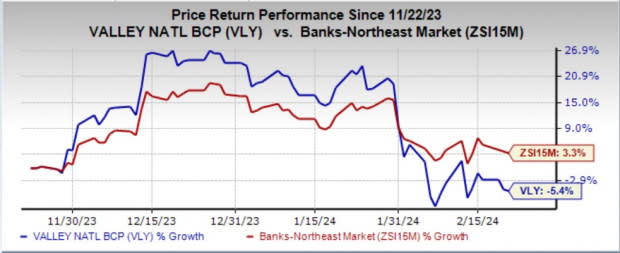

In the past three months, shares of VLY have lost 5.4% against the industry’s 4.6% growth. The company's shares were adversely impacted due to its huge exposure to commercial real estate and residential mortgage loans, which accounted for 74.8% of total gross loans as of Dec 31, 2023. This huge loan category exposure is turning out to be a big concern because of the current macroeconomic backdrop.

Image Source: Zacks Investment Research

Currently, VLY carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Other Banks Taking Similar Steps

Last week, Axos Financial, Inc. AX announced an additional share repurchase program. The company is authorized to buy back up to $100 million worth of shares.

AX’s new share buyback plan supplements the existing repurchase program. The existing plan has almost $20 million worth of authorization remaining. AX repurchased $83.2 million worth of shares during the first half of fiscal 2024.

Earlier this month, Zions Bancorporation ZION announced a new share repurchase plan for 2024. The plan authorizes the company to buy back up to $35 million worth of shares.

ZION repurchased shares in each of the last three years, indicating an impressive capital distribution plan on the back of anticipated growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Valley National Bancorp (VLY) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report