Is Valley National (VLY) Worth a Look on 5.4% Dividend Yield?

Solid dividend-yielding stocks are highly desirable amid expectations of recession in the near term. One such stock is Valley National Bancorp VLY.

Headquartered in Wayne, NJ, VLY offers various integrated financial services and products related to commercial, retail, insurance and wealth management, operating with a widespread network of more than 232 branches.

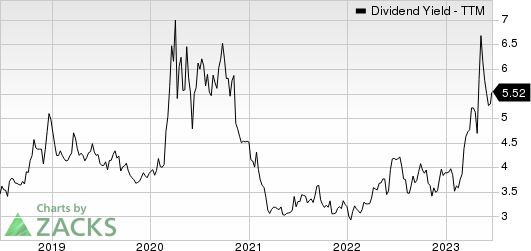

Considering the last day’s closing price of $7.97, Valley National's dividend yield currently stands at 5.39%. This is impressive compared with the industry average of 3.15% and attractive for income investors as it represents a steady income stream.

Valley National Bancorp Dividend Yield (TTM)

Valley National Bancorp dividend-yield-ttm | Valley National Bancorp Quote

Is the Valley National stock worth a look for a high dividend yield? Let’s check out the company financials to understand the risks and rewards. This will help us make a proper investment decision.

Apart from regular quarterly dividend payouts, VLY has a steady share repurchase program in place. In April 2022, the company announced a repurchase authorization of up to 25 million shares, which will expire on Apr 25, 2024. As of Mar 31, 2023, no shares were repurchased under the current authorization.

VLY has recorded a constant rise in revenues. Driven by a continued rise in loan balances, its total revenues witnessed a compound annual growth rate (CAGR) of 17.1% over the last seven years (2016-2022). Net loans saw a CAGR of 20.6% over the last six years (ended 2022). The momentum for revenues and loans continued in the first quarter of 2023.

Driven by strategic buyouts, higher interest rates and a decent rise in loan demand, revenue growth is expected to continue. Revenues are projected to see growth rates of 7.2% and 3.3% in 2023 and 2024, respectively.

The Federal Reserve is expected to keep the interest rates high in the near term to control inflation despite pausing the hike now. Valley National’s net interest margin is likely to keep rising in the near term, though the pace will likely slow down on rising funding costs.

Valley National has grown through a series of acquisitions over the years. In April 2022, the company completed the acquisition of Bank Leumi Le-Israel B.M.’s U.S. banking arm. In 2021, it acquired Westchester Bank and the Arizona-based advisory firm, Dudley Ventures. These, along with several past acquisitions, are expected to be earnings accretive and help VLY diversify revenues and footprint.

Despite near-term headwinds that include rising expenses and major loan portfolio exposure to risky loans, VLY stock is fundamentally solid.

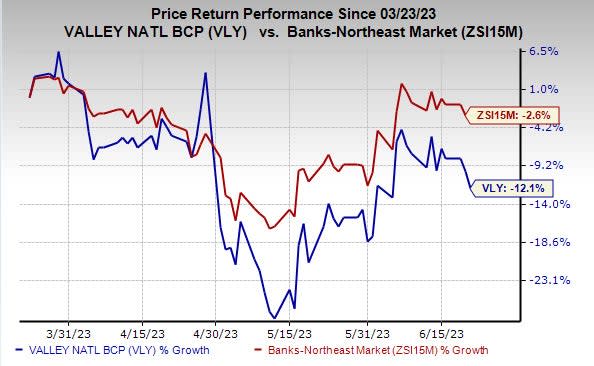

In the past three months, shares of Valley National have declined 12.1% compared with the industry's fall of 2.6%.

Image Source: Zacks Investment Research

Therefore, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as it will help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Stocks With Solid Dividends

A couple of other finance stocks like Ares Capital Corporation ARCC and Heritage Commerce Corp HTBK are worth a look as these too have robust dividend yields.

Considering the last day’s closing price, Ares Capital’s dividend yield currently stands at 10.36%. Over the past three months, shares of ARCC have gained 8.1%.

Based on the last day’s closing price, Heritage Commerce’s dividend yield currently stands at 6.19%. Over the past three months, shares of HTBK have lost 1.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Heritage Commerce Corp (HTBK) : Free Stock Analysis Report

Valley National Bancorp (VLY) : Free Stock Analysis Report