Valmont Industries Inc (VMI) Reports Mixed Fiscal Year 2023 Results Amid Market Challenges

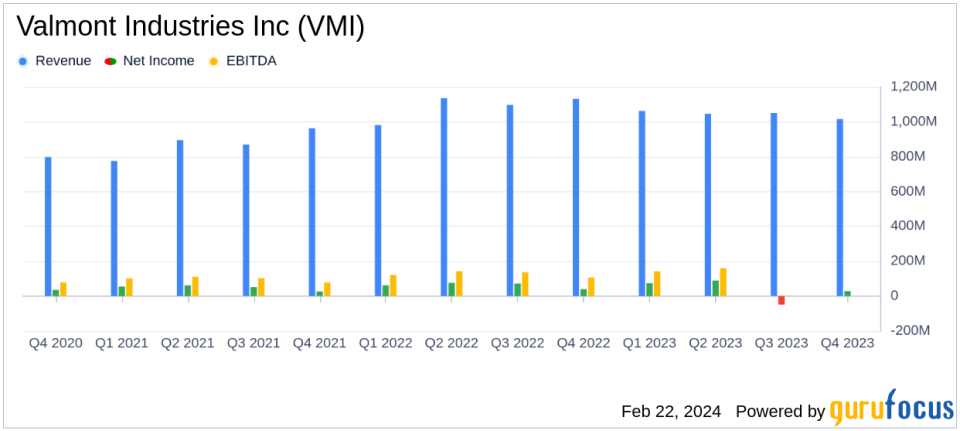

Net Sales: Reported a decrease of 3.9% for the full year 2023 compared to the previous year.

Gross Profit: Increased by 9.8% year-over-year, with gross profit margin improving to 29.6%.

Operating Income: GAAP operating income decreased by 32.7%, while adjusted operating income saw a 5.2% increase.

Net Earnings: GAAP net earnings declined by 42.8%, but adjusted net earnings rose by 6.3%.

Diluted Earnings per Share (EPS): GAAP EPS fell to $6.78 from $11.62, while adjusted EPS increased to $14.98 from $13.82.

Free Cash Flow: Generated $210.0 million in free cash flow for the full year 2023.

2024 Outlook: Expects net sales change of (3.0%) to flat and diluted EPS of $14.25 to $15.50.

On February 21, 2024, Valmont Industries Inc (NYSE:VMI) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. Valmont, a global leader in infrastructure and agriculture, faced market challenges, particularly in North America agriculture and telecommunications, which pressured the top line. However, the company managed to expand gross profit margins through successful pricing strategies and improved operational efficiencies.

Valmont began in 1946 and has since grown into a global leader with 85 manufacturing facilities in 22 countries. The company operates primarily in two segments: Agriculture and Infrastructure, providing engineered products and services that support infrastructure development and agricultural productivity.

Performance and Challenges

For the fourth quarter of 2023, Valmont reported a 10.3% decrease in net sales compared to the same period in 2022. The Agriculture segment saw a significant sales decrease of 18.9% year-over-year, primarily due to lower volumes in North America and slowing market demand in Brazil. The Infrastructure segment's sales decreased by 3.0%, with lower Telecommunications and Coatings volumes, despite higher volumes in Transmission, Distribution, and Substation (TD&S) and Solar product lines.

Despite these challenges, Valmont's gross profit margin improved from 25.9% to 29.6% for the full year, reflecting the company's ability to maintain profitability in a difficult market. The company's focus on operational efficiencies and pricing strategies helped mitigate the impact of softer demand.

Financial Achievements

Valmont's financial achievements in 2023, particularly the increase in gross profit margin, are significant for a conglomerate operating in diverse markets. The ability to improve margins in the face of declining sales volumes is a testament to the company's operational strength and strategic pricing. These achievements are crucial as they demonstrate Valmont's resilience and adaptability to market conditions, which are essential qualities for long-term success in the conglomerates industry.

Financial Metrics and Analysis

Key financial metrics from Valmont's income statement, balance sheet, and cash flow statement include:

Net sales for the full year 2023 were $4,174.6 million, a decrease from the previous year's $4,345.2 million.

Gross profit for the full year increased to $1,236.0 million, up from $1,126.2 million in 2022.

Operating income on a GAAP basis for the full year was $291.6 million, a decrease from $433.2 million in the previous year.

The company's net earnings on a GAAP basis were $143.5 million, down from $250.9 million in 2022.

Adjusted net earnings, which exclude certain non-recurring items, were $316.9 million, an increase from $298.1 million in the previous year.

Free cash flow for the full year 2023 was robust at $210.0 million.

These metrics are important as they provide insights into the company's sales performance, profitability, and cash generation capabilities. The decline in net sales and GAAP net earnings highlights the challenges faced by the company, while the increase in gross profit and adjusted net earnings underscores the effectiveness of Valmont's strategic initiatives.

"Our market leadership, combined with a relentless focus on strong cash flow generation, return on invested capital, and a disciplined capital allocation framework gives us confidence in our actions to enhance shareholder value for years to come," stated Avner M. Applbaum, President and Chief Executive Officer of Valmont.

Valmont's balance sheet remains solid with $203.0 million in cash and cash equivalents at the end of 2023. The company also returned value to shareholders through significant stock repurchases, including a $120.0 million Accelerated Share Repurchase program executed during the fourth quarter.

The company's 2024 outlook anticipates net sales changes ranging from a 3.0% decrease to flat and diluted EPS between $14.25 and $15.50. Valmont also introduced long-term financial targets, aiming for organic net sales growth above mid-single digits, operating margin approaching mid-teens, return on invested capital (ROIC) in the high-teens, and free cash flow conversion of 100% of net earnings.

Valmont's performance in 2023 reflects a company navigating through market headwinds while maintaining a strong focus on profitability and operational efficiency. As the company moves into 2024, it remains committed to strategic growth initiatives and delivering value to shareholders.

Explore the complete 8-K earnings release (here) from Valmont Industries Inc for further details.

This article first appeared on GuruFocus.