Valmont (VMI) Buys HR Products, Expands Offerings & Market

Valmont Industries, Inc. VMI, a global leader in vital infrastructure and agricultural productivity, has announced its definitive agreement to acquire HR Products, a leading wholesale supplier of irrigation parts in Australia. This strategic move allows Valmont to expand its geographic footprint and enhance its parts presence in a key agriculture market. The financial details of the deal were not divulged.

The acquisition of HR Products aligns with Valmont's global agriculture growth strategy, focusing on aftermarket parts and services. By extending its offerings, Valmont can better serve its customers and tap into the substantial market for replacing wearable irrigation parts. This positions the company to capitalize on the long life cycle of irrigation equipment, creating recurring, high-value revenue streams that help mitigate cyclicality in its agriculture business.

HR Products has been a trusted provider of irrigation products since its establishment in 1979 in Perth, Australia. With nearly 100 employees and six warehouse facilities, the company has built a strong dealer network across Australia, which would strengthen Valmont's market leadership. Australia's well-developed agriculture market, coupled with its transition from flood irrigation, presents significant opportunities for growth. HR Products has a successful distribution model, solid operations and strong customer relationships across the country.

The transaction, which is expected to close in the third quarter of 2023, will be funded with cash on hand. Valmont anticipates immediate earnings accretion, with first-year revenues projected at roughly $45 million. The acquisition is subject to customary closing conditions.

The acquisition of HR Products positions Valmont for continued growth in the agriculture sector. With expanded product offerings and a strengthened presence, VMI is well-placed to meet customer demands, drive innovation and deliver value to agriculture customers in Australia.

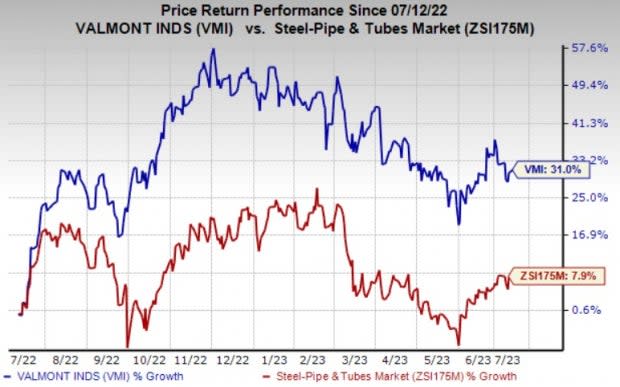

VMI shares have rallied 31% in the past year against the 7.9% growth of its industry. The Zacks Consensus Estimate for the company’s current-year earnings has been revised roughly 0.1% upward in the past 60 days. The consensus estimate for current-year earnings is currently pegged at $15.70, suggesting year-over-year growth of 13.6%.

Image Source: Zacks Investment Research

Revenues from the company’s Agriculture segment went up around 8% year over year to $332.2 million in the first quarter of 2023, aided by higher average selling prices of irrigation equipment globally. International sales were significantly higher, driven by a record first quarter in Brazil and higher sales in the Middle East.

The company is seeing favorable underlying agricultural market fundamentals globally. It expects international growth to be robust this year, supported by project sales in a strong Brazil market. VMI projects international sales to rise around 10% sequentially in the second quarter of 2023.

Valmont Industries, Inc. Price and Consensus

Valmont Industries, Inc. price-consensus-chart | Valmont Industries, Inc. Quote

Zacks Rank & Key Picks

Valmont currently has a Zacks Rank #2 (Buy).

Other top-ranked stocks worth a look in the industrial products space include Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and W.W. Grainger, Inc. GWW.

Worthington Industries currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for WOR’s current fiscal-year earnings has moved 10.5% north in the past 60 days.

Worthington Industries has an average trailing four-quarter earnings surprise of 14.9%. WOR shares have popped around 52% in a year.

The Zacks Consensus Estimate for MTW’s current-year earnings has moved up 7.7% over the past 60 days. Manitowoc currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Manitowoc’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 256.3%, on average. MTW shares have rallied around 73% in a year.

Grainger currently carries a Zacks Rank #2. The Zacks Consensus Estimate for GWW’s current-year earnings has been revised 1.8% upward in the past 60 days.

Grainger beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 9.2% on average. GWW shares have risen roughly 68% in the past year.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report