Valmont (VMI) Closes HR Products Buy, Boosts Australian Growth

Valmont Industries, Inc. VMI, a global leader in providing critical infrastructure solutions and advancing agricultural productivity, has successfully acquired HR Products, a prominent wholesale supplier of irrigation components in Australia.

HR Products boasts an extensive portfolio of irrigation solutions catering to the agriculture and landscaping sectors. Established in 1979 in Perth, Western Australia, the company has cultivated a strong distribution network and established robust operations nationwide.

This acquisition significantly enhances Valmont's value proposition to customers in the crucial Australian agriculture market by expanding its geographical reach and bolstering its presence in the aftermarket parts segment. Valmont noted that it expects an immediate positive impact on earnings, with first-year revenues estimated at approximately $45 million.

This strategic move to acquire HR Products positions Valmont for sustained growth in the agricultural industry. With an expanded product portfolio and a reinforced market presence, VMI is well-prepared to meet customer demands, foster innovation and deliver exceptional value to its agricultural customers in Australia.

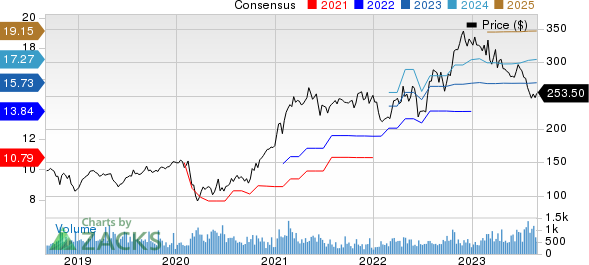

Valmont Industries, Inc. Price and Consensus

Valmont Industries, Inc. price-consensus-chart | Valmont Industries, Inc. Quote

Valmont reported adjusted earnings per share (EPS) of $4.37 for the second quarter, surpassing the Zacks Consensus Estimate of $4.10 and showing growth from the previous year, attributed to favorable pricing, cost management, and operational efficiencies. However, the company's revenues of $1,046.3 million fell short of estimates, declining by 7.9% year over year.

For 2023, Valmont revised its guidance for net sales growth to 0-2% from its previous view of 4-7%. Adjusted EPS guidance was retained in the range of $15.45-$16 per share. The company expects an improved full-year operating margin compared to 2022.

VMI’s shares have lost 8.4% in the past year compared with 1.8% fall of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Valmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industrial products space are Caterpillar Inc. CAT and ABB Ltd ABBNY, both sporting a Zacks Rank #1 (Strong Buy), and A. O. Smith Corporation AOS, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Caterpillar’s current year is pegged at $19.82, indicating a year-over-year growth of 43.2%. CAT beat the Zacks Consensus Estimate in three of the last four quarters, with the average earnings surprise being 18.5%. The company’s shares have rallied 52.2% in the past year.

The consensus estimate for ABB’s current-year earnings is pegged at $1.97, indicating year-over-year growth of 49.2%. ABB beat the Zacks Consensus Estimate in three of the last four quarters, with the average earnings surprise being 19.8%. The company’s shares have rallied 37.5% in the past year.

The consensus estimate for A. O. Smith’s current-year earnings is pegged at $3.57, indicating a year-over-year growth of 13.7%. In the past 60 days, AOS’s current-year earnings estimate has been revised upward by 2.9%. The company beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have rallied 28.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ABB Ltd (ABBNY) : Free Stock Analysis Report