Valmont's (VMI) Eco-Concrete Pole Plant Opens in Bristol

Valmont Industries, Inc. VMI has announced the opening of a concrete utility pole manufacturing facility in Bristol, IN. The company has achieved an industry first by producing utility transmission and distribution poles at scale with lower greenhouse gas emissions. This was achieved by reducing cement usage, which is considered a significant contributor to global CO2 emissions. The facility also features an onsite solar array designed to offset 100% of the plant's electricity usage.

Valmont, one of the largest producers of utility structures in North America, expects the plant to reduce its CO2 emissions by over 400 tons by the end of 2023 by implementing a proprietary concrete mix. Valmont partnered with Ameresco, a leading cleantech integrator and renewable energy asset developer, to build the solar array.

The solar array at the Bristol facility incorporates Valmont's Convert solar tracker solution, consisting of 70 single-axis trackers. By following the sun throughout the day, this award-winning solution generates up to 25% more energy compared to fixed in-place racking, thus optimizing energy generation. The solar array is expected to produce more than 900,000 kilowatt hours of green electricity per year, and likely to make the facility Scope II Net Zero.

The facility employs a concrete mix that incorporates supplemental cementitious materials of steel slag, such as waste material from furnace-burned steel production. This innovative approach reduces emissions and promotes sustainability.

While slag cement has been used for decades in various applications, Valmont is pioneering its use at scale in utility pole production. Furthermore, Valmont plans to transition all six of its concrete utility pole facilities across the country to the eco-concrete mixture within the next 12 months. This initiative could result in an overall annual reduction of over 12,000 tons of CO2.

The Bristol facility is strategically located in the Northeast/Midwest region of the United States to meet the increasing demand in the area. It provides customers additional utility pole options while improving freight costs and reducing transportation emissions. The facility's centrifugally spun, pre-stressed concrete process reduces weight while maintaining strength.

Given the projected growth in electrification demand in the U.S. market, it is estimated that over $21 trillion will need to be invested in the electric grid by 2050, Estimates suggest a 60% increase in U.S. transmission capacity. Valmont's Bristol facility, concrete pole product line and utility product offerings are poised to play a crucial role in supporting this growth.

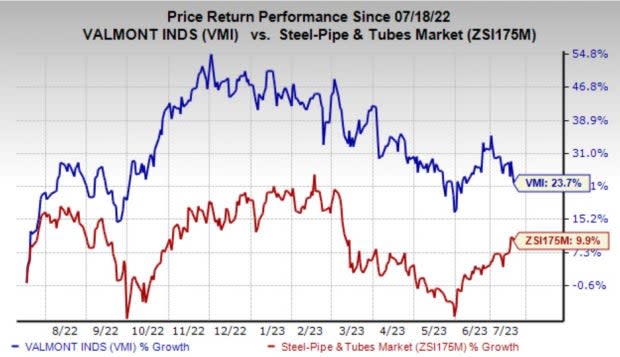

VMI stock has gained 23.7% in the past year compared with the industry’s rise of 9.9% in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Valmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products space include A. O. Smith Corporation AOS, sporting a Zacks Rank #1 (Strong Buy), and W.W. Grainger, Inc. GWW and Caterpillar Inc. CAT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AOS’s current-year earnings is pegged at $3.47, indicating year-over-year growth of 10.5%. AOS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 8%. The company’s shares have rallied 34.2% in the past year.

The Zacks Consensus Estimate for GWW’s current-year earnings has been revised 7.7% upward in the past 90 days. GWW beat the Zacks Consensus Estimate in the last four quarters, with the average earnings surprise being 9.2%. The company’s shares have gained 68.4% in the past year.

The Zacks Consensus Estimate for CAT’s current-year earnings has been revised 1.4% upward in the past 60 days. CAT beat the Zacks Consensus Estimate in three of the last four quarters, while missing in one quarter. It delivered a trailing four-quarter earnings surprise of 14.3% on average. The company’s shares have risen roughly 47.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report