ValueAct Capital Adjusts Portfolio, Major Reduction in Fiserv Inc by -8.04%

Insights from ValueAct Capital (Trades, Portfolio)'s Latest 13F Filing for Q3 2023

ValueAct Capital (Trades, Portfolio), a renowned investment firm with a 21-year track record of over 100 core investments, has recently disclosed its 13F holdings for the third quarter of 2023. The firm, known for its long-term investment approach and active participation in company boards, has made significant changes to its portfolio during this period. ValueAct Capital (Trades, Portfolio)'s investment strategy is deeply rooted in working closely with management teams to enhance business models and create value for all stakeholders, often holding positions for several years.

New Additions to ValueAct Capital (Trades, Portfolio)'s Portfolio

ValueAct Capital (Trades, Portfolio) has expanded its portfolio with four new stocks in the third quarter of 2023, including:

Illumina Inc (NASDAQ:ILMN), purchasing 519,610 shares, which now comprise 1.6% of the portfolio, valued at $71.33 million.

Roblox Corp (NYSE:RBLX), with an acquisition of 1,800,000 shares, making up about 1.17% of the portfolio, totaling $52.13 million.

Alarm.com Holdings Inc (NASDAQ:ALRM), adding 585,400 shares, accounting for 0.8% of the portfolio, with an investment worth $35.79 million.

Complete Exits from Holdings

During the same quarter, ValueAct Capital (Trades, Portfolio) also decided to exit a position:

Altus Power Inc (NYSE:AMPS), selling all 4,017,628 shares, which had a -0.34% impact on the portfolio.

Key Position Reductions

ValueAct Capital (Trades, Portfolio) has trimmed its stakes in six companies, with the most notable reductions being:

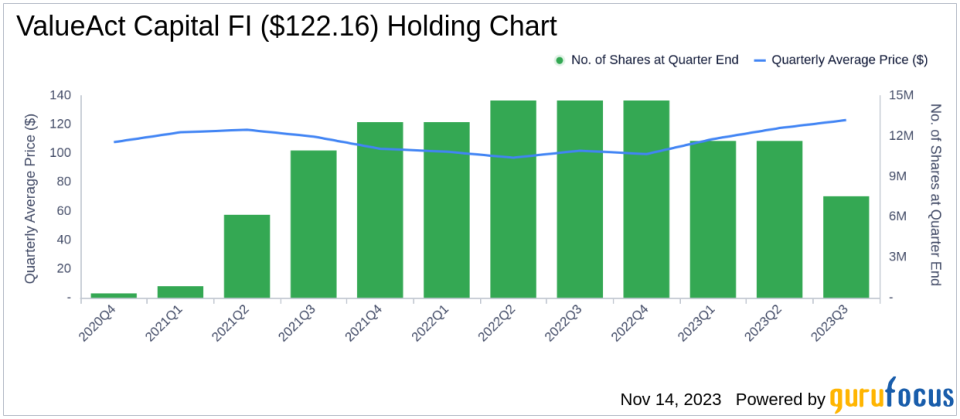

Fiserv Inc (FISV), where 4,098,935 shares were sold, leading to a -35.19% decrease in the holding and an -8.04% impact on the portfolio. The stock's average trading price was $123.15 during the quarter, with a -1.86% return over the past three months and a 20.87% year-to-date return.

KKR & Co Inc (NYSE:KKR), with a sale of 9,114,325 shares, resulting in a -44.38% reduction and a -7.94% impact on the portfolio. The average price during the quarter was $60.73, and the stock has returned 8.15% over the past three months and 44.79% year-to-date.

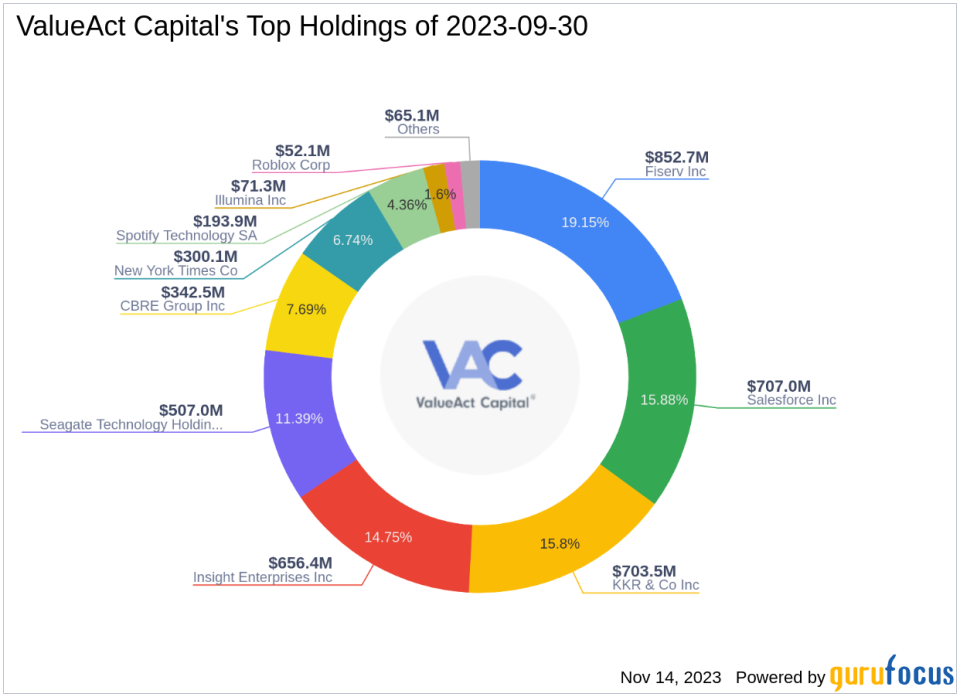

Portfolio Overview

As of the third quarter of 2023, ValueAct Capital (Trades, Portfolio)'s portfolio consists of 13 stocks. The top holdings are:

19.15% in Fiserv Inc (FISV)

15.88% in Salesforce Inc (NYSE:CRM)

15.8% in KKR & Co Inc (NYSE:KKR)

14.75% in Insight Enterprises Inc (NASDAQ:NSIT)

11.39% in Seagate Technology Holdings PLC (NASDAQ:STX)

The investments are primarily concentrated in six industries: Technology, Financial Services, Communication Services, Real Estate, Healthcare, and Industrials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.