Valvoline Chalks Out Plans to Strengthen Quick-Lube Model

Recently, Valvoline Inc. VVV announced that it has successfully acquired a quick lube location in Peoria, AZ. Henceforth, the store is operating as the company’s authorized Valvoline Instant Oil Change (VIOC) service center.

The VIOC service stores allow customers to stay in cars while the VIOC’s qualified technicians accomplish their services. These centers provide a number of preventive maintenance services relating to radiator, air conditioning and transmission. Additionally, most locations offer battery and fuel system services to customers.

Prior to this, on Jun 7 and Jun 8, Valvoline unveiled Valvoline Express Care centers in Little Rock, AR, and Fresno, CA, respectively.

Valvoline currently carries a Zacks Rank #3 (Hold) and flaunts a VGM Score of A.

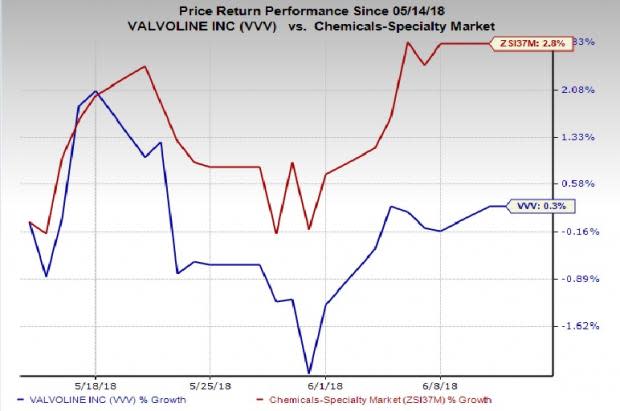

At present, a core business strategy of the company is stoking growth for its industry-popular quick-lube model. The aforementioned moves of the company are in sync with this stratagem. The company is poised to grow on the back of strong Quick Lube and International segments performance and strategic capital deployment moves. However, rising oil prices has been weighing over the company’s cost in the recent quarters. Notably, over the last month, the stock has rallied 0.2%, underperforming 2.8% gain recorded by the industry.

Per our estimates, the company’s revenues and earnings are currently projected to be up 5.7% and 14.3%, respectively, for fiscal 2019 (ending September 2019).

Stocks to Consider

Some better-ranked stocks in the same space are listed below:

DAQO New Energy Corp. DQ sports a Zacks Rank #1 (Strong Buy). The company’s earnings per share (EPS) are predicted to be up 7%, in the next three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ferro Corporation FOE carries a Zacks Rank #2 (Buy). The company’s EPS is estimated to rise 16.70%, over the next three to five years.

Ingevity Corporation NGVT also carries a Zacks Rank of 2. The company’s EPS will likely be up 12% during the same time frame.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ferro Corporation (FOE) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Valvoline Inc. (VVV) : Free Stock Analysis Report

To read this article on Zacks.com click here.